It's great news that Jeremy Hunt has extended EPG for a further 3 months at £2,500 - however the amounts customers pay is still projected to increase.

We urgently need to improve how the story is being told on the true costs to customers.

One social media commentator made the claim that "people would be unnecessarily subjected to “the financial and mental health damage” of a 20% rise for three months". This isn't the case - the EPG will have a ~£100 / 5% improvement when looking at the projected 12m bills starting in Q2-23.

The Price Cap is set as an annualised figure expressed over a 3 month period. It doesn't project customers bills for a 12 month period (this is not easy to do by the way) and should not be reported as such.

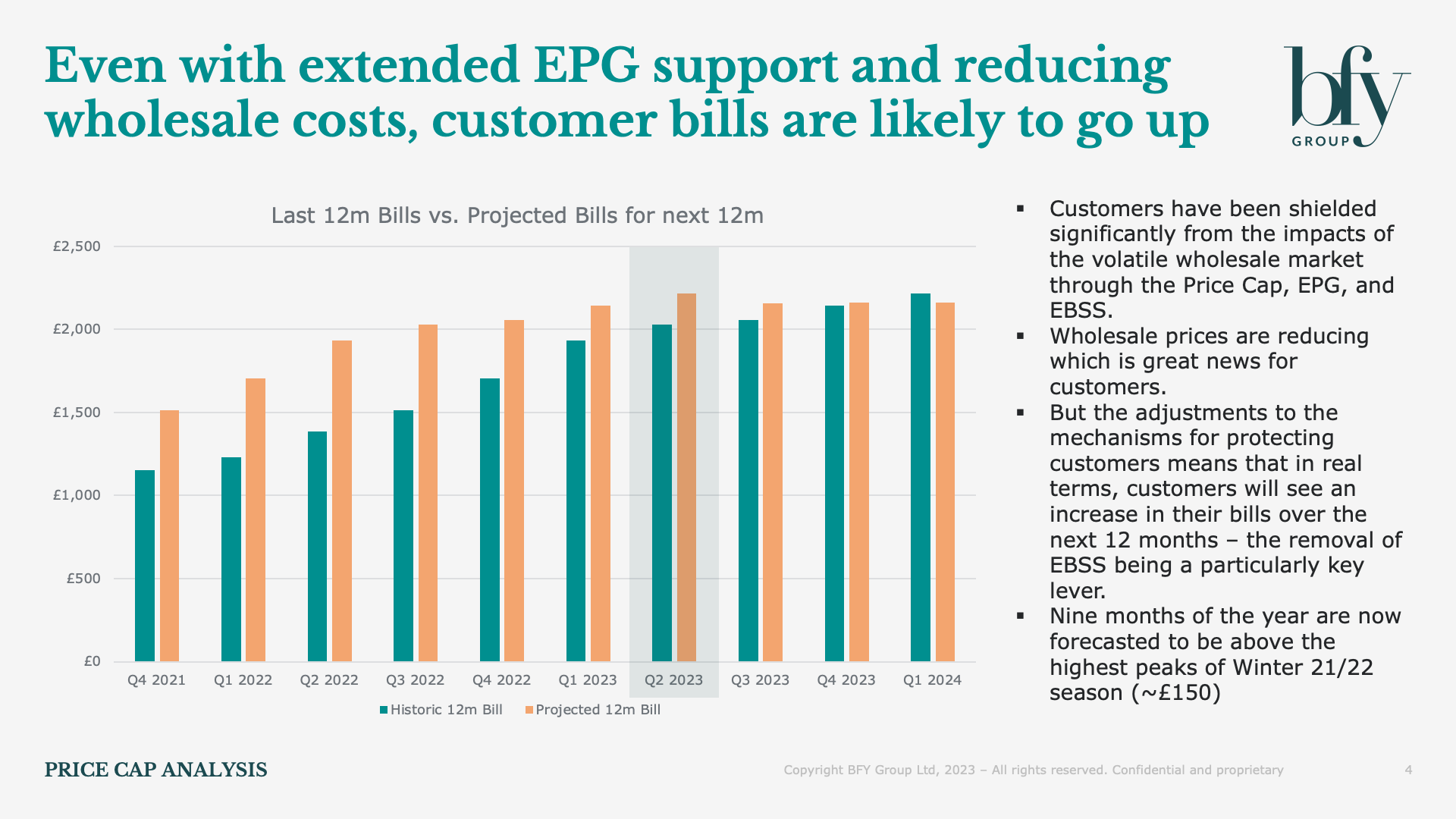

Even with the forecasted reductions in the wholesale costs, the bills customers pay each month are projected to go up due to the changes in the support mechanism from government.

Nine months of the year are now projected to be higher than the highest peaks in Winter 21/22.

True underlying customer bills for the next 12 months are projected to be ~£2,200, customers will have likely paid £1,950 over the last 12 months. This is driven by the various historic levels of the price cap, the monthly consumption profile of the customer, and the timing at which government support has been given.

To read the full Market Insight report, please click this link - BFY Energy Price Cap Analysis

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile