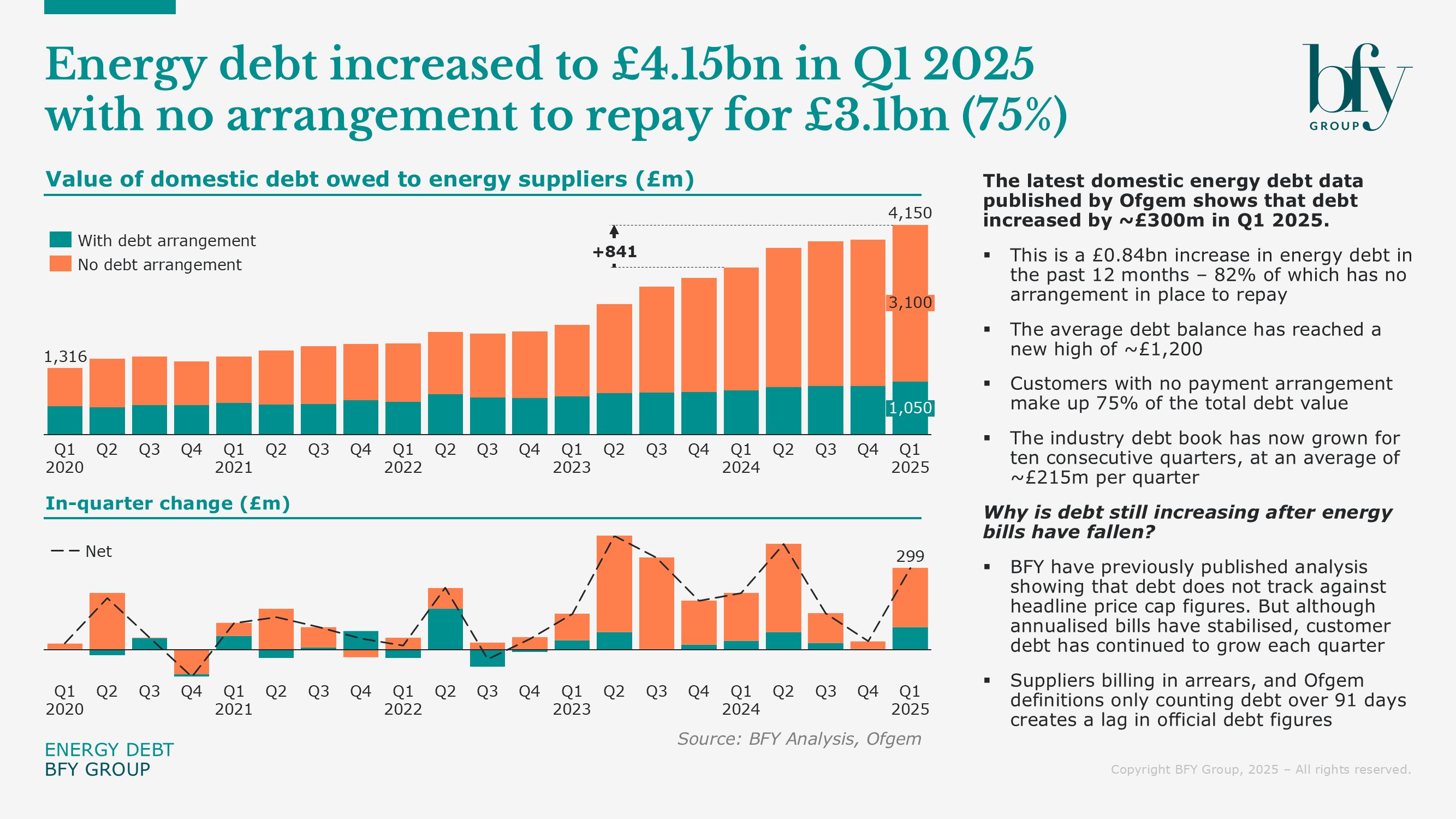

Domestic energy debt has reached a new high of £4.15bn in Q1 2025, an increase of £0.84bn compared to Q1 last year

This marks the tenth consecutive quarter of rising domestic debt, growing by ~£300m in the last quarter alone.

Key insights from the latest Ofgem data:

- The average debt per household has reached a new high this quarter, up from £1,135 to £1,202. The number of customers in debt has also risen by 78k to 3.47m

- Concerns remain as 75% of total debt still has no payment arrangement

- The weight of energy costs is having a huge impact on consumers, with as many 1 in 5 household in fuel poverty

- Ofgem and the government will hope that reductions in the Price Cap (7% from July) and changes to the Warm Home Discount scheme will start to have a positive impact over the coming months

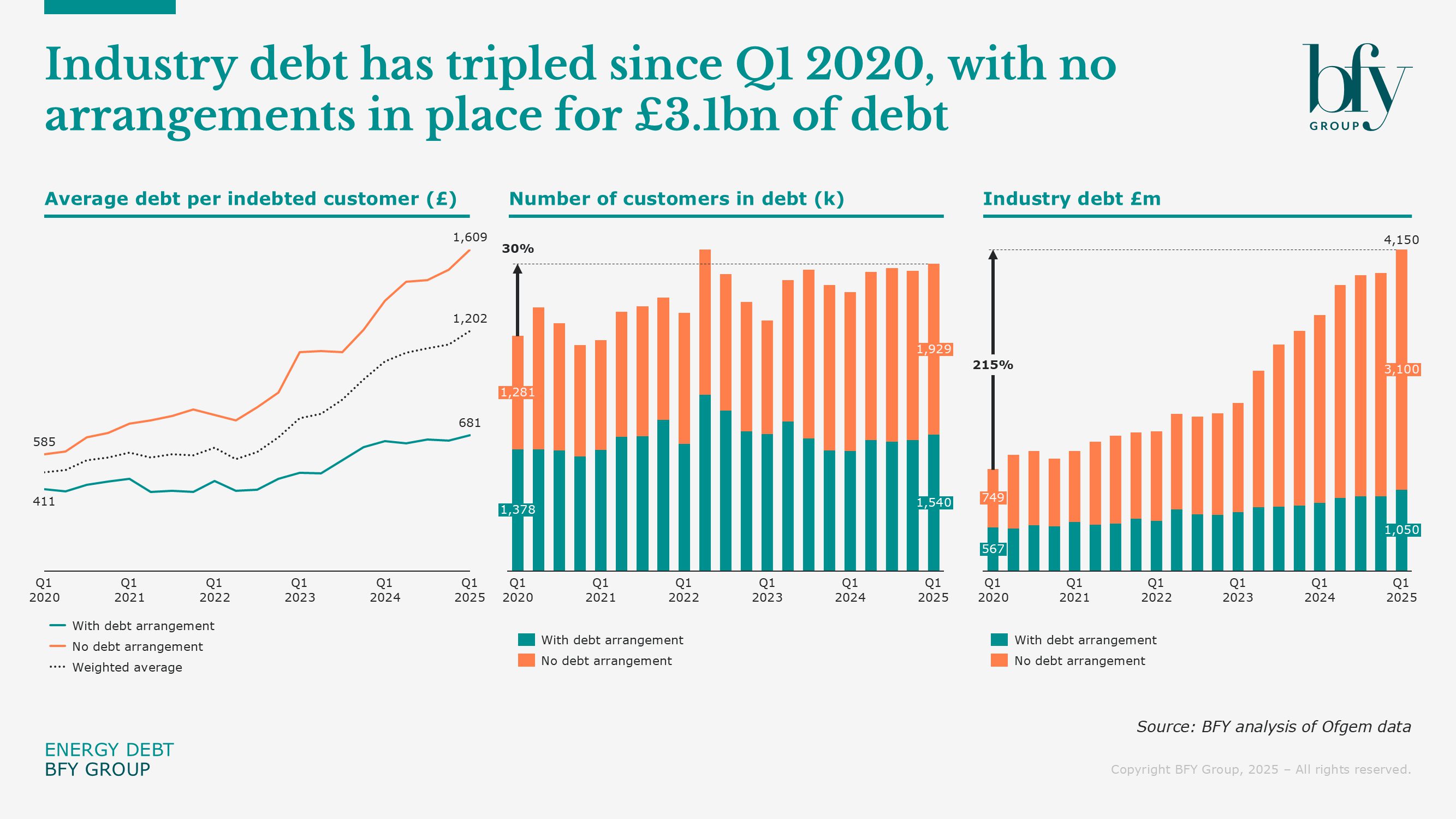

Industry debt has grown by 215% in the last 5 years

The growth in both the average debt and the number of Customers in debt has led to a record industry debt figure of £4.15bn, of which £3.1bn is unsecured.

Suppliers need to act quickly to mitigate the rates of growth and help Customers that need it the most. To support this, there should be a focus on accurately understanding each Customer’s ability to pay, moving them onto affordable arrangements, and improving plan performance through improved conversation quality and reacting quickly to failed plans.

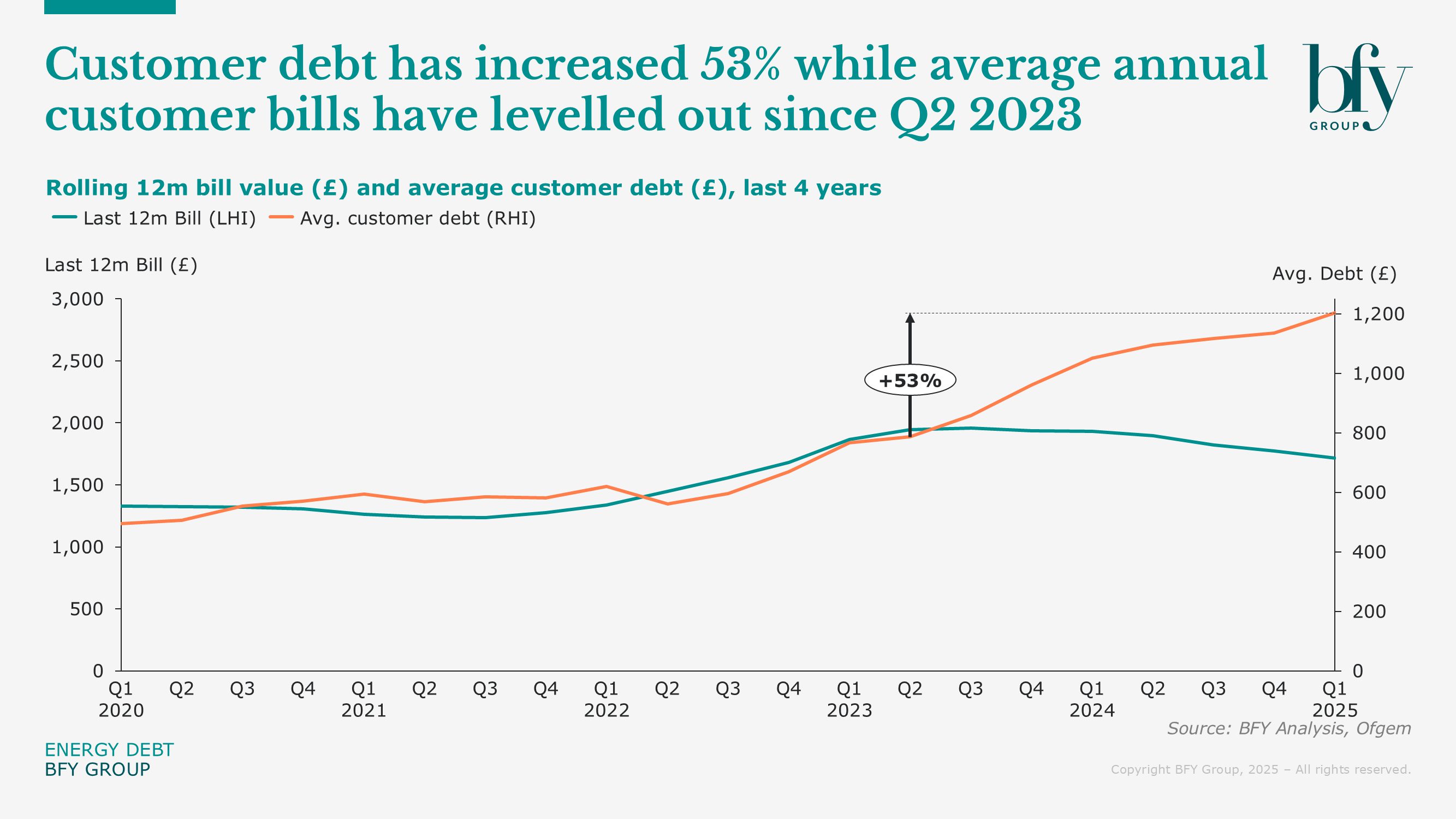

Despite falling bills, debt continues to increase

Average bill values have been declining and will fall further with the upcoming July price cap reduction; however, the average household energy debt has increased by 53% since typical household bills peaked in 2023.

Energy debt remains a persistent and deepening challenge

Initiatives such as the expansion of the Warm Home Discount, now reaching twice as many households, and the news that the Price Cap will reduce from July have been welcome news. However, these measures fall short of addressing the deep affordability issues facing many customers.

Contributing to this issue further, UK electricity prices remain amongst the highest in Europe, highlighting the need for long term policy reform.

While the upcoming price cap reduction may ease bills for some, the way debt is reported (excluding debt under 90 days old) means that higher charges from previous quarters will continue to impact the figures ahead. As a result, industry debt could climb further before any material improvement is seen.

As the industry focuses on the energy transition and net zero goals, for the millions struggling to pay their current bills, technologies such as EVs, solar panels, and heat pumps may be out of reach.

It remains crucial to build trust and engagement with customers

Whilst Suppliers should be focussed on ensuring they have visibility and understanding of each Customer’s ability to pay and their associated treatment, our recent article called for more transparent and consistent debt reporting across the industry to support targeted intervention and rebuild consumer confidence.

Additionally our recent article highlights the importance of industry-wide transparency in debt reporting, and our joint report with So Energy sets out the case for a coordinated, nationwide fuel poverty strategy. Click here to get the full report.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile