At a recent roundtable, we sat down with energy suppliers, consultants and debt charities to discuss the issue of fuel poverty - and its potential solutions.

Taking place at the House of Lords under Chatham House Rules, the conversations were frank and illuminating. We've summarised the key talking points from the roundtable in this article, including suggestions for action.

Fuel poverty is a bigger problem than ever before. Over 20% of households are affected, according to our research with So Energy. Historically high energy prices, inflation, distrust and wider financial challenges are all confounding the issue.

Fuel poverty facts at a glance

- Energy prices remain high. Bills are 50% higher than pre-crisis levels based on the latest price cap (Ofgem data May 2025).

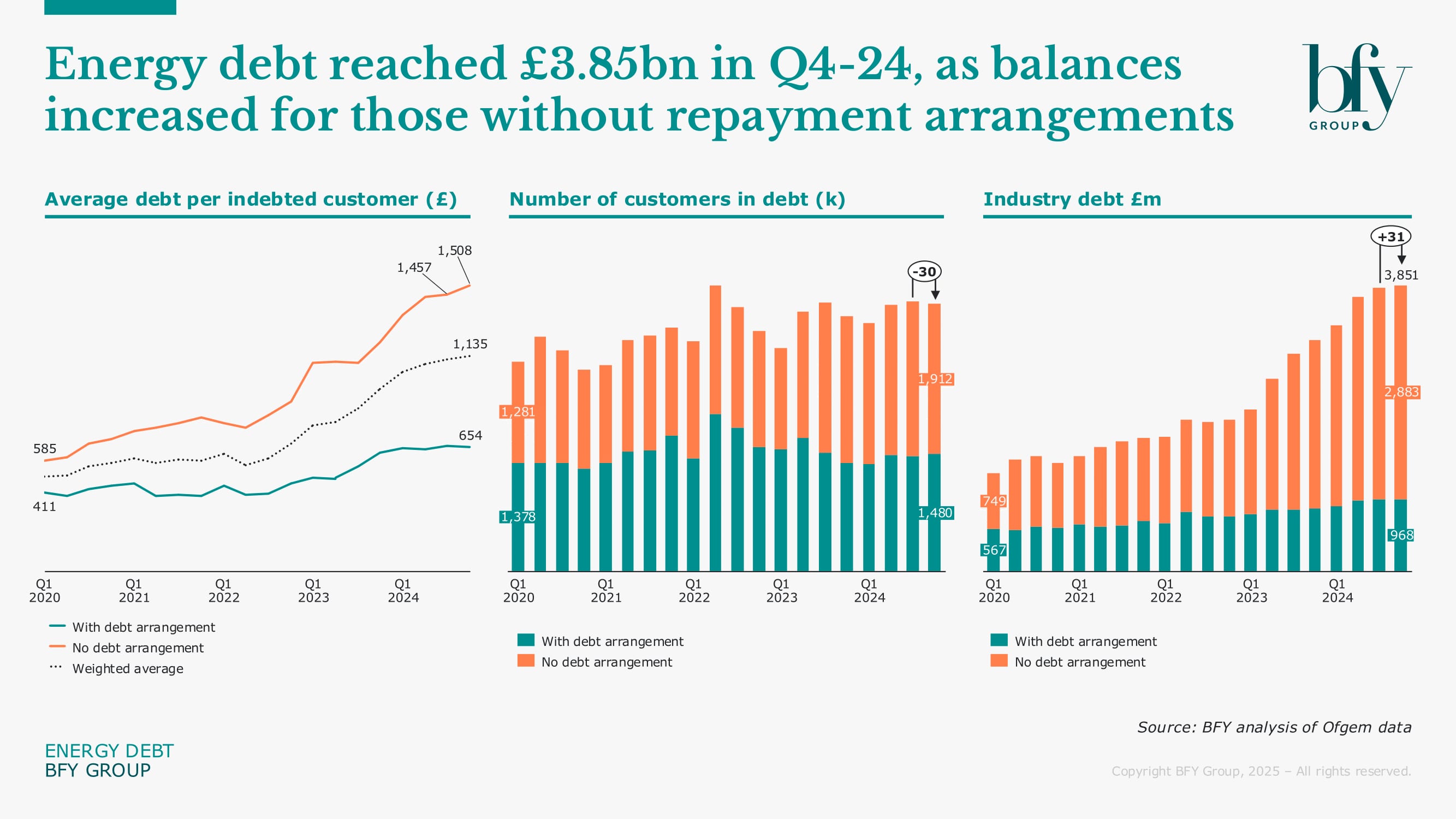

- Domestic customer energy debt has increased from £1.3bn in April 2020 to £3.85bn in December 2024. 193% since 2020. See the graph below.

- 75% of this increase is debt with no repayment arrangement in place. Challenging for customers and suppliers.

Supplier impact

£3.85bn debt is a staggering amount. While the effects of debt on customers are well documented, the effect on suppliers is not. We asked attendees how the growing burden of energy debt is affecting them.

- Increasing debt directly affects cashflow and increases commercial risk. Some attendees estimated accounts in arrears make up 2% to 9% of total revenue.

- Managing accounts in arrears increases operating costs.

