In the race to lead the energy transition, it’s easy to assume that success will go to the companies selling the most solar panels or batteries.

But look a little closer, and a very different picture emerges, an unexpected winner is gaining ground: the data scientist.

What’s driving this shift?

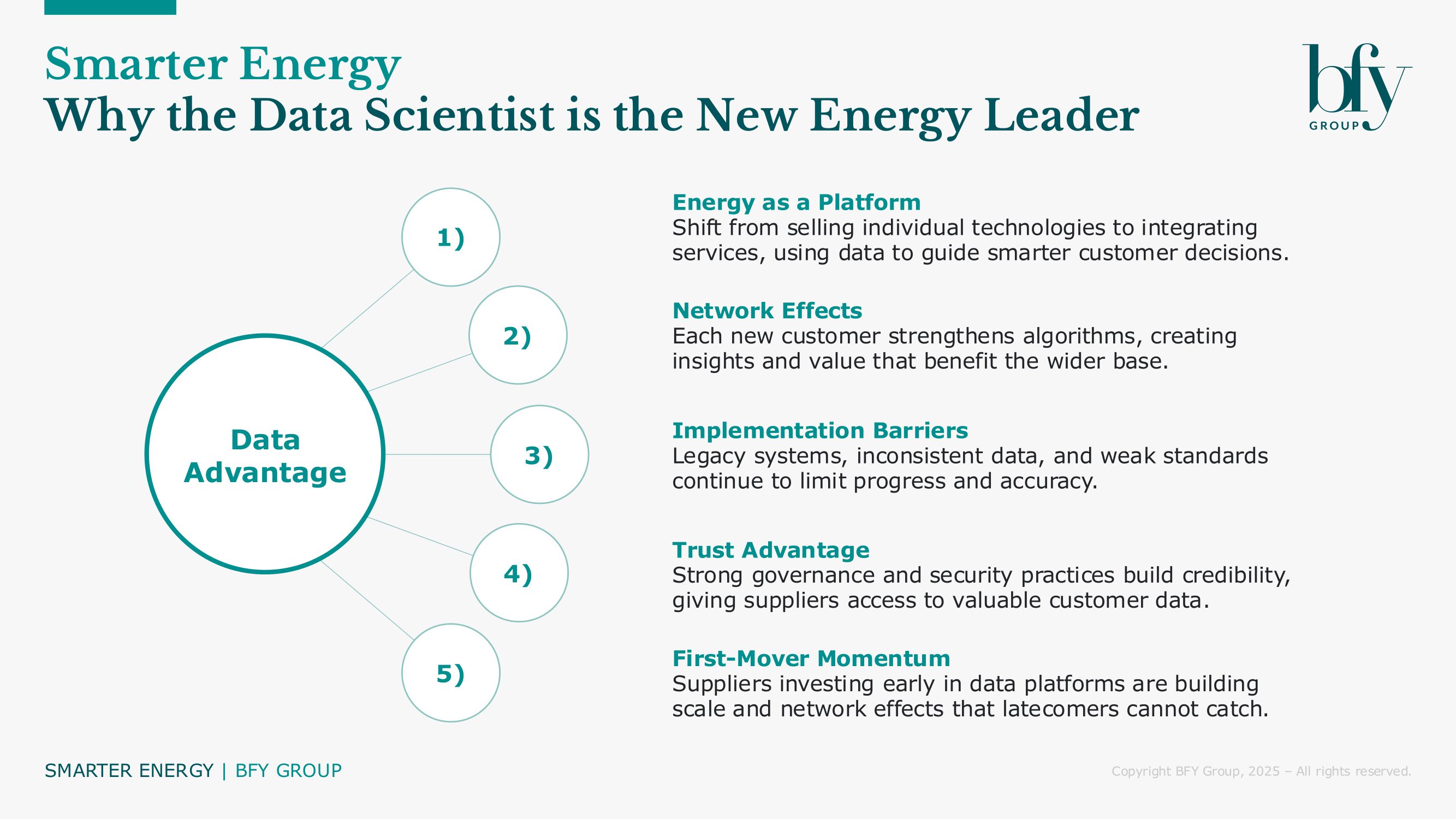

In short, energy is no longer just a product, it’s becoming a platform.

Traditionally, energy companies sold individual technologies like solar, storage, efficiency and carbon tracking. Now, forward-thinking providers are pulling these threads together, integrating technologies, analysing performance and using data to drive better decisions for every customer.

The competitive implications are profound. Each additional customer strengthens algorithms and improves outcomes for existing participants, creating network effects that traditional energy companies struggle to replicate. Success depends on the depth of customer insight rather than the volume of the commodity supplied.

It’s the same cycle that transformed industries before, like retail, media and logistics. Solar and electric vehicles for logistics companies, smart controls for retailers, predictive maintenance for manufacturers – all tailored based on consumption patterns, building profiles and behavioural data. Suppliers can pre-identify customers ready for transition based on energy intensity and asset age, proposing solutions at optimal moments rather than relying on generic sales approaches.

This precision unlocks revenue streams beyond energy supply. Predictive maintenance shifts from reactive repairs to algorithmic forecasting.

So why do substantial implementation barriers remain?

Data quality is inconsistent and building management systems rely on legacy platforms whilst data management lacks standardisation. Ultimately, all of this undermines analytical accuracy.

Customer data protection adds another layer of complexity. Commercial sensitivities and cyber security concerns require robust governance. This provides advantages to larger, more established suppliers who can more easily evidence trustworthiness - a meaningful competitive moat in an industry where trust translates directly into data access.

The strategic implications extend beyond technology choices to business model decisions. Suppliers must choose whether to build, buy or partner for data capabilities, recognising this as a journey requiring sustained commitment rather than quick tactical wins. Initial priorities must focus on data infrastructure and quality foundations before advancing to sophisticated analytical capabilities.

The transformation parallels other industries where data platforms disrupted traditional models. Amazon began selling books but built logistics algorithms. Google started with search but created advertising optimisation. Netflix moved from DVD rental to viewing behaviour prediction. Each leveraged data network effects to dominate markets far beyond their original scope.

The energy sector is heading the same way

The window for transformation remains open but narrowing. It’s becoming a strategic shift rather than a political trend, with the focus now on smarter power.

Energy companies must decide whether they want to keep competing on price in a commodity market or evolve intro trusted partners that help customers navigate complexity, manage performance and deliver measurable results. Early movers are already building momentum, collecting the data, training the algorithms and creating the network effects that will be hard to catch up to later.

To investigate how your organisation can best organise and importantly learn from your data collection and management tools, contact Hannah Sword or David Watson.

David Watson

Principal

As Principal at BFY, David leads client engagements on energy strategy, policy and commercial excellence, helping them to navigate a complex policy and regulatory landscape, capitalise on emerging opportunities in the energy transition and optimise their operating models for long-term success.

View Profile