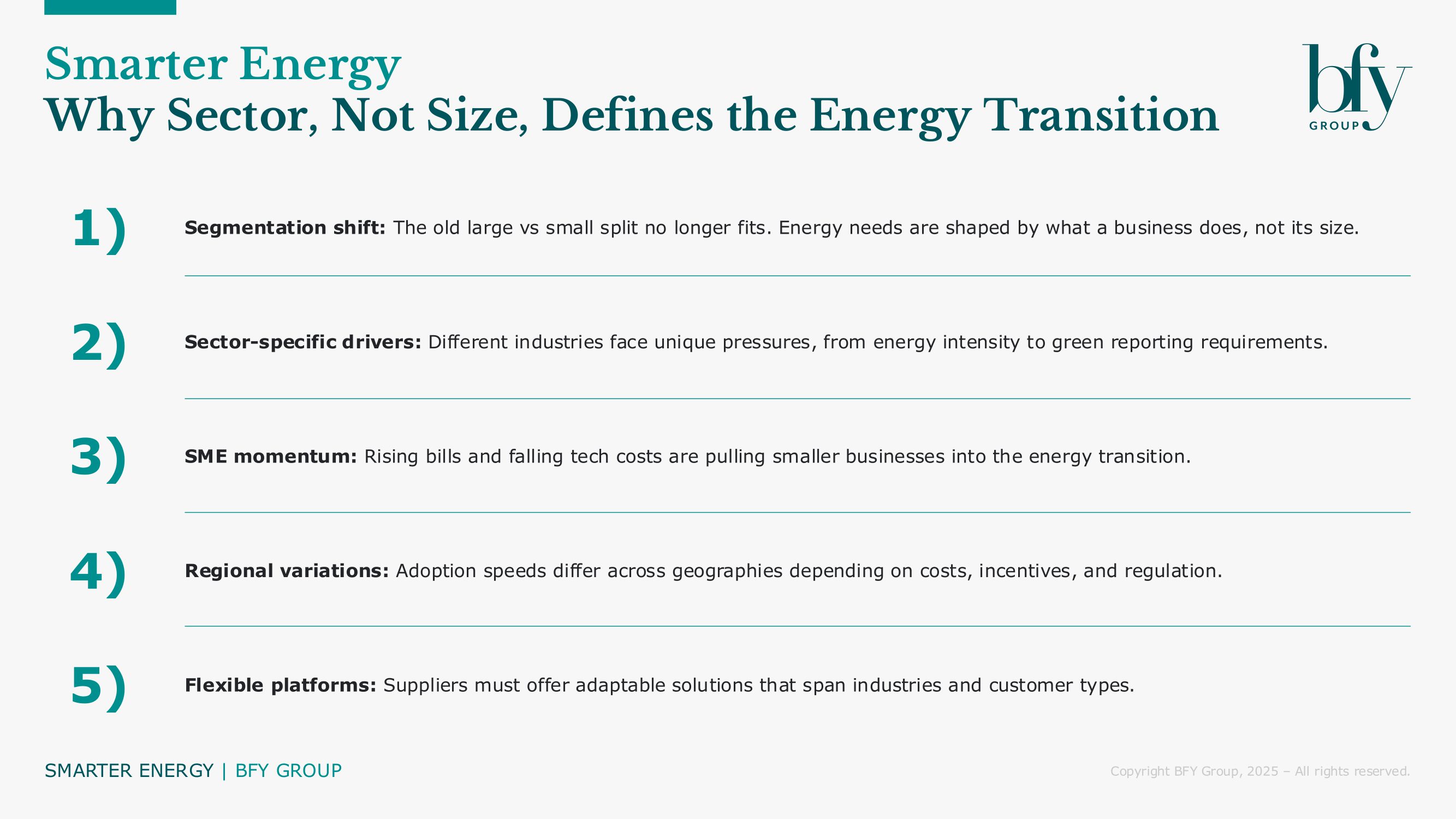

For years, the energy industry has divided its market into two neat buckets: large corporates and small businesses. But that old binary is becoming less and less useful.

In the real world, a manufacturing SME has more in common with a global industrial giant than with a local coffee shop. When it comes to energy, what a business does often matters more than how big it is.

Large enterprises led the charge, driven by mandatory climate reporting and pressure from institutional investors. In fact, nearly half the world’s largest companies have made net zero pledges, signed major renewable energy deals and rolled out sophisticated energy solutions across their global operations.

They have the teams, the tools and the time to manage complex transformation programmes.

So, what do businesses want?

It’s simple: integrated platforms. They expect partners who can deliver across multiple sites, offer flexible contracts and take on risk through energy-as-a-service models. These are strategic partnerships, not transactions.

But smaller businesses face different realities. Most don’t have a sustainability lead. Budgets are tight. Many lease their space and don’t control their buildings. Even when the economics of clean energy stack up, competing internal priorities can slow progress.

That said, things are changing. Rising energy bills and falling tech costs are turning more SMEs into active participants in the energy transition. They’re starting with proven technologies that offer clear returns, like solar, LED lighting and basic efficiency measures. Government incentives and new financing models reduce traditional barriers, while simplified procurement platforms make solutions more accessible.

It’s not about size, it’s about what you do

Manufacturers, data centres and industrial sites face high energy exposure and are investing in process optimisation, efficiency and heat solutions. Professional services firms care about green credentials and reporting and are focused on clean energy procurement and office efficiency. Retailers and hospitality brands want quick wins and customer-centric improvements, like efficient lighting or rooftop solar.

Geographic variations compound these differences. Companies in regions with higher energy costs or stronger regulatory frameworks show accelerated adoption, while those in markets with abundant fossil fuel resources lag behind.

What this tells us is that a one-size fits all approach isn’t appropriate, and that any possible solution demands differentiation not just by customer size but by sector. Success lies not in choosing between sectors but in developing platforms that adapt across boundaries. An industrial heat pump solution can serve a multinational chemical company and a regional brewery through different service models: managed transformation for the former, guaranteed performance packages for the latter.

This approach recognises that energy transition needs correlate more closely with operational characteristics than with balance sheet size. The traditional segmentation of companies into large versus small was well suited to commodity energy markets, where consumption patterns varied primarily by scale. However, the energy transition market demands recognition that how companies use energy matters more than how much they consume.

To explore what systems and platforms can best support your business and its energy transition, contact David Watson or Hannah Sword.

Hannah Sword

Director

Hannah leads client engagements, striving to ensure clients gain significant value and benefits and from the work we deliver.

View Profile