Chancellor Rachel Reeves this week delivered her first Comprehensive Spending Review (CSR).

The CSR set multi-year budgets to 2028/29 for day-to-day spend and to 2029/30 for capital investment. It marks a strategic reset of UK public finances under the new Labour government.

Although the CSR covered the whole range of government spending, energy, climate, and infrastructure dominated the agenda, with major public investment announced for domestic clean energy production, the wider green transition and UK re-industrialisation.

In the context of ongoing fiscal pressure, this week underlines the government’s commitment to the energy policies set out in their manifesto at the last election. The media are already describing Ed Miliband as one of the big winners from this week’s announcement.

Headlines

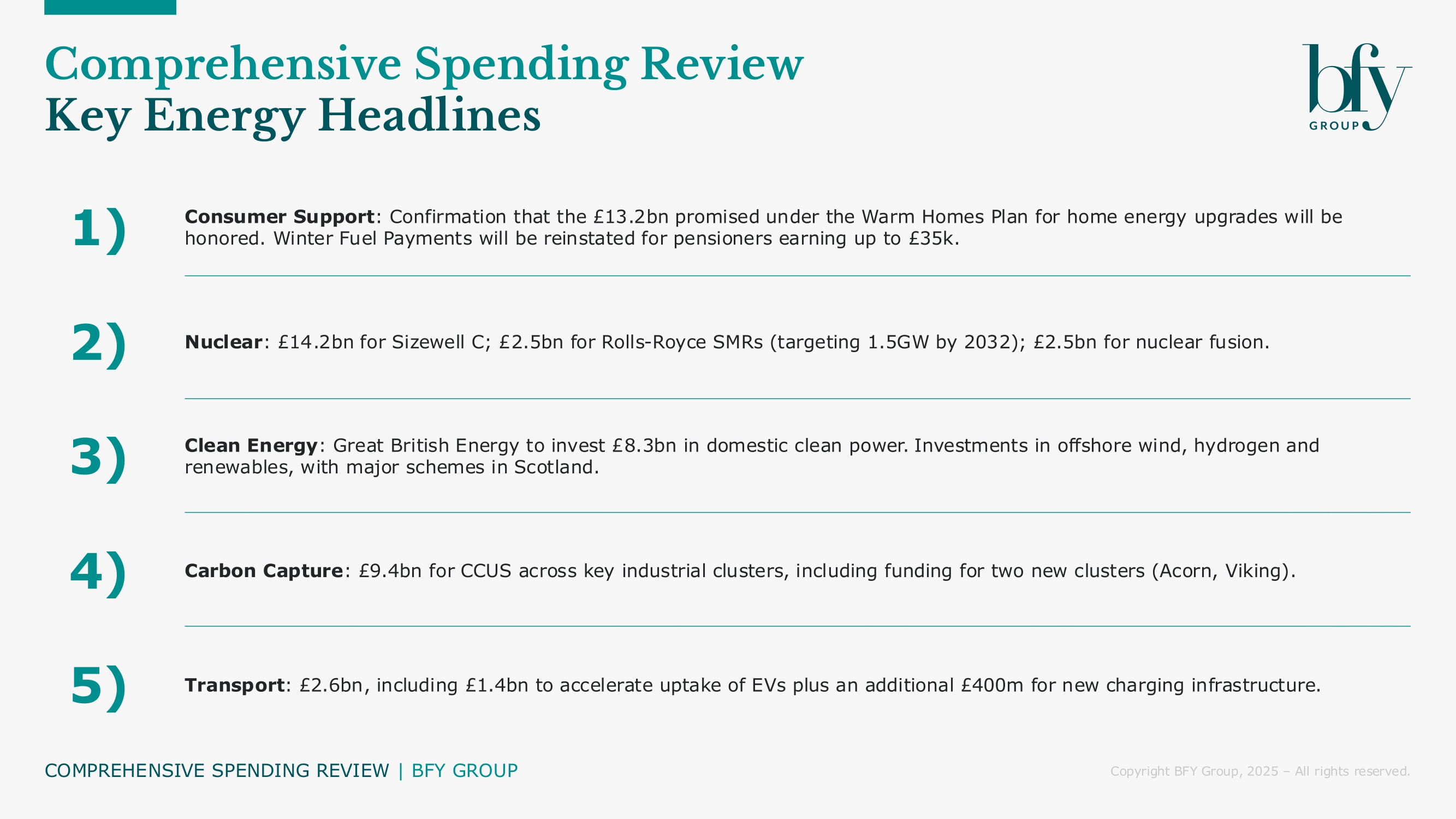

- Consumer Support: Confirmation that the £13.2bn promised under the Warm Homes Plan for home energy upgrades will be honoured. Winter Fuel Payments will be reinstated for pensioners earning up to £35k.

- Nuclear: £14.2bn for Sizewell C; £2.5bn for Rolls-Royce SMRs (targeting 1.5GW by 2032); £2.5bn for nuclear fusion.

- Clean Energy Hubs: Investments in offshore wind, hydrogen and renewables, with major schemes in Scotland.

- Carbon Capture: £9.4bn for CCUS across key industrial clusters, including funding for two new clusters (Acorn, Viking).

- Transport: £2.6bn, including £1.4bn to accelerate uptake of EVs plus an additional £400m for new charging infrastructure.

- Public Delivery: Great British Energy to invest £8.3bn in domestic clean power.

What has been announced?

Warm Homes Plan

The Chancellor confirmed the £13.2bn funding set out in the Labour manifesto for the Warm Homes Plan for home upgrades such as insulation, solar, heat systems, targeting savings of up to £600 per household. Earlier reports in the media had suggested this plan was under threat. The government suggest this will cut bills by up to £600/year for affected households. Backed by the National Wealth Fund, more detail will follow by October.

Nuclear

Nuclear power formed the centrepiece of energy announcements with the Chancellor committed to “the biggest rollout of nuclear power for half a century”, focused on strengthening UK energy security and reducing price volatility. There was confirmation that Sizewell C will receive £14.2bn – enough to power 6m homes and create ~10,000 jobs, including 1,500 apprenticeships.

The announcement from earlier this week that Rolls-Royce will lead the first UK Small Modular Reactor (SMR) deployment with ~£2.5bn support was also confirmed. At least 3 SMRs (~1.5GW total) are planned by 2032, powering 3m homes and creating up to 3,000 jobs. The government claims that once Hinkley Point C, Sizewell C, and small modular reactors come online in the 2030s, they will add more nuclear power to the grid than the past 50 years combined.

Finally, it was announced that over £2.5bn has been allocated to further nuclear fusion research, including the STEP project in Nottinghamshire, expected to create thousands of jobs.

Wider Clean-Energy

The North East Scotland Investment Zone (Aberdeen) will prioritise floating wind, green hydrogen, and digital clean energy - expected to attract £220m and create 8,000 jobs. Inverness & Cromarty Green Freeport will receive £25m in seed funding with a target of £6bn in private investment, with up to 18,300 jobs.

£9.4bn in capital funding to expand carbon capture use and storage (CCUS) in Merseyside, Teesside – plus Humberside (Viking) and Scotland (Acorn) - was announced, with final investment decisions expected this Parliament. £2.6bn was committed towards the decarbonisation of transport, with £1.4bn for EVs and £400m for charge points. Further detail due in the upcoming 10-Year Infrastructure Strategy.

Great British Energy (GBE)

GBE and its nuclear arm, GBN, will invest £8.3bn over the CSR period to accelerate clean domestic energy delivery. This marks the shift from concept to implementation, though detailed allocation is yet to be confirmed.

Vulnerable Households

Rachel Reeves reversed her July 2024 decision to restrict the Winter Fuel Payment only to pensioners on pension credit. Instead, she’s reinstated it for pensioners earning up to £35,000, covering approximately 9 million people in England and Wales.

Payment amounts remain at £200‑£300 (with higher payments for over‑80s), funded at an annual cost of £1.25 billion.

What does this week’s announcement mean for the energy sector?

Labour set out a plan in their manifesto to make the UK a clean energy superpower. This week’s announcement reaffirms that aim. Whilst progress remains slow, the spending announced this week will provide investors with confidence to bring forward projects – particularly in nuclear, CCUS, home energy efficiency and renewables.

- Nuclear: Long-term pipeline of major capital projects set to boost domestic engineering, construction, and grid management sectors. UK-first deployment of SMRs create early mover advantage for firms in manufacturing, modular construction, and advanced nuclear supply chains.

- CCUS: Cluster support will maintain momentum to industrial decarbonisation supply chains around chosen geographies.

- Home Efficiency: Further demand-side support for insulation and heat pump sectors.

- Renewables: State-backed Great British Energy opens new investment and partnership opportunities for offshore wind, tidal, and hydrogen.

- Public-Private: The state will invest upfront - but private delivery remains critical. Ongoing momentum is expected through the life of this Parliament on bringing forward private capital.

What does it mean for energy consumers?

Consumer demand for low carbon energy products has been weak and we remain off track on delivering our targets. This week’s announcement signals ongoing support for the demand-side but also represents a significant investment which will ultimately feed through to consumers - offset by the benefits of a cleaner, more efficient, system. Those benefiting from Warms Home Plan funding are particularly likely to benefit.

- Household Bills: Focus on domestically produced clean energy is designed to reduce exposure to international markets and the associated volatility that brings. Under current market structures investment will largely feed through to bills in the short to medium term creating some additional upward pressure to household bills – offset by efficiency gains from electrification and energy efficiency where deployed.

- Home Upgrades: Continued support for insulation and heat pumps is designed to support a demand side shift and improve the overall efficiency of the system. This underlines government intent to stay the course on domestic and commercial decarbonisation plans.

- Environmental Benefit: Shift toward low-carbon electricity mix improves climate credentials of standard energy tariffs.

- Winter Support: Wider eligibility for Winter Fuel Payments provides direct relief to millions.

What should you do about it?

This week’s announcement confirms the opportunity for those operating at the customer edge. With the consensus on net zero (and this week’s announcements) breaking down however, there will remain a premium on strategies that withstand medium term uncertainty.

If you’d like to discuss any aspect of the Comprehensive Spending Review or wider energy policy and what it means for you, contact David Watson.

David Watson

Principal

As Principal at BFY, David leads client engagements on energy strategy, policy and commercial excellence, helping them to navigate a complex policy and regulatory landscape, capitalise on emerging opportunities in the energy transition and optimise their operating models for long-term success.

View Profile