Ofgem have announced the Price Cap for Oct-Dec 23 at £1,923 in line with BFY Group projections.

🔔 For access to more market insights, join the BFY mailing list here.

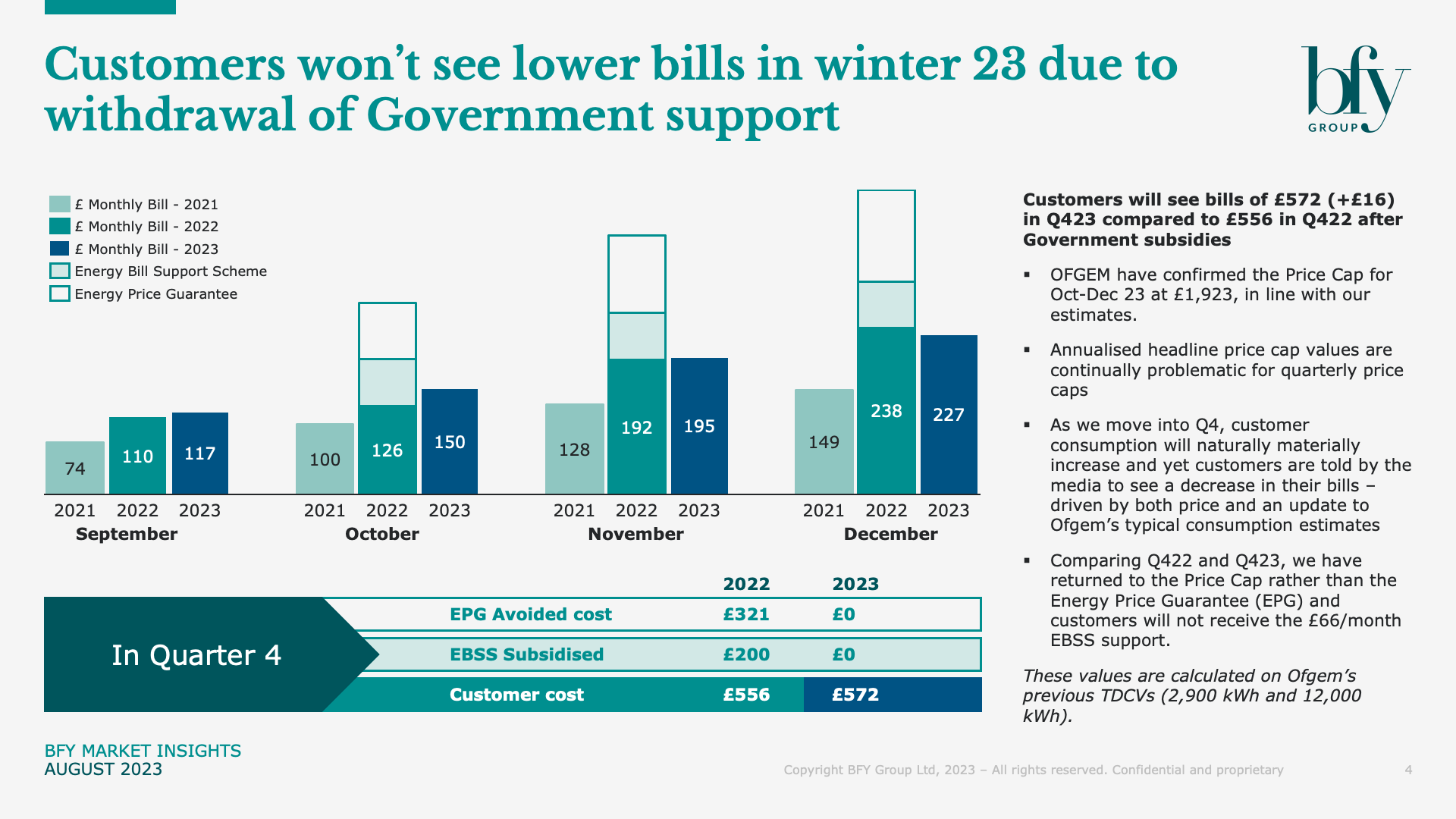

Although this represents a decrease for the second consecutive quarter, we’re expecting to see customer bills moving in the opposite direction this winter, due to the removal of government support.

This is going to be confusing for customers who are being told by the media they will see lower bills - the reality is they won't.

We project the ‘typical’ customer will face bills of £572 in Q423, which is higher than the same period last year, after government support had been applied.

Our latest best view also shows that prices will go up again in January - whilst wholesale prices have been lower for the observation window that makes up the October Price Cap, wholesale prices are on the rise and will increase the future Price Caps.

Based on Ofgem’s latest consumption values, low users (who are typically low income households in social rented properties) will see a quarterly bill increase of over £100 for Q4. As shown below, consumers across all usage groups were protected from higher bills last year, due to the EPG and EBSS being effective.

An uplift in the standing charges paid by customers is also contributing to rising bills. These charges have increased by £126 per year since January 2019, now representing 23% of a low-user’s bill.

Finally, the price cap and annual bills sit against the backdrop of customer debt. We see a clear trend that more customers are in debt to their energy suppliers each year and the average balances of customers that haven’t agreed payment plans have significantly increased.

Low users saw their debt significantly decreased, or completely covered, by the £400 Energy Bill Support Scheme last winter and levels of market debt recovered slightly in Q1 2023. However, we face winter 2023 without the same £11.5bn Government support package.

These insights all but confirm that another difficult period is ahead for customers and suppliers. Last month, we shared the view that government support had masked some of the industry’s underlying issues, wrongly convincing some that debt is under control and may have peaked. Today’s announcement shows that more challenges are coming.

We’re continuing to work with suppliers to support their customers throughout the cost of living crisis. Collections journey maturity, customer engagement, and tailored treatments will all be key, as risks of bad debt and customer indebtedness remain significant.

For more information on the latest Price Cap announcement and how it will impact your customers, contact Ian Barker or Matt Turner.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile