The UK faces an ambitious timeline on its journey to Net Zero. Electric vehicles (EVs) will be a key driver of the transition, with 2035’s combustion engine ban set to shape not only the future of transportation, but also its adjacent markets – such as energy.

Strategic decisions around electricity generation and charging infrastructure will become increasingly important over the next decade, while Time-of-Use and Renewable Energy tariffs are already becoming prevalent as the market reopens.

Evolving regulations and policies will continue to impact business structures and pricing, so how do suppliers ensure they’re equipped to find the most effective solutions, for themselves, their customers, and the environment?

We explore these challenges in this blog, presenting opportunities for suppliers to use EV adoption to their advantage, whether through automaker partnerships, or the formation of innovative strategic plans.

EV adoption is increasing, but can we support it?

The 2035 ban (originally 2030) has prompted both automakers and consumers to shift their focus toward electric alternatives. As a result, the transition to electric vehicles in the UK has gained a lot of momentum in the last few years, fuelled by advancements in technology, environmental awareness, and government incentives.

As of the end of November 2023, there are now almost 1 million fully electric cars on UK roads and a further c.600,000 plug-in hybrids. More than 265,000 battery-electric cars were registered in 2022 (a growth of 40% on 2021) with an additional c.300,000 registered during 2023.

Government Incentives

To accelerate the adoption of EVs, the UK government has introduced various incentives and policies. This includes grants for purchasing electric vehicles, tax benefits, and initiatives to expand the charging infrastructure across the country.

In 2022, many of the grants for EVs were removed. The rationale for removing the grant was that the general uptake had began to rapidly increase, and there had been a subsequent drop in the price difference between an EV and combustion engine equivalents.

There are still, however, a handful of incentives available to support those adopting greener transport solutions, including grants on some vans and wheelchair accessible vehicles.

Consumer Acceptance

While the EV market has witnessed substantial growth, challenges remain in convincing consumers to fully embrace electric vehicles. Critics have long warned that a lack of affordable EVs would eventually stall the steep sales growth boosted by early adopters and corporate fleets.

Range anxiety, charging infrastructure, and the upfront cost of EVs are common concerns. Many assume that the technology will improve in coming years and would rather wait for the next model rather than risking a buying a vehicle that could drop very quickly in value.

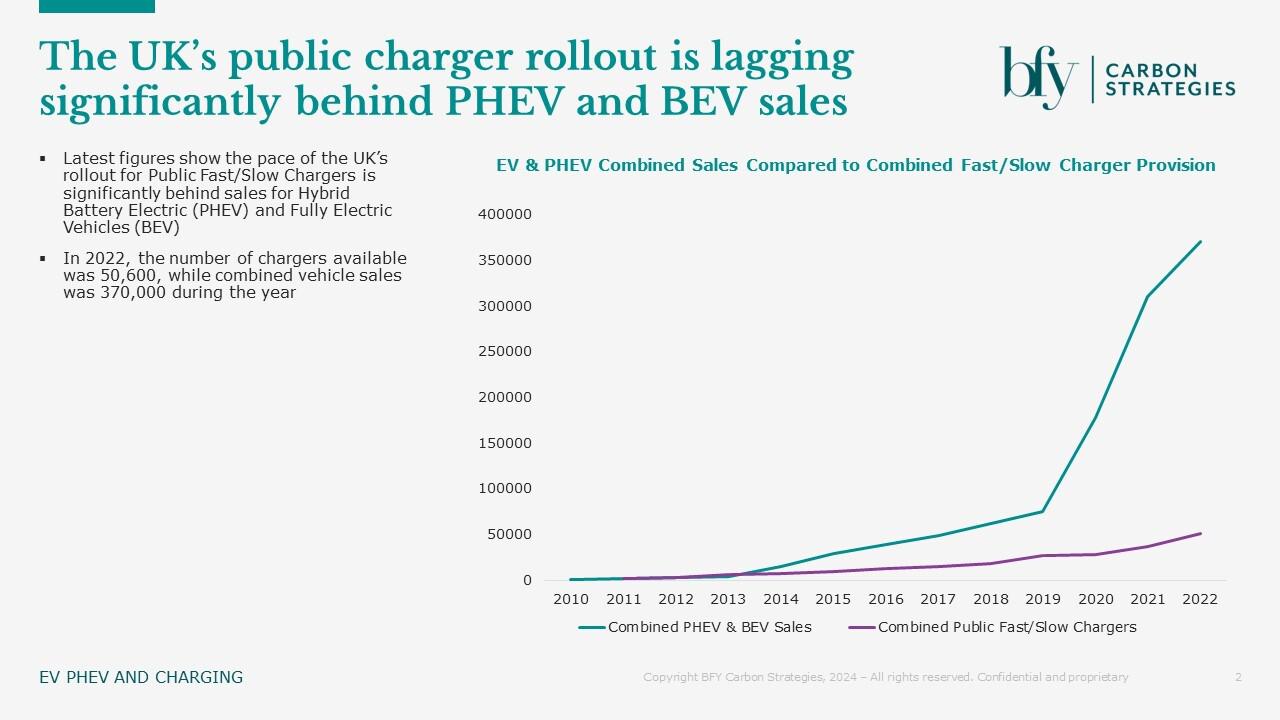

As technology advances however, electric vehicles are becoming more affordable, with longer ranges and improved charging infrastructure expected to alleviate some of these concerns. There has been a 45% year-on-year growth between 2022 and 2023 in the number of UK charging points, however despite the now circa 54,000 locations, there is still some way to go to address some patchy regional coverage.

Our Carbon Strategies team have highlighted the need to accelerate this rollout below, showing the gap between sales of plug-in hybrids (PHEVs) and battery electric vehicles (BEVs) in comparison to availability of fast and slow chargers.

New EVs make up a growing percentage of new car sales, but the used market remains more dampened as battery life fears come into play. In late 2023, it was estimated that less than 5% of the vehicles on UK roads were electric/hybrid.

Automaker Initiatives

Many major automotive manufacturers are responding to the changing landscape by investing heavily in electric vehicle development. Many have pledged to phase out internal combustion engines entirely in the coming years, focusing on electric and hybrid technologies. This shift not only aligns with the government's targets but also positions these companies as leaders in sustainability.

Some manufacturers are still feeling cautious however, suggesting recently they were delaying the launch of cheaper EV models due to weaker demand and higher costs. This could make the issue cyclical as a lack of availability in cheaper EVs naturally stunts demand.

Impact of the 2035 Deadline

Regardless of current feelings, the 2035 target to ban new combustion engines is a critical milestone in the UK's journey toward a greener future. The closer it gets the more it will serve as a catalyst for innovation, encouraging research and development in electric vehicle technology. As the deadline approaches, automakers are expected to intensify their efforts to produce more affordable, efficient, and technologically advanced electric vehicles.

Whilst we may still see a relatively high percentage of combustion engines on the roads past 2035 (as only new car registrations are banned), the adoption of EVs will become more and more commonplace.

How will this impact the energy market?

While the environmental benefits of transitioning to electric vehicles are evident, challenges such as charging infrastructure development, recycling of batteries, and addressing the impact of vehicle production must be addressed.

Electricity Generation

Generation capacity is likely to become a concern, as electricity consumption demand will continue to rise as EV saturation increases. Modern EVs, on average, will achieve about 3 miles per kWh of electricity. If we assume an average mileage of just 5,000 per year (assuming average mileage continues to fall as has been the trend since pandemic), the 35 million vehicles on UK roads will require more than 58 terawatt hours of energy (for reference, the UK’s 2022 total electricity demand was just 275.24 terawatt hours).

The question as more EVs hit the road will be, where does this additional generation come from, and how will the market go about meeting the dynamic and often unpredictable variations in this demand? This may include peak demand periods or sudden drops in consumption.

Incorporating renewable energy sources (solar, wind, etc.) into the energy mix, and managing the intermittency and unpredictability associated with these sources, will become an ongoing challenge for the market.

Charging Infrastructure

Maintaining and upgrading the existing power infrastructure (including transmission lines and distribution networks) to ensure reliability and efficiency, will be key to supporting EV adoption across the UK. Energy companies have an opportunity to engage with this development but will need to consider how they approach the investment.

Octopus Energy, who have already established their own EV company car scheme, offer home charging installation, but there’s no reason why we couldn’t expect energy companies to increase investment in the wider charging infrastructure. This could include fast-charging stations to make it more convenient for electric car owners to charge their vehicles.

Balancing the need for investments in new technologies and infrastructure with economic considerations, including the cost-effectiveness of energy production will be a strategic challenge for many suppliers, which will also play into the affordability of electricity for consumers.

Time-of-Use and Renewable Energy Tariffs

Time-of-use (TOU) tariffs are becoming more prevalent, as EV owners look to improve their electricity affordability, by charging their vehicles during off-peak hours. This promotes more efficient use of the energy grid, supporting a further reduction to their cost of transport. Energy companies that don’t allow this flexibility may see their appeal dropping to a growing market segment.

Similarly, as the energy market begins to reopen, we will likely see increased offers for the use of renewable energy plans. This will allow EV owners to charge their vehicles using clean and sustainable energy sources, aligning with the eco-friendly nature of electric cars.

Battery Technology

TOU tariffs can also utilise battery storage solutions. This allows EV owners to store excess energy generated from renewable sources, and use it to charge their vehicles or power their homes.

Energy suppliers could gain a price advantage by developing effective storage solutions, addressing the intermittent nature of renewable sources, by storing excess energy during low-demand periods, for use during times of high-demand.

Goldman Sachs analysts highlighted in December 2023 that reducing fossil fuel costs and higher interest rates (which increase the relative cost of renewables and construction costs respectively), are being offset by a decline in battery costs and EV development. For energy companies looking to invest in ‘greener’ solutions, batteries present a strong opportunity.

Digitalisation and Decentralisation

The implementation of smart charging solutions, enabling EV owners to schedule and monitor their charging remotely through mobile apps or online platforms, will slowly become the expectation as the transition continues. These platforms will also give energy providers an opportunity to promote educational resources about the benefits of electric vehicles, how to charge them efficiently, and any government incentives or rebates available.

Suppliers will face ongoing pressure to keep up with technological advancements, to optimise energy production and consumption, through smart grid technologies, demand response systems, and IoT integration. This will create further challenges around protecting critical infrastructure from cyber threats, and ensuring the security of data and communication systems within the energy sector.

How can suppliers maximise EV opportunities?

Partnerships with Automakers

There may be an opportunity for energy suppliers to collaborate with EV manufacturers to create bundled services, such as special charging plans, or discounts for customers purchasing both an electric vehicle and an energy plan. They may introduce incentives, discounts, or special offers for customers who own electric vehicles, creating added value for choosing sustainable transportation options.

By taking these measures, energy companies can actively contribute to the growth of EV adoption, provide valuable support to individuals who have embraced sustainable transportation solutions, and stay relevant as the world shifts more towards sustainability.

Energy companies should be looking to not only enhance customer satisfaction, but also contribute to the overall sustainability goals of both their energy company and the communities they serve.

Government and Social Engagement

The green transition (heavily influenced by EVs) presents a myriad of opportunities or challenges (depending on your viewpoint). Naturally, the general net zero push from the government and changing societal views will be creating significant impacts in the renewable energy sector, so energy companies should also be looking to support their customers moving greener.

Adapting to and complying with evolving energy regulations and policies, which may impact business models, pricing structures, and environmental standards, will be a challenge. However, the more energy companies can engage and/or collaborate with stakeholders, governments, and technology providers, the more likely they are to be at the forefront of finding effective solutions.

Historically the most valuable customers to an energy supplier have been in the disengaged, low cost-to-serve segments. However, with this market shift, engaged customers who care about environmental pressures, but are digitally savvy enough to self-manage or self-serve, may become a larger and ultimately more valuable customer base.

Energy suppliers need to develop strategic plans to invest in innovative solutions to attract the right customer base, ensuring a reliable, sustainable, and resilient energy supply, for a future that’s clearly heading towards electrification and sustainability.

Where does the market go next?

EV adoption will have a major impact on the pace at which change is required in the energy market. As we head towards a greener future, fluctuating electricity demand patterns will be battling with grid resilience and reliability, while technological innovation will present its own issues through cybersecurity risks. Decisions around investments will also need to be carefully balanced against public perception and acceptance.

The UK's commitment to phasing out combustion engines by 2035 is a bold step toward a more sustainable, and environmentally friendly transportation sector. The progress made so far, coupled with ongoing government initiatives and automaker commitments, suggests that the electric vehicle revolution is well underway.

As we approach the 2035 deadline, it will be fascinating to witness

1) How the automotive landscape transforms, and;

2) Where energy providers react to, or actively support the trends that are paving the way for a cleaner and greener future.

For more information on EV adoption, the energy transition, and how this will impact suppliers, contact Zander Cleves.