The energy transition is moving faster than any one company can keep up with on its own.

The technologies are broad: solar, heat pumps, energy management systems, data platforms and carbon tracking – each requires deep expertise. Trying to build all of this in-house isn’t just slow, it’s largely unrealistic.

That’s why the smartest companies aren’t trying to do it all themselves. They’re choosing strategic partnership over pride to unlock speed, scale and innovation. Strategic partnerships offer speed, expertise and capital efficiency that internal development cannot match. More importantly, they enable risk distribution across specialist partners who understand specific technologies and sectors more deeply than generalist energy suppliers ever could.

This approach allows portfolio-based learning - testing multiple market and technology approaches simultaneously whilst scaling successful partnerships and ending unsuccessful ones with limited financial exposure. Rather than betting everything on internal capability development, suppliers can diversify approaches and double down on what works.

Building flexible ecosystems for the sole purpose of learning

Different partnership models suit different opportunities:

- Joint ventures work for large-scale investments requiring significant shared resources, for example major industrial decarbonisation projects or new geographic market entry.

- Preferred supplier agreements provide reliable delivery capacity through volume commitments.

- Revenue sharing models align incentives around performance outcomes, particularly effective for energy-as-a-service offerings where both parties benefit from customer satisfaction.

- White label arrangements enable suppliers to retain customer relationships whilst partners handle technical delivery behind the scenes.

- Technology licensing allows digital energy management without building internal software capabilities.

- Equipment financing partnerships enable capital-light expansion into asset-heavy sectors.

Successful partnerships require explicit agreements on customer ownership, revenue attribution, risk allocation, data rights and conflict resolution. The allocation of risk demands clear agreements on performance guarantees, liability sharing and upside participation that align incentives with customer outcomes.

Partnerships often evolve through multiple structures as relationships mature, starting with pilot projects and expanding into integrated arrangements as trust and performance grow.

Implementation often fails not due to technical shortcomings but because organisations struggle to integrate new processes, data flows and decision-making frameworks into existing operations. Energy transition technologies require systematic change management to embed new capabilities across supplier operations and avoid creating parallel systems that fail to achieve cultural adoption.

Seven-step process to manage partnership lifecycle effectively

- Assess the market – where are your capability gaps?

- Screen potential partners – do they align strategically and culturally?

- Choose the right structure

- Define the rules – clear agreements on value, roles and risk

- Start small – pilot first, then scale

- Measure what matters

- Plan to evolve – market and needs change, and so should partnerships

The transformation parallels other industries where partnerships enabled rapid capability development. Technology companies partner rather than build every component. Pharmaceutical companies license rather than develop every drug internally. Automotive manufacturers partner rather than produce every part. Each recognises that speed and expertise trump control in rapidly evolving markets.

The energy sector is now facing the same reality. The companies that build smart, flexible partnerships will move faster, serve customers better and capture more value than those solely relying on internal development. The energy transition timeline doesn't accommodate the luxury of building everything internally. Partnership becomes not just strategic preference but competitive necessity.

Revisit the full Smarter Energy series

This article concludes our five-part series on succeeding in the energy transition. In our closing video, David Watson shares the key takeaways and how B2B suppliers can position themselves to win. You can also revisit all five articles on our series landing page.

How We Help Suppliers Succeed in the Energy Transition

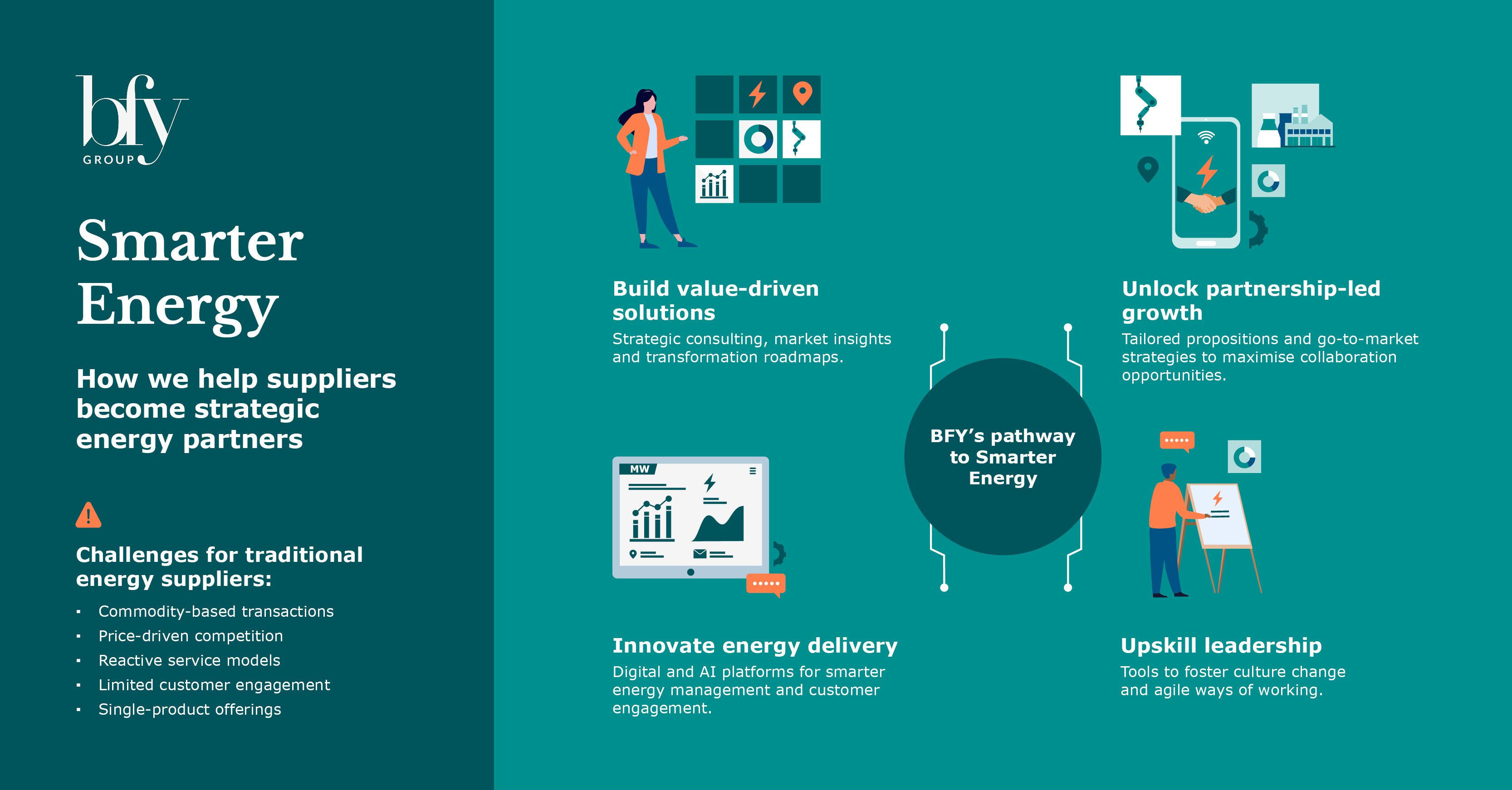

Throughout our Smarter Energy series, we’ve shown how suppliers can evolve from commodity providers into trusted energy partners by combining strategy, technology, partnerships and people.

Here’s how we help make that transformation happen:

- Build value-driven solutions - Strategic consulting, market insights and transformation roadmaps to define the right path forward.

- Unlock partnership-led growth - Tailored propositions and go-to-market strategies to maximise collaboration opportunities.

- Innovate energy delivery - Digital and AI platforms for smarter energy management and stronger customer engagement.

- Upskill leadership - Tools to foster culture change and embed agile ways of working across the organisation.

To explore how your business can take these steps and succeed in the energy transition, contact David Watson or Hannah Sword.

Hannah Sword

Director

Hannah leads client engagements, striving to ensure clients gain significant value and benefits and from the work we deliver.

View Profile