- Reduced capital limits funds which would otherwise be available for development and innovation.

- Extra strain on customer service systems worsens service levels.

- Offsetting higher operational costs makes it difficult to offer competitive products.

- In extreme cases, these factors contribute to suppliers exiting the market.

Added market complexity

The UK energy market will get even more confusing with Time of Use (ToU) tariffs, proposals on zonal pricing, and standing charge changes. Without intervention, we risk placing greater strain on vulnerable customers and increasing debt levels.

The risk is not just operational, but reputational and regulatory. If the sector fails to respond meaningfully, scrutiny and oversight will inevitably increase. The industry can’t just react to financial vulnerability. We must be proactive and serve with empathy, effectiveness and foresight.

Everyone agreed we need to act now. For everyone’s benefit.

Here’s what came out of the discussion - key challenges identified and practical steps proposed to tackle them.

Challenge 1: The scale of fuel poverty

First things first. Without fully understanding the scale of UK fuel poverty, the job of lowering it is even more difficult.

Official estimates put the current number of households in fuel poverty at 4.15m. However, with different definitions in the devolved countries of the UK, the figure is inaccurate. Methodologies to measure fuel poverty vary too, adding even more confusion. See Challenge 2.

Using a universal definition of “energy spend being over 10% of a household’s income after housing costs,” the figure is considerably higher.

5.4m homes. That’s 1 in 5 households.

While this 10% income definition is easier to understand and apply, it’s still flawed. Each household is unique. Energy requirements vary between buildings, occupants and lifestyles. And other financial obligations (like childcare or loans) aren’t recorded, let alone other debts.

Multiple debts per household

One debt charity attendee said customers regularly have nine different debtors. The Money Advice Trust’s data shows 13% of adults (7m) are in debt with council tax, energy or water bills, and 2.6% (1.4m) are in debt across all three!

Citizens’ Advice support these findings too. They are helping more people than ever with debt, with 53% of clients struggling with four or more debt issues. The average debt per client is up 21% from 2019 to £8,627. £3,000 is from household bills (up 38% since 2019) with the rest being consumer debt.

Solution 1: Better recording

All roundtable guests agreed we need better data to understand the situation better. Clearer, collective and regular reporting will show the extent of the problem. It will also help drive discussions outside of the industry to support (and lobby for) changes. We can also measure the impact of initiatives, helping us review and improve.

Safe data sharing

We would need proper funding support and a robust infrastructure to share household data safely. By using trusted intermediaries or investing in compliant data platforms, suppliers and Ofgem could identify and support vulnerable customers quicker.

Opt-in model using open banking

The group enthusiastically discussed applying an opt-in model using open banking or HMRC data for all customers. The data would automatically identify financial hardship without putting the customer through sensitive and uncomfortable conversations. Suppliers could better assess the credit risk of potential customers, then provide the most suitable products or appropriate support.

To build customer trust and encourage uptake, we should communicate the process and emphasise the benefits. Sharing data would enable us to provide support that wouldn’t be possible otherwise.

Done well, using a universal definition, this could standardise financial vulnerability assessments. Customers would get fairer deals and treatment, reducing the risk of them disengaging. And suppliers could automate basic tasks, reducing significant investments of time and money.

Challenge 2: Identifying those in need

From all the discussions we had, one thing is clear. There is no consensus on who is financially vulnerable. Customers identified as ‘fuel poor’ have other financial challenges, while others who don’t fit the traditional profile are also struggling with higher prices.

A major problem is that financial vulnerability gets confused with physical vulnerability. Confusion made worse because England, Scotland and Wales assess fuel poverty differently. Ofgem’s definition (which guides how suppliers respond) focuses on physically vulnerable customers. So, customers who are facing financial hardship without physical vulnerabilities fall between the gaps.

Varied debt profile

There is no standard customer profile for those struggling with energy payments, but the government support on offer is the same. For many customers, this will be their first time in this situation. Others will be familiar customers who often recycle through debt journeys. There may be common behaviours or flags, but suppliers must discover these themselves and act accordingly.

Therefore, suppliers are setting their own assessment criteria for identifying financially vulnerable customers and creating their own support. Support which varies hugely in its methods and impact. For example, longer-established suppliers may have clearer definitions and stronger support mechanisms than a new supplier. Customers effectively become part of an unfair support lottery depending on their supplier.

Solution 2: Universal definition

We need a universal definition and criteria for financial vulnerability. Only then can identification and support be consistent, fair, and transparent across all suppliers and sectors.

We also discussed cross-sector learning and meetings to share best practice. Banking, water and telecoms can help us identify insights and actions.

- Banking has developed collaborative forums (like UK Finance) and open banking tools to identify and support customers early.

- The water sector operates social tariffs. It doesn’t disconnect for non-payment, protecting essential services.

- Telecoms have established low-income broadband options and standardised letters with debt advice references.

Challenge 3: Existing support is insufficient

Attendees shared frustrations with current fuel poverty support being too little, too late.

For most customers to lower their bills, they need to buy significantly less energy. Energy-saving measures don’t make a big enough impact. Generating their own energy is the only realistic solution. But two major hurdles stand in the way – inefficient buildings and limited funds.

Improving the energy efficiency of your home and generating your own energy feels out of reach for most. These upgrades often remain more accessible for the most financially stable households. Energy-saving technologies (solar panels and batteries, electric vehicles, wind turbines, heat pumps) are prohibitively expensive. And UK houses aren’t energy efficient on the whole.

Although well-intentioned, the Warm Home Discount (WHD) and Energy Company Obligation (ECO) schemes don’t go far enough. They already fail 4m homes that need support.

Many customers aren’t even aware of the schemes. Even when they know, uptake is low because of a lack of trust – see Challenge 4. Such limited uptake makes the schemes even less effective.

Supplier or third-party support is good in theory, but it kicks in (or is sought out) once customers are in financial difficulty. Working in isolation makes support fragmented and the customer experience even more inconsistent.

We also discussed the issue of debt recycling - where a customer quickly re-enters debt after completing a repayment plan. Support mechanisms can be a temporary fix. Easing immediate pressure without addressing the underlying financial situation.

Solution 3: Active prevention and collective support

Everyone agreed we need a more proactive and holistic approach. Suppliers and charities are working hard to improve customers’ situations, but together we can all make a bigger positive impact.

Here are some initiatives and ideas we discussed.

Industry-wide practices to lobby for

- A unified approach to working with charities and advice organisations. Creating consistent referral mechanisms, standardised communications, and collaborative support models. This would enable quicker hand-offs, better customer experiences, and a more joined-up system of care.

- Funded targeted bill support. Centrally designed and funded, then administered by the government or a central body. This would ensure consistent, fair funding, and avoid placing a disproportionate burden on individual suppliers or customers. Read our Fuel Poverty: Warm Homes Support Scheme report for more information.

- Integration with broader poverty-reduction initiatives. Treating energy debt as another symptom of wider financial exclusion. Link with hardship funds and welfare reform, and expanding debt relief options.

- Learning from other countries. Netherlands has government-backed debt forgiveness schemes to help customers break out of long-term energy debt cycles.

What suppliers are doing internally (and you could too)

- Proactively identify financially vulnerable customers. Don’t wait for missed payments to signal distress. Learn from external research and your own customer insights to spot signs or patterns of behaviour.

- Pre-debt intervention teams. Develop a multi-department support function or advocates to focus on pre-debt interventions. Teams can explore ways to promote debt support and help customers avoid debt wherever possible.

- Speed up support with automation. Trigger support with no need for the customer to take the first step.

- Integrate energy efficiency solutions into long-term support plans. Include upgraded boilers, heat pumps or insulation, especially for poorly energy-rated homes.

- Staff development. Train advisors to recognise vulnerability during conversations and respond with empathy. Offer flexibility and clear actions to deliver suitable customer support, without extra burden. Our free Vulnerability Excellence Workshop will help you identify vulnerability and respond appropriately.

Challenge 4: Disengaged and distrusting customer base

Many customers are disengaged from their energy accounts. Some ignore issues, so they miss out on early and effective intervention by their energy supplier. Others don’t trust their supplier to help, or worry about what will happen if they ask for support.

With such low trust and fear of the consequences, customers turn to third-party support instead. Some customers then get into further debt by using credit cards or securing loans to cover energy payments.

Increasing complexity

New Time of Use (ToU) tariffs, zonal pricing and standing charge changes will add further layers of choice and confusion. Less engaged customers already struggling to keep up will find it even harder. More customers will disengage, trust will dwindle, and debt will rise.

Solution 4: Re-engage and empower customers

This may be one of the toughest challenges, but some suppliers are making a positive impact. By learning from them and with a collective effort, every supplier can improve.

- Review communication. Ensure help is visible, believable, and easy to access to help rebuild trust.

- Develop third-party partnerships. Learn from and link with specialists who have trusted brands. Customers feel more comfortable with specialist and reputable third-party support. And they can access more varied solutions to fit their individual situation.

- Target disengaged or overwhelmed groups. Work with community groups or welfare support networks to raise awareness and build trust. Provide accessible education to empower behavioural changes too.

- Engage tenants with better landlord-tenant processes. Review processes to empower tenant engagement and limit how landlords can prevent direct access or block engagement. Create campaigns to ensure support reaches the tenants who need it.

Energy debt shouldn’t be inevitable

As the roundtable discussion highlighted, fuel poverty is a challenging and complex problem. However, the passionate debate means there’s a strong appetite to address things before it gets worse.

As an industry, our goal should be to identify customers suffering financial hardship and support them through their journey. Together, we should help them to confidently regain their financial resilience.

The ambition must be for suppliers to provide best-in-sector, proactive, and tailored support for customers. This means building systems that can identify financial vulnerability before it becomes a crisis.

We should aim for a future where energy support is trusted and accessible. Where customers feel empowered to engage early and suppliers work together through enhanced data sharing to protect consumers, regardless of who profits.

By employing some of these solutions in your organisation, and lobbying for industry change, we can make a difference.

Contact Rachel Littlewood to discuss more ways to avoid escalating customer debt. From identifying debt drivers and collection strategies, to automation and support systems.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile