Blog

EV Adoption – Assessing the Energy market impact

The UK faces an ambitious timeline on its journey to Net Zero. Electric vehicles (EVs) will be a key driver of the transition, with 2035’s combustion engine ban set to shape not only the future of transportation, but also its adjacent markets – such as energy.

Localised Energy Bills – How do they differ to the Price Cap?

We’re all familiar with the headline figure of the Energy Price Cap. Set most recently at £1,834 (following Ofgem's reduction in TDCV's), the number serves the useful purpose of providing an estimated average bill for customers. But rarely is there a discussion about the reality of this figure, and how it can’t possibly reflect the actual bills faced by households across the UK. In short, this is far from the case.

Service vs Sales – A dilemma for suppliers as the market reopens

With the prospect of a switching resurgence on the horizon, it will be interesting to see whether suppliers decide to chase the volume of new customers, or seek to prioritise customer retention. In short, many are likely to face a ‘Service vs Sales’ dilemma – bringing a degree of unpredictability to the market.

Customer indebtedness is set to worsen this winter

Customer indebtedness is growing at an unsustainable rate. And it’s projected to get worse as we head into winter. Analysis from our Market Insights supports this, highlighting three key points, which we’ve explored further in this blog.

The Energy Price Cap – A tragedy in four acts

The Energy Price Cap was introduced by Ofgem back in 2019, to ensure “that prices for people on default energy tariffs are fair and that they reflect the cost of energy". If the goal was to prevent loyalty premiums (which was the original stated intention), then we’d argue that a relative price cap would have been better.

Market debt levels continue to rise with prices

Market debt levels have continued to rise as the the price cap rises - however we've also seen customers absorb a greater proportion of the price increases than expected. This isn't all good news - we're potentially starting to see a latent effect where customers are running out of options by which to cover the increased costs which will give rise to increased debt levels in Q4-23 / Q1-24.

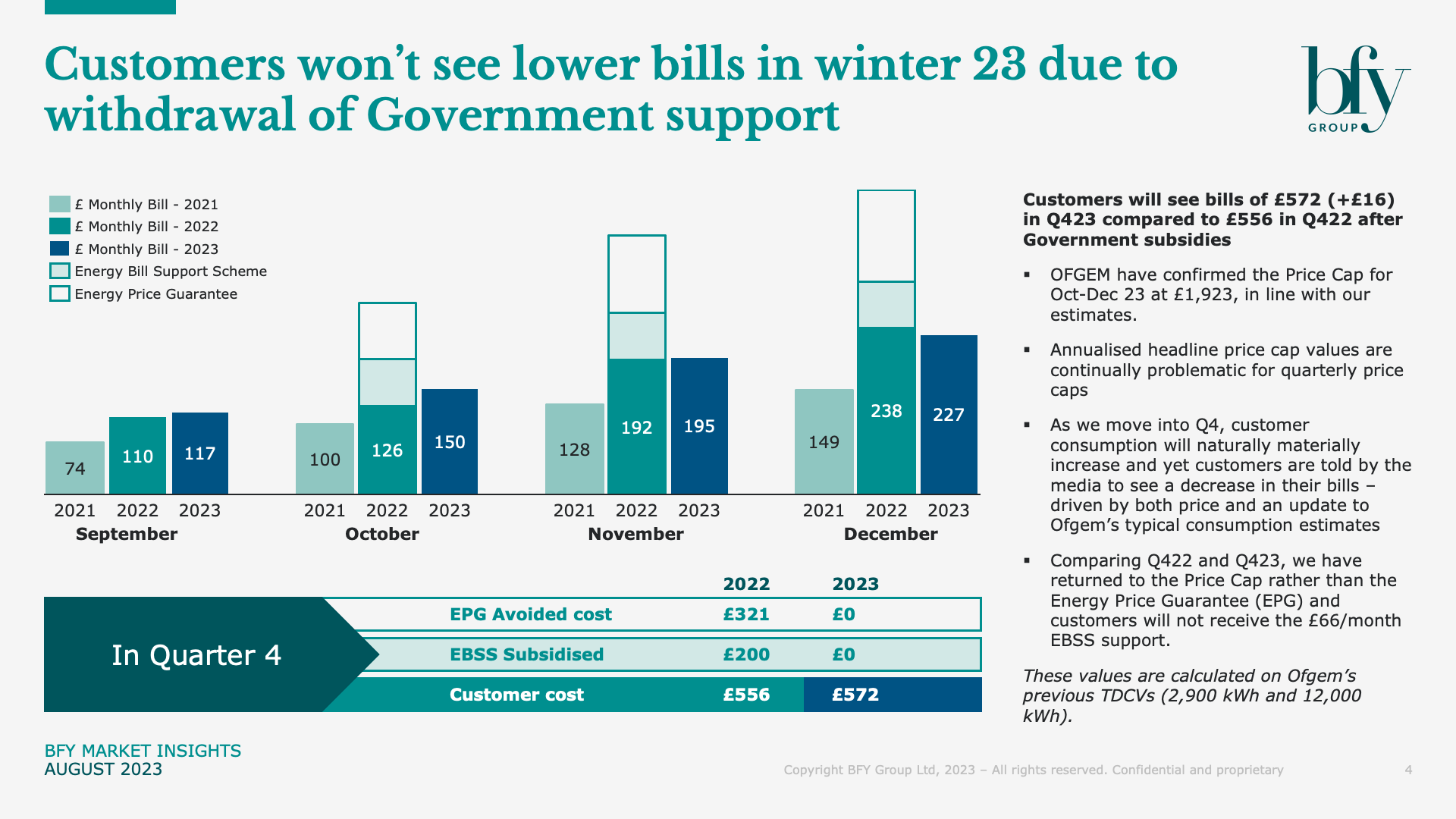

Winter bills to rise as the Price Cap falls – Here’s why

Ofgem have announced the Price Cap for Oct-Dec 23 at £1,923 in line with BFY Group projections. Although this represents a decrease for the second consecutive quarter, we’re expecting to see customer bills moving in the opposite direction this winter, due to the removal of government support.

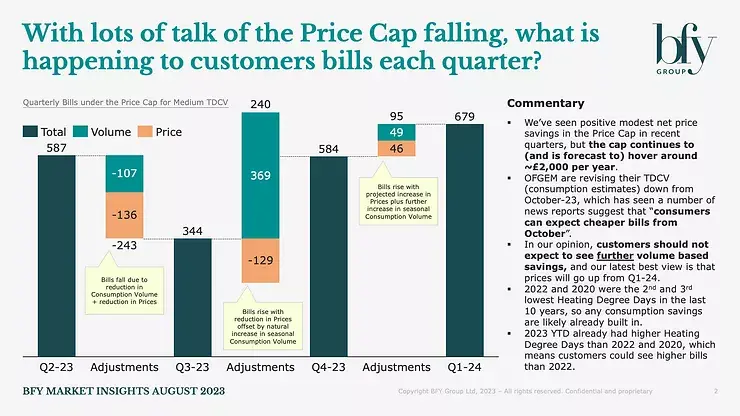

What is happening to customers bills each quarter?

With lots of talk of the Price Cap falling, what is happening to customers bills each quarter?

Changes ahead for consumer standards – Reacting to Ofgem and FCA guidance

It's time for a shake-up in consumer standards. That's the key message from Ofgem after launching its Consumer Standards Statutory Consultation. New rules are being introduced which will have immediate implications for suppliers, as we approach another challenging winter for customers.

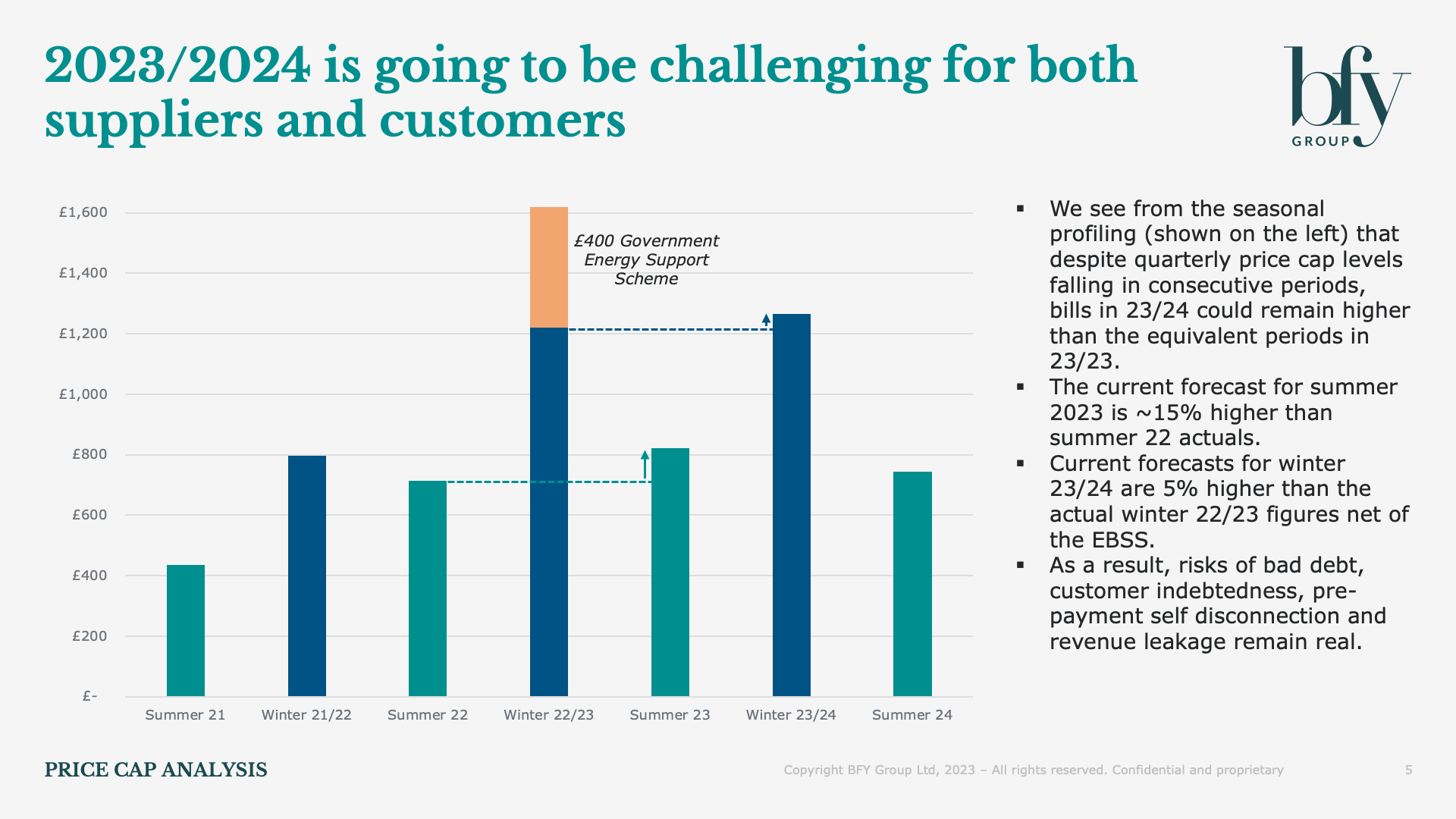

Dropping Prices - Rising Bills. Energy Price Cap Analysis.

Based on the latest update from Ofgem , the BFY Group team have modelled that prices will remain around £2,000 per year. The forecast £450 reduction in the headline rates won't be felt as a £450 saving customers pockets, this is because OFGEM have to articulate an annual value based on prices for a quarterly window.

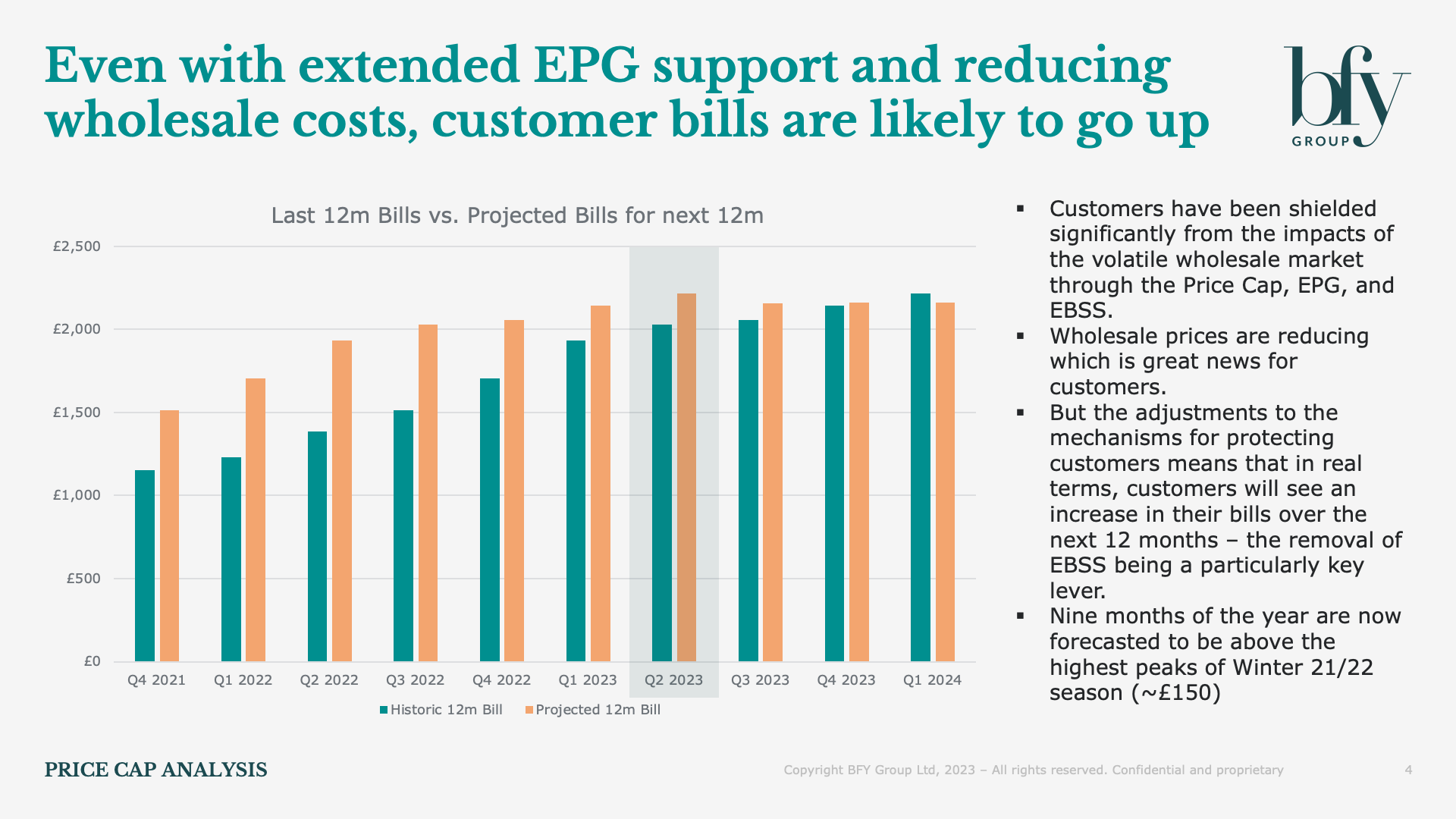

Energy Bills Projected To Rise Despite EPG Extension

It's great news that Jeremy Hunt has extended EPG for a further 3 months at £2,500 - however the amounts customers pay is still projected to increase.

Retaining and attracting customers in a changing Energy market

In recent weeks, wholesale energy prices have started to fall, and Ofgem have announced a reduction in the energy price cap. If wholesale trends continue, we’re likely to see a renewed increase in sales activity and customer switching.

Subscribe today to receive the latest news and updates from BFY

By submitting my personal data, I consent to BFY collecting, processing, and storing my information in accordance with our Privacy Policy.