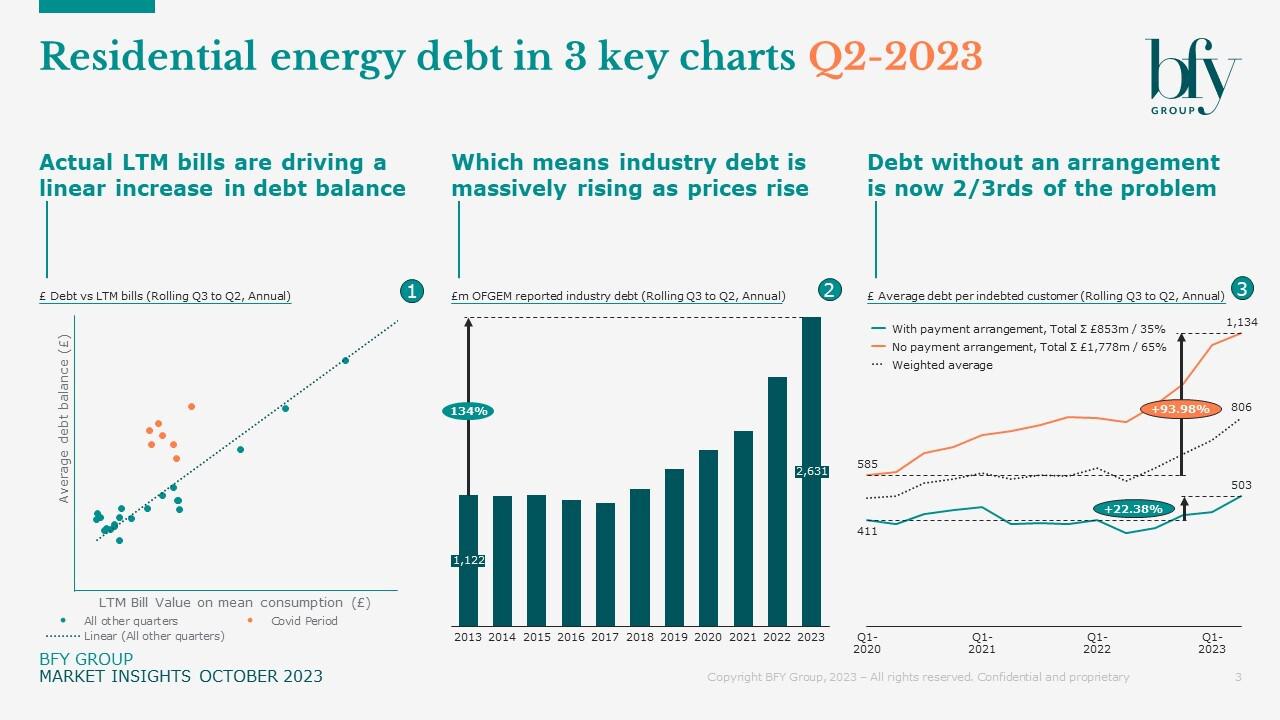

Customer indebtedness is growing at an unsustainable rate. And it’s projected to get worse as we head into winter.

Analysis from our Market Insights supports this, highlighting three key points, which we’ve explored further in this blog.

- The increase in actual bills over the Last Twelve Months (LTM) is unsurprisingly driving an increase in customer indebtedness

- So as prices rise, the industry as a whole falls more into debt

- Two thirds of this debt (>£1.1bn) relates to customers without an agreed repayment arrangement – and these customers are slipping further into debt

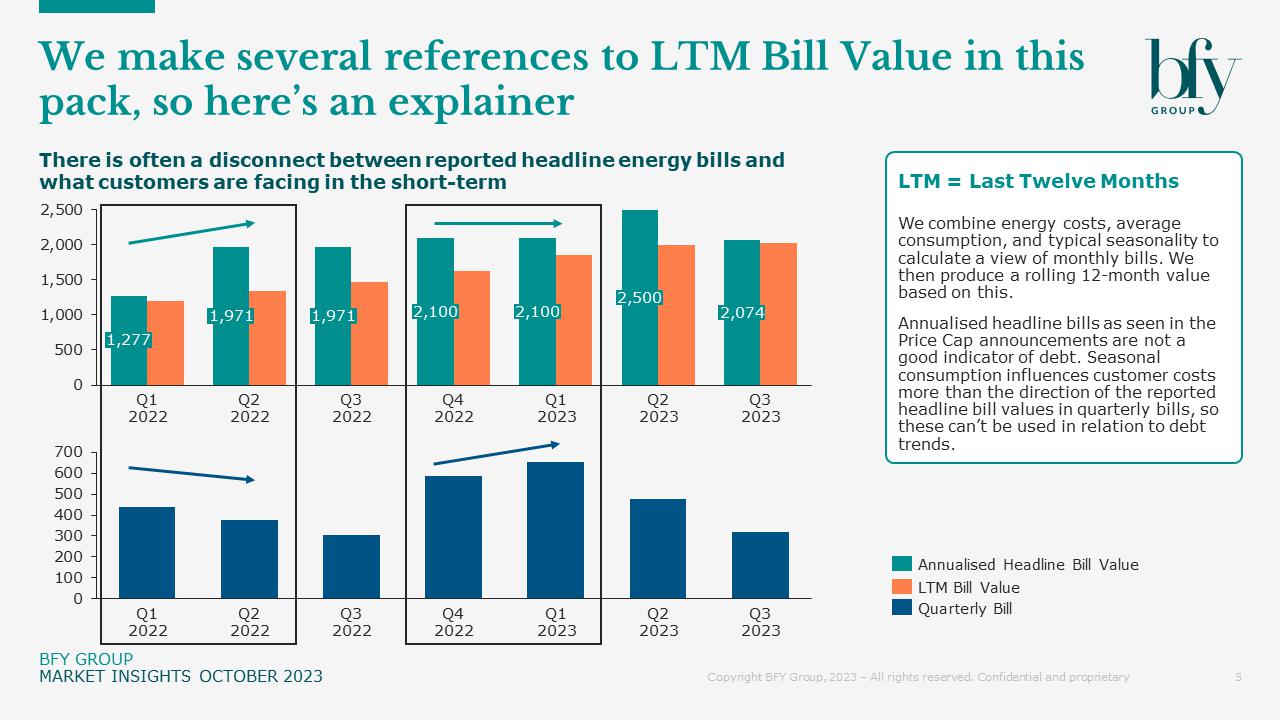

LTM Bills – Last Twelve Months

Actual energy bills, when aggregated over the last 12 months (LTM), are now at the ~£2,000 level and projected to remain there for some time.

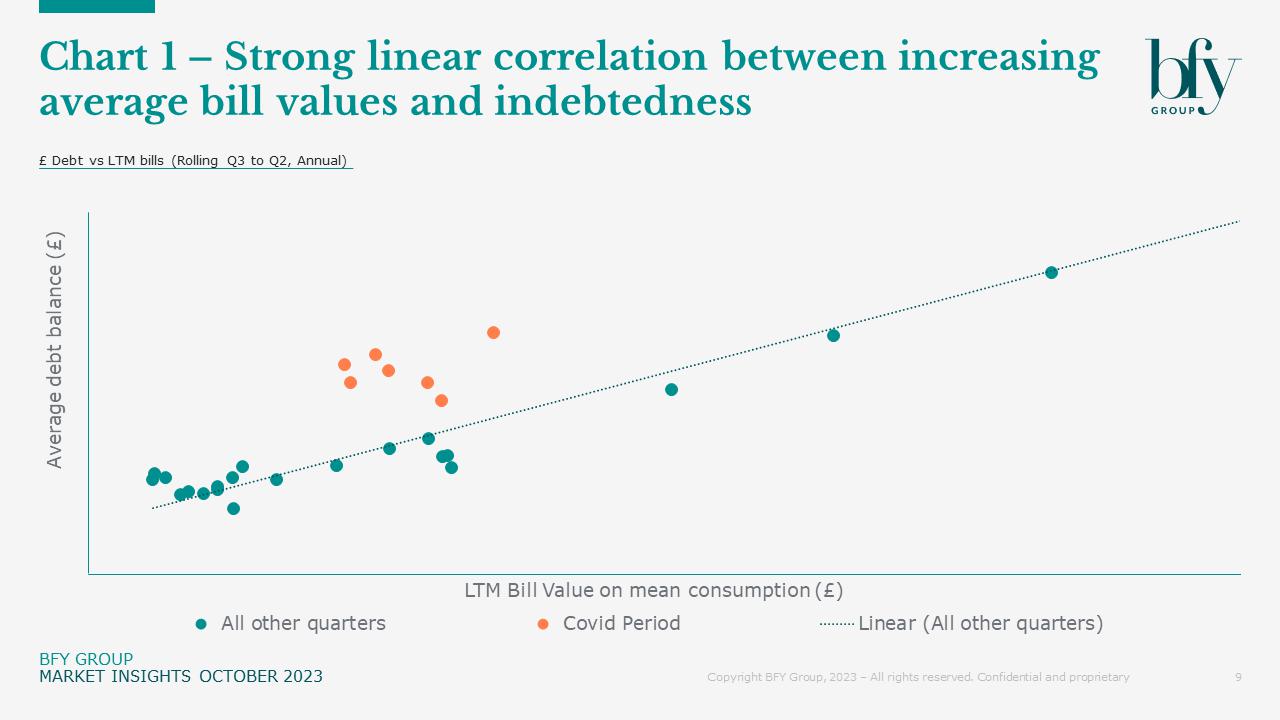

Debt levels are rising with LTM bills

Customer debt levels are rising in line with LTM bills – Chart 1 shows a linear correlation with levels of customer indebtedness and LTM bills, after adjusting for the COVID-19 periods.

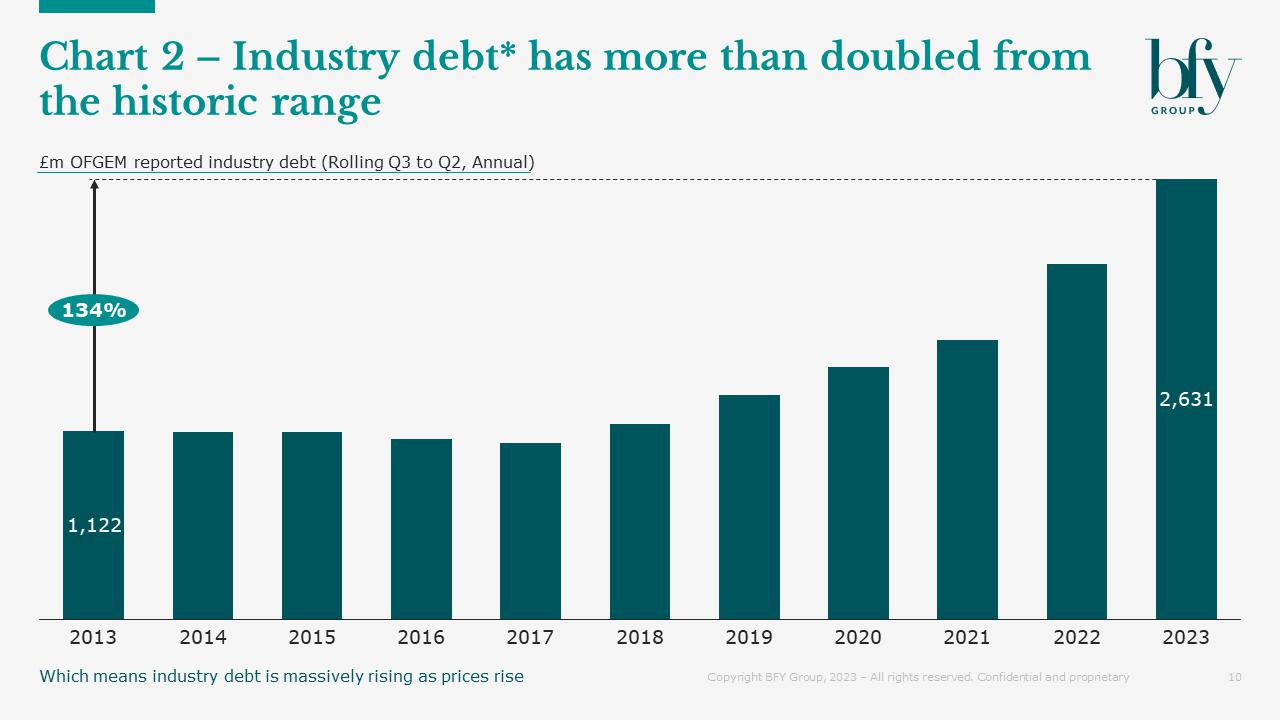

Industry debt continues to grow

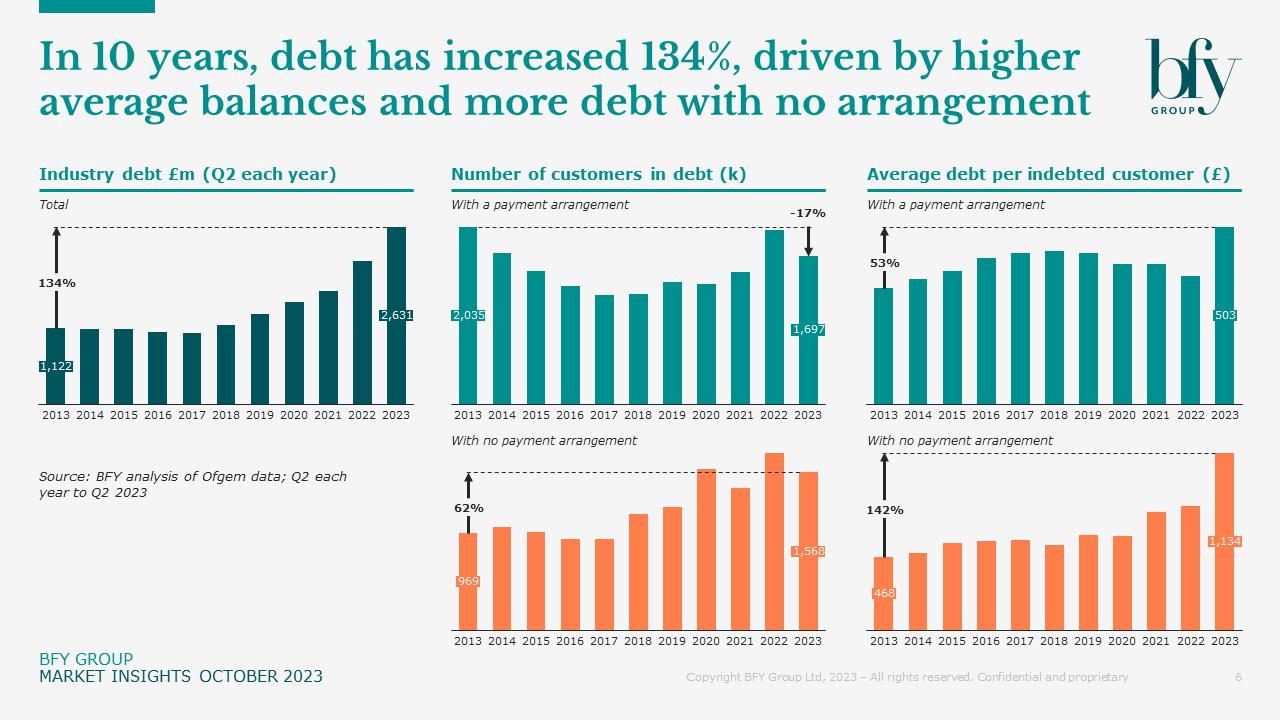

At an industry level, Chart 2 shows a 134% increase in aggregate debt* from the historical average.

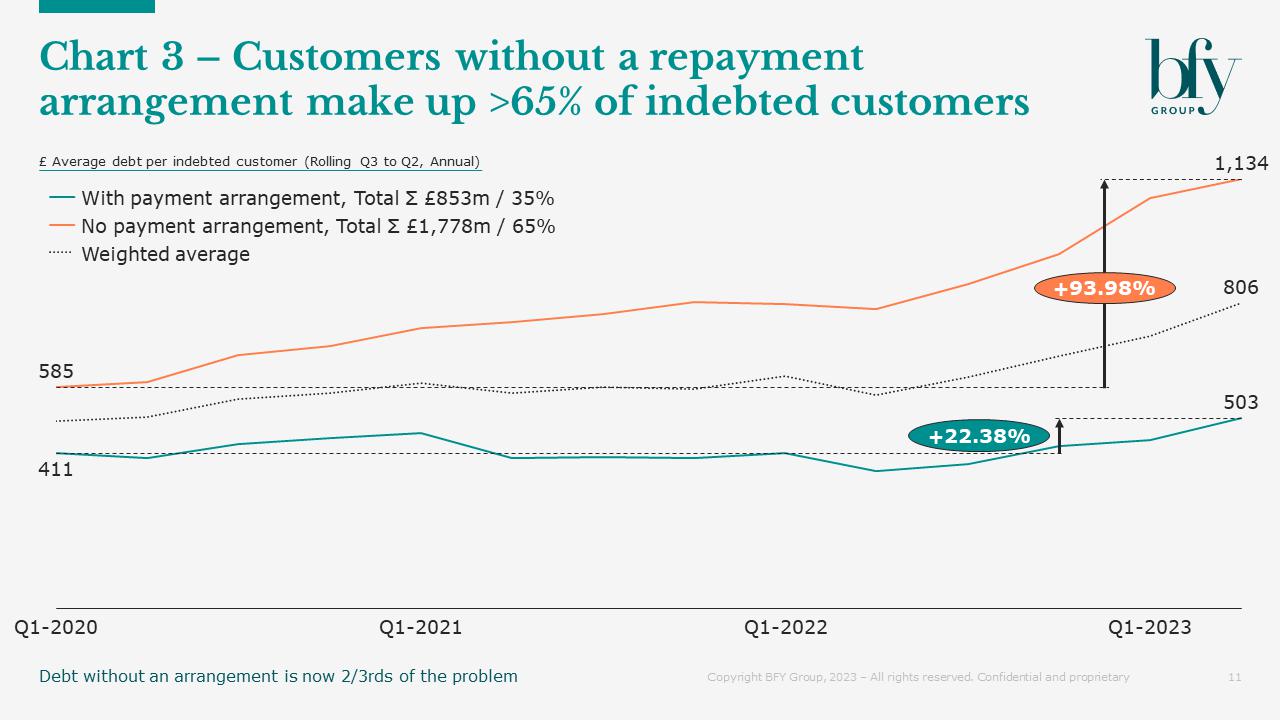

Customers without a repayment arrangement need support

The stark reality of customers without an arrangement to repay their debt is seen in Chart 3, with customer indebtedness levels doubling - compared to customers who are willing/able to engage with suppliers, where we see a moderate 20-25% increase.

These customers make up >65% of indebted customers.

Customers without an arrangement to repay their debt will need more support to understand and rehabilitate their position. Consideration should be given to whether Receipt of Bill is an appropriate repayment mechanism for these customers - many of whom are likely to be struggling financially.

This isn’t all debt in the market

We have based this debt* update on the industry debt figures regularly reported by Ofgem.

*Reported figures do not include:

- Any balances of Direct Debit customers, even if repaying debt

- Debt on Prepayment Meters

- Any debt <= 90 days, even if outside of payment terms

- Final debt after a Change of Tenancy

Our debt benchmarking suggests the full view of debt in the industry is 2.5x to 3.3x higher than currently reported.

This likely means that the most challenged customers are excluded from the reporting.

EBSS helped last winter – but isn’t available this time

Number of customers in debt* has been rising in line with net LTM bill levels – however the EBSS / EPG payments in Winter-22 have broken the correlation, and we need additional data to more accurately project the amount of customers in debt.

For more information on debt in the energy industry, contact Ian Barker.

You can also sign up to our mailing list here, to receive updates like these directly to your inbox.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile