Headlines around reducing energy prices sound great, but customers are not likely to feel any benefit in their pockets - the amounts paid by customers under the energy price cap is likely to increase this winter due to the reduction in government support.

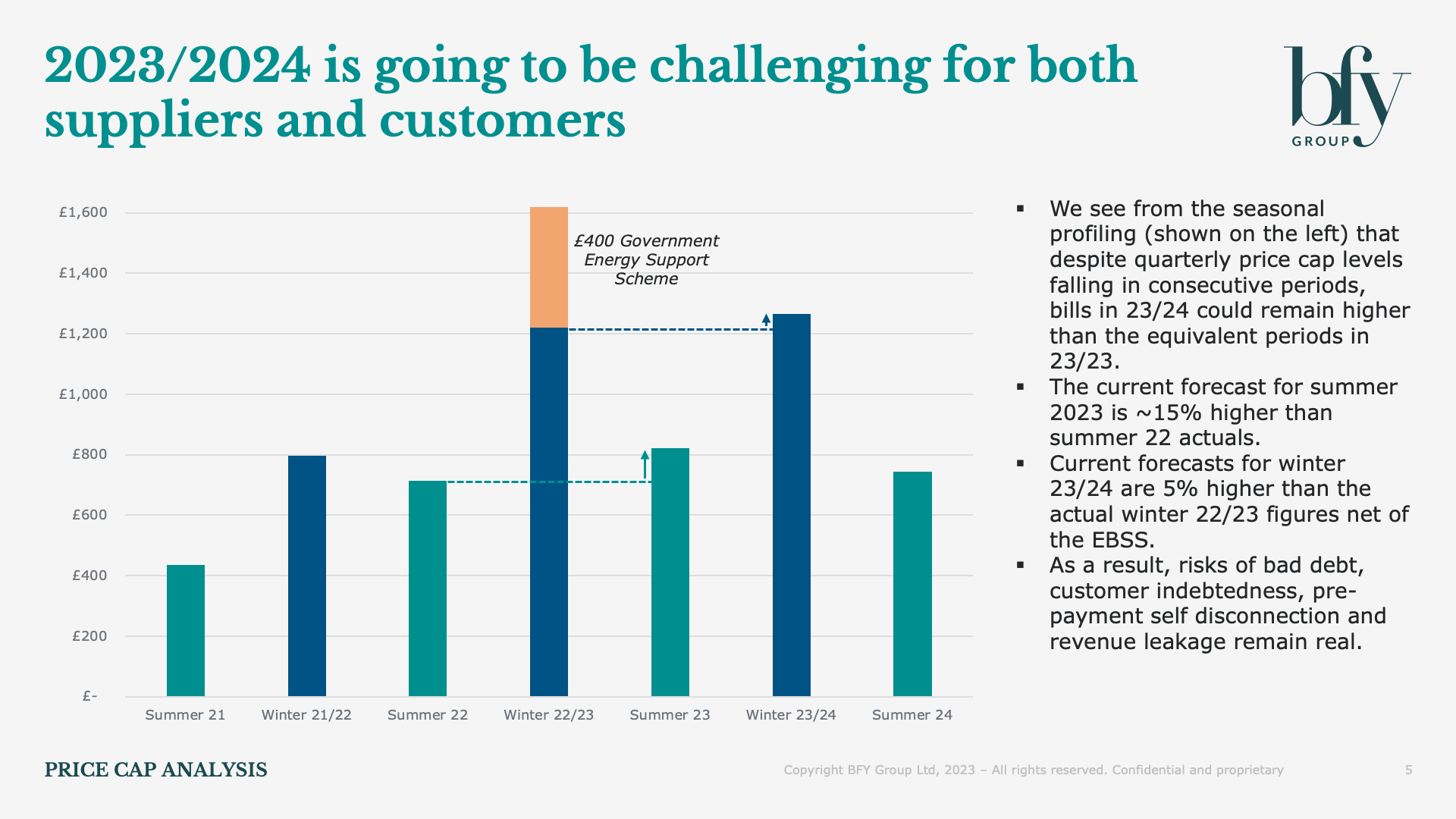

Chart 1: Estimated bills by Winter / Summer season (6m)

The use of an annualised figure for a quarterly bill creates a lack of clarity for customers due to the fact we consume different amounts of energy in each of those periods - in Winter we use more gas, and a bit more electricity for lighting for example.

Customers hearing headlines of a £450 reduction will understandably expect to see that in their pockets. As we see in Chart 1, we're expecting the net impact of bills to increase for customers across the winter due to the removal of Government support.

Chart 2: Projected 12m bills, with and without EPG

The huge 'bubble' is the impact mitigated as a result of Government support, and shows how the headline numbers are translating into what customers actually pay.

Potting the projected 12m bills shows that the annual amount (i.e. total paid over a 12 month period) has been limited to ~£2,000 for the median customer, and we're projecting bills to stay around this level for a while.

For more information on the Energy Price Cap, contact Ian Barker or Tom Bromwich.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile