In this second article about reducing debt, we’re building on the short-term actions we shared in the articles below.

- How to reduce B2B energy debt today and build future resilience

- How to protect customers and profits as household water debt reaches £2bn

We’re also featuring the stories and results from a few of our clients to help you take action, including how we delivered ~£50m benefit in 6 months.

Being more proactive with your own debt will help you boost collections, improve systems and protect your organisation from future market changes, reforms and challenges.

Challenges and opportunities

As we set out previously, market conditions are tough and we’re all seeing the effect of rising debt levels. Whether it's due to limited visibility, fragmented data, or inconsistent processes, many organisations are finding it harder to prioritise accounts, intervene early, and prevent further exposure. Developing a clearer, more accurate view of your debt position, and tightening control around how it's managed, can unlock significant capacity and stabilise performance.

While energy suppliers are more experienced in adapting to market changes and government reforms, it’s a relatively new necessity for the water industry. However experienced your organisation or sector is at weathering the changes, there are still plenty of opportunities for everyone to refine processes and build resilience.

Step one: taking stock

For example, a client approached us to address rising aged debt and its impact on working capital. They wanted to reduce bad debt provisions, improve credit control processes, and strengthen financial resilience.

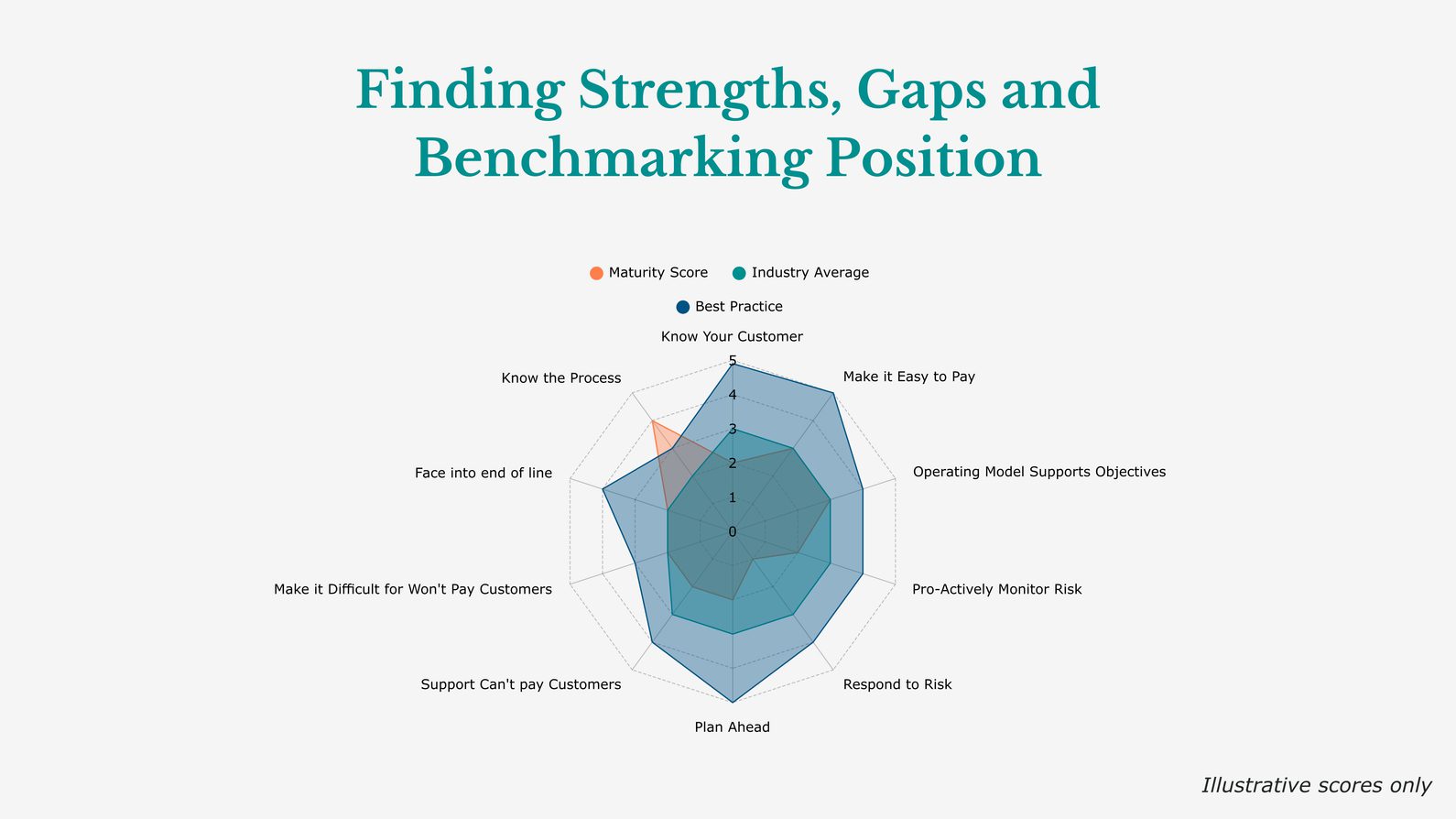

After completing our comprehensive debt maturity assessment, we gave them a detailed snapshot of their performance across 186 capability areas, benchmarked against industry ‘average’ and best practice.

The areas that needed attention were now clear, but they needed tangible actions to implement and start getting results. The data-led recommendations and action plan our debt experts created were based on internal engagement, existing capabilities and systems. All designed to make the biggest impact in the shortest time, with minimal disruption.

We discovered they were servicing accounts well and supporting those in arrears but missing some opportunities to limit debt exposure. So, we helped them discover more proactive ways to manage debt, including how to identify potential pre-debt behaviour (higher usage levels, missed or delayed payments) so they could intervene accordingly.

All together, our targeted 6-month improvement plan across 5 work streams helped to recover £50m within six months.

“The BFY team was a pleasure to work with and they clearly understand their subject matter. They provided clear communication, clear proposals and excellent knowledge.”

Step two: taking action to improve

There are plenty of tried and tested ways to improve debt management. But it’s important to choose the most effective way that meets your commercial needs, system and people capabilities. And that’s why even if you know what you want to improve, it’s still worth completing step one to understand what you need and how best to get there.

From understanding your portfolio and identifying pre-debt behaviours, to streamlining payment options and targeting accounts with outreach campaigns. You need tactical intervention and targeted campaigns that are right for your business and portfolio.

By applying this approach for another client, we helped them collect >£10m within 12 weeks.

They knew technology was a big hurdle in their debt collection process. They relied heavily on out-dated dunning processes (requesting debt repayments) which used poor data and demanded manual checks and updates. This was understandably exacerbating their debt position, creating huge backlogs, and lengthening payment resolution times.

Due to the urgency of the rising debt, there wasn’t time to design and install a bespoke digital system. Instead, we designed and ran white-label digital campaigns using external software systems to re-engage account holders and make it easier for them to pay. It was up and running in just four-weeks.

We also deployed a digital collections platform to streamline debtor engagement. Addressing the other issue of poor data, we collated and cleaned contact data from the different client databases, which increased active debt accounts by c.150%.

Step three: sustaining improvements and building for the future

Whatever actions you choose to take, reviewing their effectiveness is crucial to building long-term improvements. While quick wins are often essential in debt collection, a sustainable approach is more commercially beneficial. When you’re deep in the day-to-day or month-to-month detail, it's hard to see the longer-term implications. Our team has the experience to help you address the pressures, challenges and intricacies you face day-to-day.

Where to start?

Do you have a holistic view of your debt maturity?

Stepping back to understand your performance always helps uncover your challenges and opportunities.

Could you be more proactive?

Are your systems and processes able to identify pre-debt behaviour? Could you implement early intervention strategies to reduce exposure?

What are your quick wins and long-term goals?

Could you segment your portfolio better, run digital campaigns to offer support, or fill gaps in your data? Look at actions you can take in the next month or so while you gather ideas for longer-term improvements.

How prepared are you?

Does your strategy cover the latest industry initiatives? Could you easily pivot according to reforms and regulatory restructures?

Contact our debt management specialists to discuss your answers to these questions and start building your improvement plan.

We work closely with senior management and debt teams, bringing our expert knowledge and external perspective to identify key areas for measurable improvement.