Why does energy debt keep rising, and who’s responsible for reducing it? We gathered industry leaders from EDF, E.ON Next and Utility Warehouse in our latest webinar to talk things through. The webinar recording is available but here’s a summary of the frank and insightful discussion.

The panel

Rich Hughes, Director of Retail at EDF Energy, set the context for the discussion by contrasting the UK energy market with other European models, drawing on decades of experience managing customer debt.

Rob Harris, Chief Operating Officer at Utility Warehouse, offered insights from his background in finance and his role at the multi-utility provider, serving customers across energy, broadband, and mobile.

Stefan Guy, Director of Credit Management and Affordability at E.ON Next, brought perspectives from one of the UK’s largest energy suppliers on managing debt at scale whilst supporting vulnerable customers.

Rachel Littlewood, Director at BFY Group, shared insights from BFY’s extensive work with energy suppliers on debt reduction and operational improvement.

2-minute takeaway

- The UK energy market is unique. It’s structurally different across the UK and faces bigger challenges than the rest of Europe. It also differs from other credit services. Customers can easily accumulate high levels of debt with no immediate consequence, unlike council tax, mortgage repayments, rent, or credit agreements.

- A critical lever for addressing debt is customer engagement. Without engagement, it’s difficult to get much-needed and targeted support in place, limiting suppliers’ ability to intervene early and prevent debt from escalating.

- External support is constrained. Limited support mechanisms mean suppliers are expected to bridge the gaps.

- There’s a trust and accountability imbalance. Media representation, poor communication and misinformation widen the trust gap. The lack of consequences for energy bills shifts responsibility and weakens some of the accountability between customers and suppliers.

- Everyone wants to help those in need and improve the energy market in the UK, but regulatory change is slow, limiting and lacks impact. The onus therefore, is on suppliers.

Why is debt still rising?

Energy prices have stabilised, but debt is growing at an alarming rate. Panellists shared their views on the factors increasing debt levels and subsequent changes in customer behaviour.

Price, credit access and perception

“At the heart, this is a poverty problem which goes beyond the energy sector. We’re seeing customers who were just about coping before now unable to absorb higher bills, even though prices have stabilised.” Rich Hughes, EDF Energy.

Rob Harris, Utility Warehouse, added “the way in which customers are managing their home economy has changed. What would have been potentially a cash flow issue that they could mask over time, they can’t now because they’re excluded from credit, and the credit is too expensive.”

Stefan Guy, E.ON Next, “energy is fundamentally different to other credit markets. It’s an essential service. The costs are socialised in a way that disproportionately impacts those least able to afford it. And the consequences of non-payment are very different. All of that contributes to debt behaving differently here.”

Stefan Guy continued, “we see customers that have been cycling in and out of debt now just find themselves getting further underwater.”

The panel regularly sees customers getting into £2,000- £3,000 of debt over the winter months, but even on a repayment plan only paying back £20 a month. This makes the level of debt completely unrepayable and acts to discourage customers from repaying at all.

Fewer consequences than other creditors

All panellists agreed that most customers experiencing debt are struggling with other household bills as well. So, when customers face multiple creditors and limited resources, they will naturally prioritise debts with immediate consequences over energy payments (mortgage or rent, council tax and other credit agreements).

“Debt is an emotional topic. It invades people’s lives in a way that their natural response is to bury your head in the sand.” Rachel Littlewood, BFY Group.

Stefan Guy said, “the ease of payment avoidance and the potential lack of consequence of getting into debt, illustrates a market design problem specific to energy. Customers that are in debt to energy organisations are most often up to date in their bills to other lines of credit. Energy debt growth is disproportionately more significant relative to other lines of credit.”

Everyone agreed that energy is an essential service and should stay that way. However, the perception and management of energy debt must change. The official lines of support available are limited but suppliers can’t intervene until debt has already mounted.

Shared cost of unpaid debt

Another system issue which amplifies the problem is the cost of unpaid debt. A cost which is disproportionately borne by customers who are least able to afford it. The flat ‘socialised’ rate for everyone is unfair to many and increases the pressure on customers who are already struggling. The same applies to customers who pay on receipt of bill.

Who’s responsible?

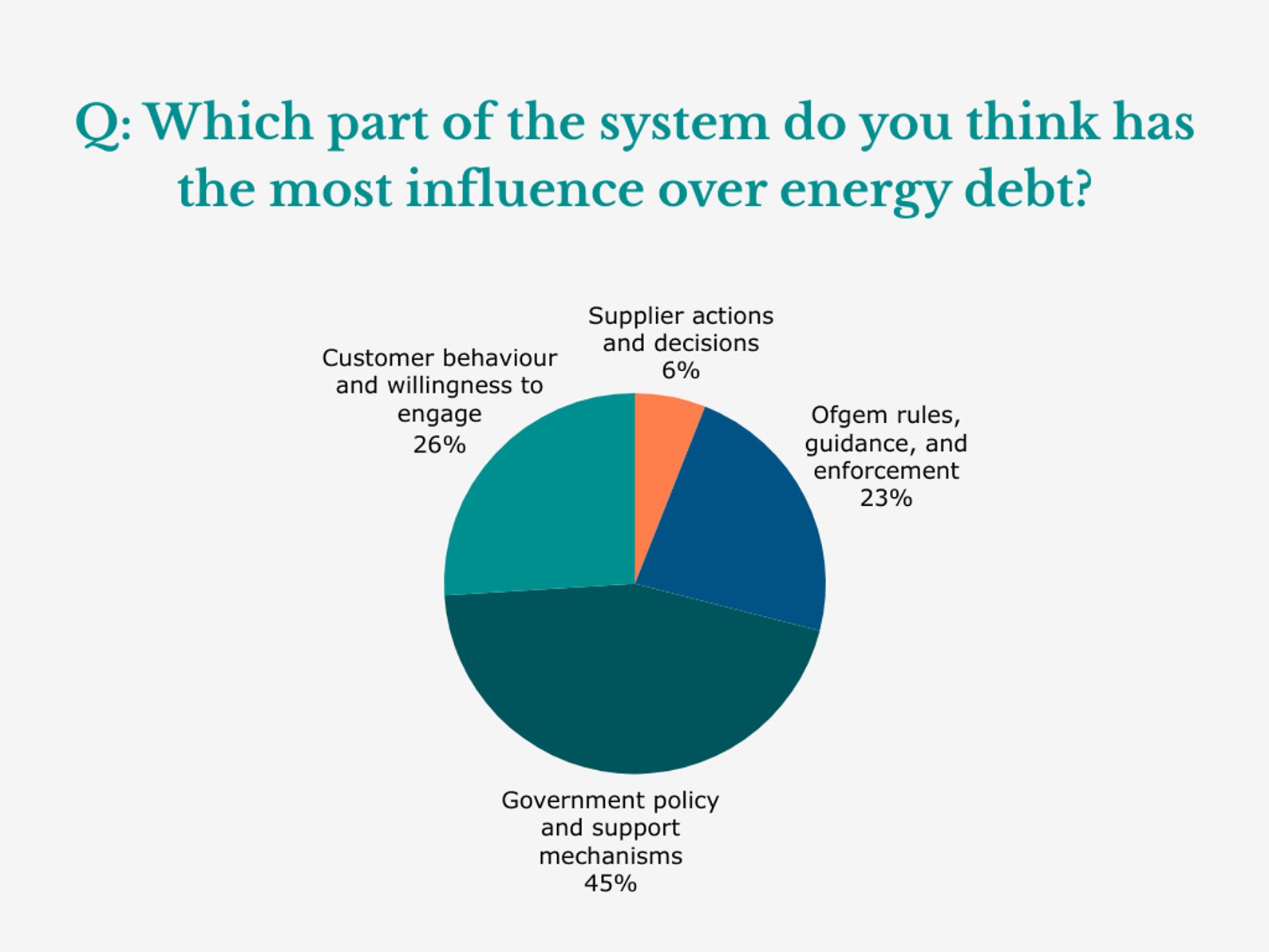

Everyone agreed it’s a complex and nuanced problem. Actions by markets, government policy, regulators, suppliers, customers and even popular media shape debt levels. So, who’s responsible for reducing and preventing debt?

The audience response was split, but only 6% said suppliers had the most influence.

Rob Harris cut to the chase. “As suppliers, you can’t abdicate responsibility to anyone else. We have the biggest responsibility to support customers and make sure that they’re on the right track.”

He continued, “I was in financial services before I moved into energy. We had similar issues pre-financial crisis. It led to some really poor behaviour, but fundamentally, the banks learned to operate differently ahead of the regulation changing. The regulation was an enabler, but it came after the banks made the early moves.”

Stefan Guy added, “Everything’s symbiotic. And, you know, if we lower the cost, it’ll make things easier. If you get the protections right, it’ll make life better for suppliers. If suppliers do the right thing, it’ll help. So, we’ve all got a significant role to play.”

Rachel Littlewood, pointed out, “everybody is approaching this challenge from the right place, with the right intentions. But it’s very slow, and it needs to be quicker. Before we know it, it will be 2030, and we will be nowhere near where we wanted to be in terms of the transition.”

The panellists suggested there’s less immediate impact suppliers have on policy or regulation. The onus is on them to find better and quicker ways to engage customers and provide support to those who really need it. The solution needs to be comprehensive to drive significant improvement, but we can all do our bit to make a positive change today.

Potential solutions

Turning to the changes we can all make, panellists offered their ideas to tackle the common issues the energy industry is facing in terms of debt, as well as wider improvements. There was no ‘magic wand’, but a combination of comprehensive tactics suggested.

Rachel Littlewood set out the big picture. “Engagement is the real nub of it; there’s a trust gap. The rhetoric is so strong against what energy supplies are and what they stand for, that any offer of help is immediately looked upon with suspicion, and that is a real barrier to fix, not just for debt. Look at the reaction to the Warm Homes Plan, Clean Power 30, etc. None of these improvements can happen without market engagement. Customers need to trust suppliers to take these solutions into their homes, and trust that the financial support and offer is genuine.”

Low uptake of write-off or support schemes highlights deep trust and engagement barriers rather than a lack of available help.

Media communications

We often overlook the media’s role in energy, yet misinformation and speculation shape public perception. This influences government policy because they’re voted in by public consensus. Which then affects how customers engage with their energy supplier.

There is help available for customers experiencing debt, but the low uptake of write-off or support schemes emphasises the deep trust and engagement barriers. Suppliers, government and regulators must work harder to address misconceptions and build trust. As Rich Hughes said, “in a post-truth age, it’s really important to get some facts on the table.”

Smart meters

Rich Hughes added smart meters can give customers “more confidence and a bit more awareness of their budgeting.” But he and others reiterated that they need to be used as just one way to boost customer engagement. Lack of meter access and reads leads to estimated bills that can inflate debt beyond what customers actually owe.

Prepayment

Despite negative perceptions, prepayment can be an effective budgeting and debt recovery tool.

Rob Harris pointed out, “in many sectors and industries, prepayment is a default at the start of your relationship with an organisation.”

Instead of customers consuming as much as they like and only paying what they want, prepayment can establish better spending habits and providers can assess credit risk.

Rich Hughes agreed, “the reason I like prepayment is not to collect money, it’s to put people on a pathway to recovery.”

Targeted support and operational change

“You need an individual approach to each customer, but operationally, that’s incredibly difficult to achieve.” Rachel Littlewood.

Meaningful improvement requires suppliers to adapt operating models now rather than waiting for regulatory change. Identifying risk is the goal to prevent debt escalation but operational scale and data gaps make this challenging.

And now, some external and industry-wide solutions.

Better data

Improved data sharing will help twofold. First, by defining what a financially vulnerable customer really is. The current system isn’t working. As Stefan Guy pointed out, “clearly defining what a financially vulnerable customer is critical. If you asked 100 people, you’d probably get 100 different answers.”

Second, collaborating with and getting almost real-time data from DWP, HMRC, credit bureaus and open banking will help suppliers identify at-risk customers and intervene earlier and better.

Social support with clear rules

Rich Hughes suggested we “take inspiration from other countries, For example, Australia. First time round, you get your equivalent of an additional support credit. The second time, you have to give some proof. But what’s really clever is they share it across multiple industries and multiple suppliers.”

He continued, “or look at the water sector; they are obligated to provide social tariffs. Social tariffs with typically 50-75% discount off the bill, but then you’re expected to pay. And they get payment much better than we do.”

Improving people’s homes

Panellists said although the intentions are good, support like the new warm homes plan doesn’t apply to the right groups of people and doesn’t go far enough.

Some lamented the loss of ECO, not without its faults, but it made a significant difference to bills by improving the energy performance of people’s homes. Without a similar scheme or some type of financial support, the panellists worry people will continue thinking the net zero transition and decarbonisation is just to benefit the wealthy.

Final thoughts

Energy debt is rising. Waiting for regulation to catch up isn’t an option. The problem is structural, the consequences are compounding, and suppliers carry a significant responsibility to act now.

Customer engagement is the critical lever. Without it, support schemes are underutilised, debt escalates, and trust disintegrates. Reduced external support, limited data sharing and a socialised cost model makes the challenge bigger.

There are practical steps suppliers can take. Suppliers making a difference aren’t waiting for a policy change or a magic wand. They’re redesigning how they work. Earlier intervention, targeted support, smarter use of data, and operating models built to reach customers who are struggling.

Ready to act?

BFY Group help energy suppliers recover and prevent customer debt through targeted, practical operational changes. Collections improvements, debt strategy, customer engagement and operating model redesign.

If debt prevention or recovery is a priority for your business, get in touch with our team.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile