A new wave of innovation is sweeping the domestic energy market. As we explored in our previous article, suppliers are introducing a range of new tariffs designed for EVs, heat pumps, time-of-use patterns and more.

Whilst this innovation creates exciting opportunities, it also introduces complexity, and with complexity, comes commercial risk.

Smart tariffs have the potential to reduce emissions, lower bills, and deepen customer engagement. But they also bring strategic and commercial challenges that suppliers must navigate carefully.

We've identified five critical considerations that can help transform tariff complexity from a potential liability into a strategic advantage.

1) Strategic Product Integration: When tariffs compete with themselves

Many suppliers now offer diversified product portfolios such as heat pumps, EVs, Batteries and solar installations – each with accompanying tariffs. However, as customers increasingly adopt multiple low-carbon technologies, these tariff propositions can compete with one another within a supplier’s own portfolio.

Key strategic questions to address:

- How are you managing situations where multiple tariffs (e.g., EV and heat pump) target the same customer segment?

- Who owns the customer relationship when they interact across multiple products and journeys?

- Should suppliers be designing vertically integrated propositions (e.g. tariff + asset + service) and aligning their product owners on a proposition basis?

- Are product and proposition teams aligned or working in silos?

2) Transparency and Customer Confidence: Complexity can undermine trust

A customer’s primary concern is keeping bills as low as possible. Complex pricing structures such as half hourly rates or supplier-controlled flexibility, often make it impossible for customers to accurately compare tariffs and forecast potential savings.

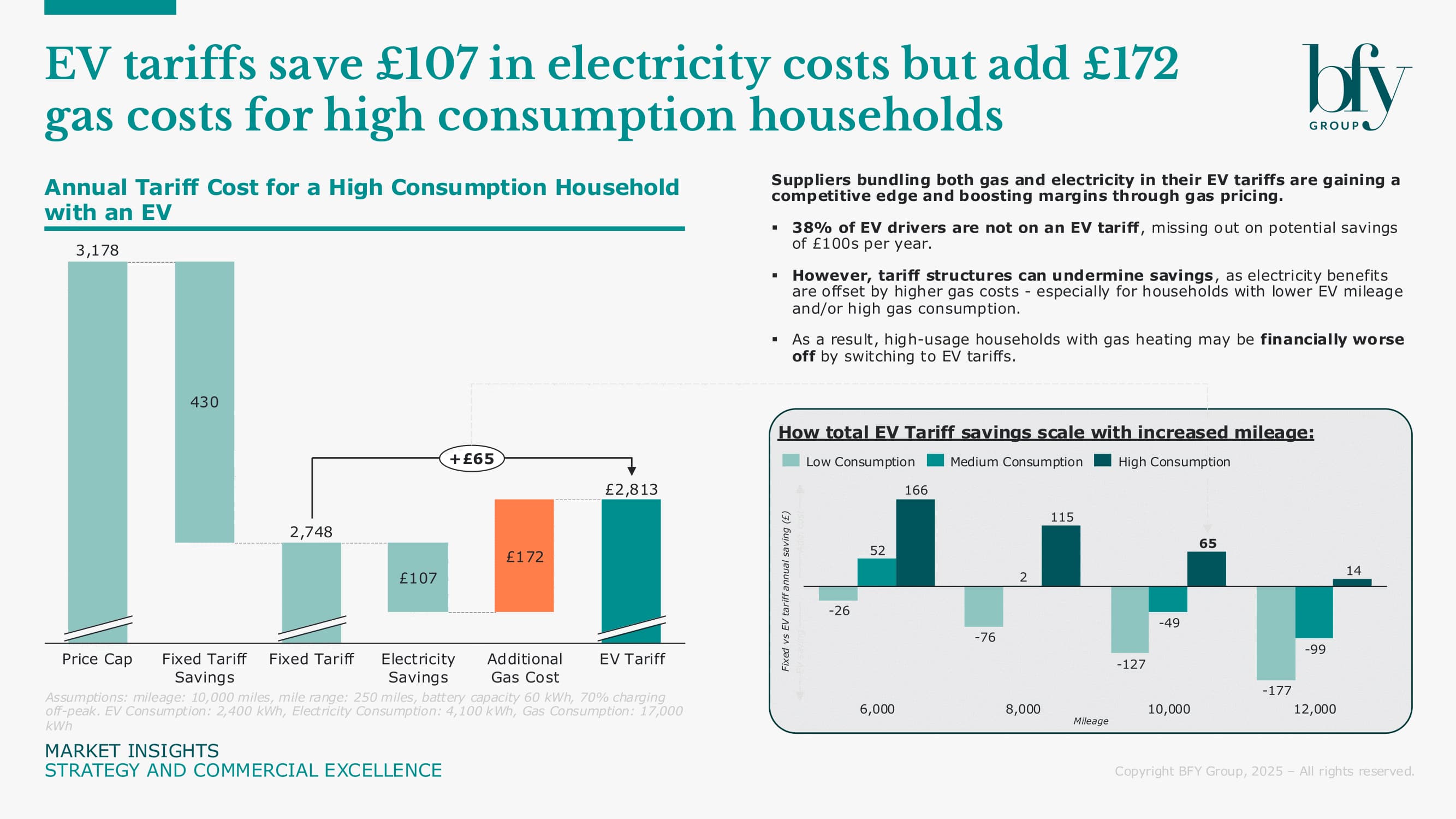

A recent market study found 38% of EV drivers aren't using EV-specific tariffs, missing out on advertised savings of "up to £400 annually." Yet these claims are often misleading. Drivers with low mileage or high gas usage may see no benefit at all. In fact, our modelling shows that high-consumption households, with gas heating and annual mileage of 10,000, could end up paying around £65 more on average compared to a standard fixed tariff. The real-world economics are far more complex than marketing suggests.

Traditional price comparison tools don’t work for smart tariffs and many customers lack the digital literacy or data access to properly assess their options. This opacity can result in customer retention by default rather than by choice.

Key strategic questions to address:

- If customers can’t calculate which tariff is better, who is responsible for showing the customer which tariff is better

- Are the projected savings accurate or are we misleading the customer?

- How can suppliers present transparent, personalised comparisons without overwhelming customers?

- Is tariff complexity serving as an unintentional barrier to switching?

- Do suppliers have a duty of care to flag better options to existing customers?

3) Granular Profitability Analytics: Portfolio-level view is no longer sufficient

As tariff options multiply, portfolio-level margin tracking becomes commercially inadequate. To ensure innovation actually drives profitability, suppliers must track performance at a more granular level across individual tariffs, asset types, customer segments, usage patterns and acquisition channels.

Key strategic questions to address:

- Are you tracking profitability at the right level? (tariff, asset, segment)

- Should you adopt a high asset margin/low tariff margin model, or vice versa?

- How do you model and forecast the take up of more complex, behaviourally driven propositions?

- How frequently do you reassess the commercial assumptions underlying new tariffs?

- How do profitability models treat customers on both a smart tariff and campaign?

- Which customer segments generate the highest lifetime value on complex tariffs?

4) Forward-looking Customer Modelling: Future focus to drive growth

Most customer targeting today is based on historic consumption. But the energy transition is about future behaviour: EV adoption, heat pump installation, load shifting and solar uptake. Suppliers must proactively model behavioural shifts to understand future value creation opportunities.

Key strategic questions to address:

- Do we understand the customer’s intent to electrify, shift usage or invest in solar?

- How will the recent DESNZ Boiler Upgrade Scheme changes impact customer behaviour?

- Can you build “next best product” engines that support customer transition and margin optimisation?

5) Channel Effectiveness: The right tariff in the wrong channel still fails

Not every smart tariff is suitable for every customer. Consequently, not every sales and service channel works for every smart tariff. A smart tariff may fail if introduced through an inappropriate channel.

For example, a dynamic ToU tariff might be brilliant but only for a customer with flexible demand and the right tech to shift usage. Deploying this proposition via a generic acquisition call or a blanket email campaign can do more harm than good.

Key strategic questions to address:

- Are your most complex tariffs being deployed through the right channels?

- Do frontline teams understand how to position these offers?

- Are your commission structures driving the right behaviours?

- Are you measuring channel performance at the tariff level?

- How do you identify and target the right customers for each proposition?

- How well are you communicating the benefits of this proposition to the intended customer?

Transforming complexity into competitive advantage

Tariff complexity can become a strategic asset that positions suppliers as market leaders, but only when executed effectively. The winners won’t necessarily be those with the most advanced technology, but those who can:

- Simplify the journey for the customer

- Personalise the offer based on intent and behaviour

- Track commercial performance with precision

- Integrate propositions horizontally across the flexibility ecosystem

Innovation is only valuable if it’s profitable. At BFY, we help energy suppliers turn complexity into competitive advantage.

How BFY Can Help

Our specialised Strategy and Commercial Excellence team help energy suppliers navigate these challenges:

- Proposition Strategy and Design: We define clear product ownership and vertically integrated propositions that align assets, tariffs, and services to customer needs

- Operating Model Design: We reshape your organisational structure around your proposition strategy, ensuring each team member focuses on the right priorities while working synergistically with supporting functions

- Commercial Modelling: We build robust, granular margin models with scenario-based forecasting to support investment and pricing decisions

- Go-to-Market Strategy: Moving beyond consumption history, we model behavioural intent, future asset adoption, and customer lifetime value for smarter customer targeting

- Tariff Strategy and Optimisation: We develop fair, competitive, and commercially sound tariff strategies that support both retention and growth

Contact Matt Turner-Tait if you’d like to know more.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile