Since 2014, the domestic energy retail market in Great Britain has been constrained by Ofgem’s Simpler Tariff rules, limiting suppliers to just four core tariffs. This regulation effectively stifled tariff innovation for years.

Now a decade on, we’re witnessing a significant transformation. The widespread rollout of smart meters, alongside supplier’s investment in digital infrastructure and rising customer engagement, has sparked a wave of innovation across the retail energy landscape. The upcoming launch of Market-wide Half-Hourly Settlement (MHHS) is set to accelerate this momentum even further. Innovation is back, and it’s growing quickly.

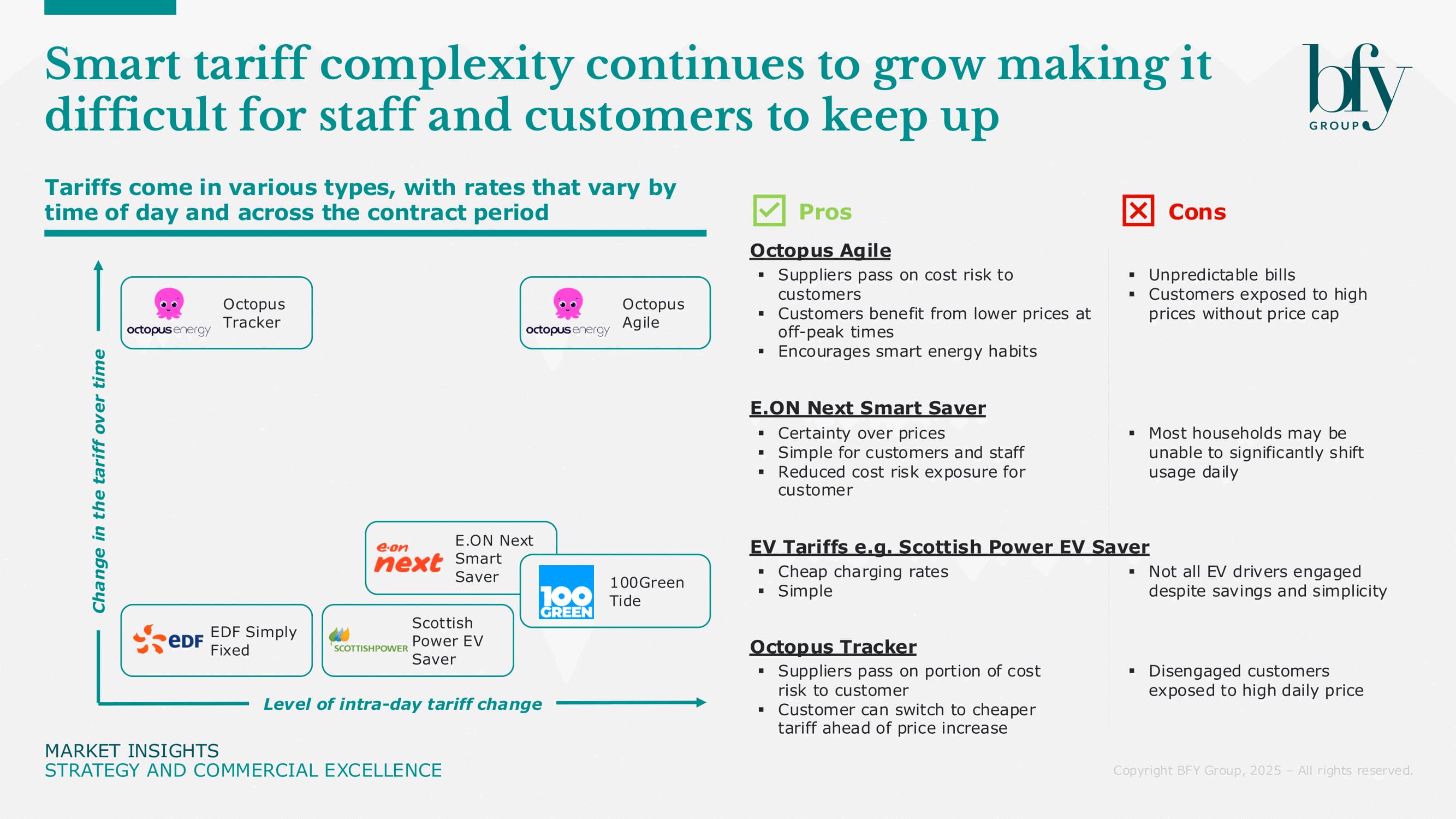

However, as innovation accelerates, there's a real risk that both staff and customers get left behind. Navigating the growing number of tariffs, and understanding how they work, can quickly become overwhelming.

In this article, we introduce a practical framework to cut through the complexity, helping suppliers simplify their propositions, align internal teams, and target customers more effectively.

From one-size-fits-all to smart, segment-specific tariffs

Tariffs have changed. Suppliers are no longer limited to a handful of generic offerings. Today’s tariffs are tailored to fit different lifestyles, behaviours, and technologies. Here's what that looks like in action:

- Dynamic Time of Use Tariffs like Octopus Agile provide complete price transparency. It encourages customers to shift demand to cheaper periods. Flexibility is rewarded. However, customers may still face price volatility depending on how the tariff is structured - highlighted by the Griddy case in Texas, where extreme weather pushed prices to $9,000 per MWh. While Octopus has set a UK precedent by voluntarily capping prices on its dynamic ToU tariff, dynamic tariffs still involve a degree of risk.

- Fixed Time of Use Tariffs like E.ON Next Smart Saver strike a balance between certainty and flexibility. A middle ground for customers hesitant about full exposure to variable pricing, while still encouraging usage shifts.

- Asset Specific Tariffs like British Gas’ EV Charging tariff are designed specifically for low-carbon asset owners. These are simple and highly attractive, with EV tariffs in particular being widely adopted. Recent figures show 62% of EV drivers are now on an EV specific tariff.

- Traditional Fixed Tariffs, like EDF’s Simply Fixed, establish consistent energy prices for the whole contract and remain the most popular choice for many customers seeking price stability. At the time of writing, falling wholesale prices are making these deals increasingly competitive compared to the price cap. However, they offer little incentive for customers to shift their energy usage.

Beyond Tariffs: Engagement campaigns and delegated control

Suppliers aren’t just innovating with tariffs. They’re finding new ways to engage customers and help them shift demand without friction.

Octopus’ Octoplus Rewards, British Gas’ PeakSave Sundays, and EDF’s Sunday Saver give customers free or discounted energy during off-peak hours. These are low-risk ways to build customer confidence and start forming flexible usage habits.

To drive prices even lower, suppliers are also offering tariffs which grant them partial control over energy use. Smart automation tariffs, such as Scottish Power’s EV Optimise, allow customers to simply specify when they need their vehicle charged. Scottish Power's systems then handle the rest, automatically charging at the cheapest times, which may fall outside traditional off-peak windows.

The Challenge: Innovation without structure risks confusion

The pace of change is fast. There’s a risk both staff and customers get left behind. Many customers will find it difficult to evaluate the benefits and cost implications of dynamic tariffs, and if staff can’t explain them confidently, the opportunity is lost.

The Solution: A framework for simplicity

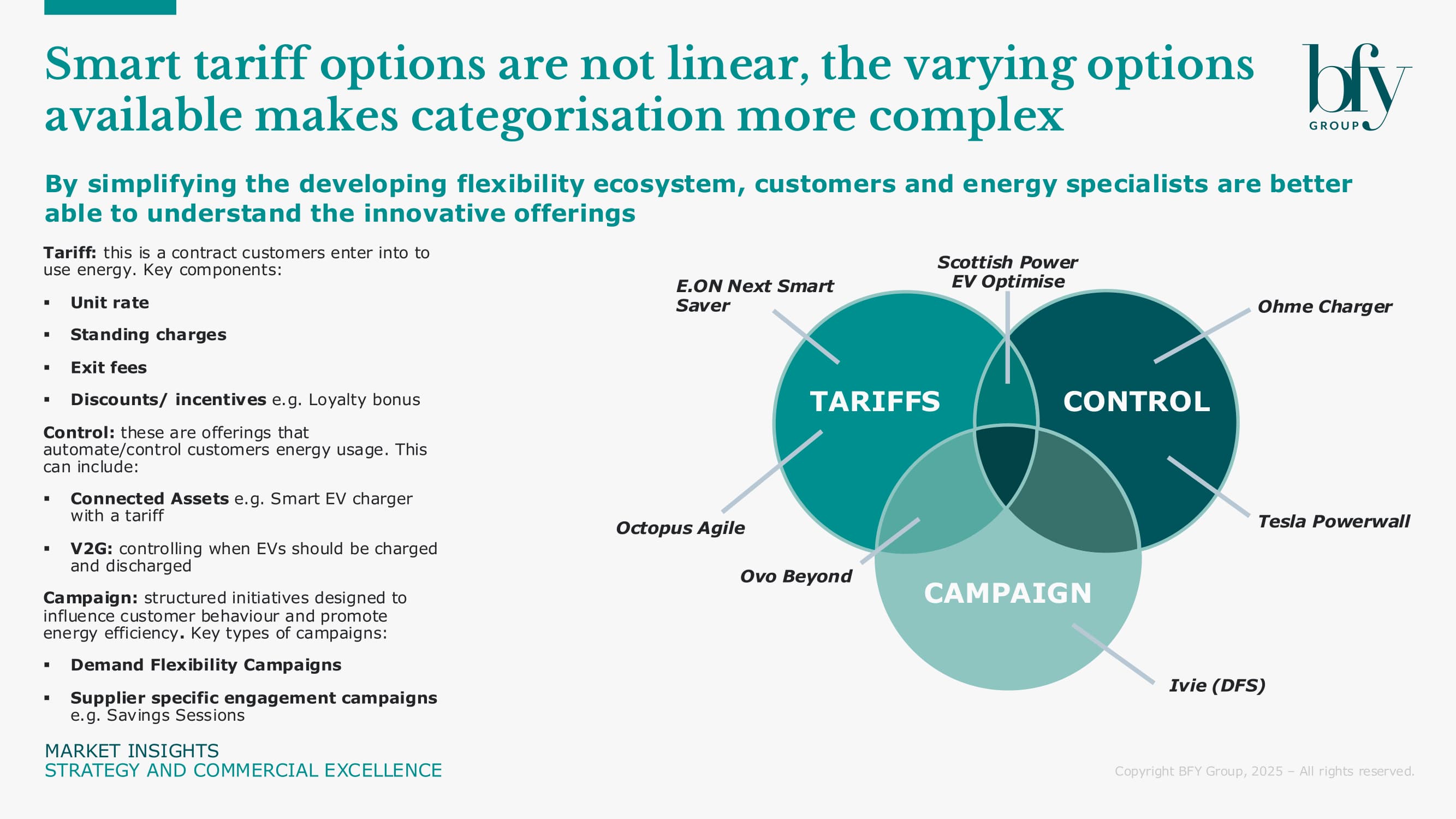

Our framework simplifies the complexity by categorising all offerings into three key dimensions.

Each product fits somewhere on this map. Overlay customer segments, and you have a powerful tool for go-to-market strategies and customer targeting:

- An EV driver? Best served by smart, automated tariffs that exchange control for savings

- A disengaged or time poor customer? Keep it simple by avoiding fully dynamic ToU tariffs and focusing on simple campaigns

- Tech-savvy Smart Home Enthusiast? Likely to sit in all three circles - ready for dynamic pricing, smart control, and reward-led engagement.

This framework empowers staff, providing a clear and consistent way to match products to customers, without needing to be an energy expert.

Benefits: Alignment and empowerment

Without structure, innovation risks becoming fragmented and confusing. But with a strategic framework, energy retailers can drive:

- Internal Team Alignment: Creates a common language around tariff innovation

- Staff Empowerment: Equips customer-facing teams to have more meaningful conversations with customers

- Improved Customer Targeting: Facilitates precision in marketing and communications

- Partnership Identification: Highlights opportunities for partnerships to be formed to enhance offerings

- Flexibility Adoption: Accelerates uptake of flexible consumption

Moving from framework to action

While this framework simplifies a complex landscape and enables better customer support, additional commercial considerations remain critical for successful implementation. In our next article, we explore how to translate this strategic alignment into concrete commercial outcomes and quantifiable business results.

At BFY, we help suppliers design commercially compelling, customer-centric go-to-market strategies for the flexible future. Get in touch to explore how a structured approach to tariff innovation can drive customer engagement, unlock commercial value, and future-proof your portfolio.

Want to see what’s happening across the market? Our market scan service provides detailed insights into competitive positioning in this rapidly evolving space.

Contact Matt Turner-Tait if you’d like to know more.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile