Energy suppliers and small businesses in the UK are at risk of a hidden crisis. A crisis of up to £1.8bn in unpaid energy bills.

This huge debt problem is growing silently and secretly due to gaps in visibility compared to domestic debt. And there are no industry-wide answers — yet.

We’re working with more clients to understand and improve their own customer debts. We want to broaden the debate so more people can appreciate and understand the problem. And share some potential solutions.

The backbone of our economy is under pressure

Small and medium businesses (SMEs) make up 99.9% of all UK businesses. They’re the cornerstone of the UK economy. In energy terms, that’s about 2.5m energy meters. But we know very little about their energy debt because no one shares the data publicly.

Without this info, the market can’t talk about or fix the growing problems we’re seeing:

- More cases of change of tenancy (COT) fraud when businesses change hands

- Older and larger unpaid bills

- Low recovery rates to collect debts

- More complex payment plans with longer recovery times

- More debt write-offs when businesses go bust

How big is the problem?

In our experience working with 75% of the UK’s energy suppliers, many have told us the same thing. SME debt is growing fast and becoming a serious problem. Suppliers have seen their individual debt books grow but can’t be sure of the full market picture.

A recent report from Bibby Financial Services (Q3 2024 SME Confidence Tracker) shows:

- 40% of small businesses say energy costs are a top challenge (more than interest rates)

- 67% said they’re waiting longer for their customers to pay them. So, cash flow suffers and bills are harder to pay

- The average small business wrote off £40,000 in bad debt in the last 12 months

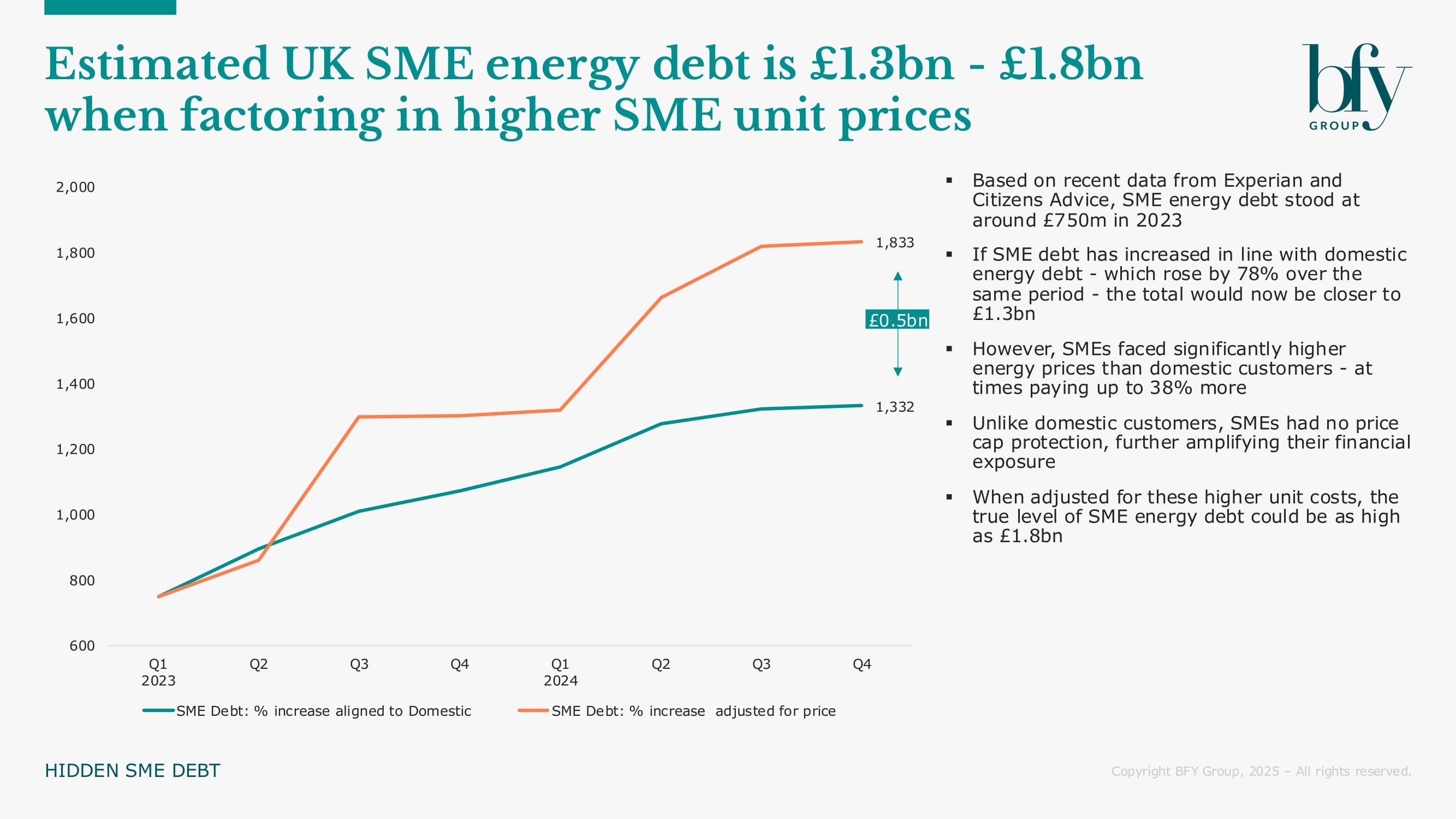

Based on our modelling, SME energy debt could already total between £1.3bn and £1.8bn - a figure driven by rising prices, weaker protections, and mounting cashflow pressures.

Why we should be concerned

When cashflow is stretched to near breaking point, businesses pay bills late or not at all. This is an enormous risk for energy suppliers who don’t get paid for the energy they provide. When businesses go bankrupt, energy suppliers are typically a low priority on the list of debtors, so often have to write-off large amounts of debt.

It’s a risk highlighted by over 30 energy suppliers going bust since 2021 and being named Supplier of Last Resort (SoLR), because debt write-offs impacted their P&Ls.

But there are plenty of commercial effects before it gets to those extremes. Customer satisfaction levels are lower, retention levels slump, cost to serve increases, and profits go down.

Small businesses behave more like domestic customers

Small businesses react to rising energy costs just like residential customers do. When prices go up, small businesses feel the pain right away. Unlike big companies, small businesses can’t:

- Change their profit margins to offset rising energy costs

- Get better deals from their suppliers and customers

- Use special energy products to cut usage

The Bibby SME Confidence Tracker also tells us small businesses look for advice and support in similar ways homeowners do. With two of the same top sources — Google, and family and friends.

The market is tough, profit margins are small and managing cashflow is hard. Energy prices, interest rates and inflation are all higher. And government changes (national insurance for example) are increasing everyday operating costs.

Rising business insolvencies

It isn’t just anecdotal stories of failure. The statistics make it clear businesses are struggling too.

- 2023 had the highest number of business failures in England and Wales for 30 years

- 2024 was slightly better but still more than the 2008 financial crisis

- There are 500,000 fewer UK businesses now than in 2020, just 5.5m

- Cashflow problems cause 82% of business failures

Businesses who struggled before are suffering even more now. This has big implications for small businesses, their suppliers and the general economy.

Learning from the domestic energy debt trend

Residential energy debt hit £3.85bn in late 2024. That’s up £0.75bn in a single year. But if we explore the data more, we can see since the energy crisis, the number of homes in debt stayed about the same. Between 3m and 3.8m. But the amount they owed went up by 116% from £1.8bn to £3.9bn.

Thanks to regular reporting and detailed data for domestic energy, we see how industry measures (like the energy price cap) helped more people avoid debt. But those with debt were getting bigger and bigger bills.

If we extrapolate the data and account for the lack of energy price caps for business energy customers, the level of SME debt rises from £1.3bn to £1.8bn.

What needs to change?

Right now, we can’t see the full picture. Small businesses don’t get the help they need. Suppliers can’t accurately factor in risk. And the industry is ignoring a potentially catastrophic problem.

We need national reporting

As an industry, we should track and report business energy debt just like we do for residential customers. This open data would help reveal the true scale of the problem. And allow government, Ofgem, suppliers and customers to react accordingly.

Home energy customers get support through the Energy Price Guarantee, Energy Bill Support Scheme, and Warm Home Discount. Yet, support for small businesses like the Energy Bill Relief Scheme and the Energy Bills Discount Scheme was less widely publicised, less impactful and is no longer available.

Better reporting would:

- Warn suppliers, regulators and support groups early

- Help spot risks sooner

- Drive changes like price caps for the smallest businesses

- Improve risk management for missed payments and delinquency

- Help suppliers make smarter choices about debt strategy, risk and recovery

- Support suppliers in assessing internal performance versus market conditions

- Lead to fairer prices and payment plans

What suppliers can do now

We’re already helping our clients boost their commercial performance while supporting their customers avoid or get out of debt. Here are some things you can start doing.

Speak up for change

- Join talks with the government about energy affordability and highlight the issues for small businesses

- Push for data collection and sharing to improve accountability and inform policy change

- Ask Ofgem to publish clear and segmented data on small business energy debt

Help small business customers now

- Set up systems and train staff to help businesses struggling to pay

- Teach teams to spot early warning signs

- Offer early support just like domestic customers

By being proactive and supporting small businesses, we can ease some of their challenges. They’re more likely to pay their debts, maintain their contracts and speak more positively about their experience. This means more long-term loyal customers, lower collection costs and fewer debt write-offs.

What BFY can do to help

At BFY, our Debt team work with clients to find the root causes of debt issues and provide them with the right actions. Actions backed up with deep industry knowledge and practical experience. We create lasting fixes for debt problems (across all types of customer) upskilling teams to continue progress after we leave.

Our experts can:

- Look at your small business debt book to find patterns and chances to improve

- Create ways to spot at-risk small businesses early

- Design support programs that help both customers and your bottom line

- Improve your processes to cut collection costs

- Share insights from our work across the energy sector

Case Study: Reducing an energy supplier’s B2B debt by £1.8m in three months

The problem

- An energy supplier was facing £6m in ageing debt from their top 100 commercial debtors, and needed quick results

Our support

- Expert advice and cross-function collaboration for rapid decision-making

- Training, knowledge sharing and upskilling

- Help to identify and tackle high value, complex problems first

The results

- £1.8m debt reduction in three months

- Another £1m secured through agreements to pay over the following 12 months

The bottom line

There’s a blind spot in the energy industry for small businesses. How big does the problem need to get? How many more suppliers or small businesses need to close before we see major change?

While we need national data reporting and transparency to fully understand the scale and drive industry-wide progress, there are steps to take today.

Suppliers can act now to lower their own risk and boost bottom lines. As well as support their small business customers. By treating small businesses more like domestic customers and setting up early support systems, suppliers can reduce debt while helping businesses survive tough times.

If you’re looking for support with tackling SME debt, contact Rachel Littlewood.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile