As Q4 begins, new customer switching opportunities are expected to emerge, placing energy suppliers at a strategic crossroads.

For more than a year now, the energy market has largely been shut down - fixed tariffs have been unviable and the Ofgem Market Stabilisation Charge (MSC) has practically eliminated market switching.

We believe that since around April, suppliers have been in a position to offer fixed price tariffs below the price cap, but this has been deliberately stifled by the MSC and the Ban on Acquisition-only tariffs (BAT), to mitigate the risk of further market disruption. This is because a sudden wave of customer losses could have been catastrophic for prudent, well-hedged suppliers.

Our view is that many suppliers have been buying for Q423 on the assumption that market switching will increase. This means they assume fewer customers on standard variable tariffs, and will have more flexibility to offer competitive fixed price tariffs, without causing themselves material losses on their existing customer base.

With the prospect of a switching resurgence on the horizon, it will be interesting to see whether suppliers decide to chase the volume of new customers, or seek to prioritise customer retention. In short, many are likely to face a ‘Service vs Sales’ dilemma – bringing a degree of unpredictability to the market.

When covering this topic in March, we highlighted the potential for diversification with innovative, EV-specific tariffs – as a means of retaining customers. Interestingly, the number of these tariffs in the market has increased, and they’re set to remain a valuable tool over the coming months.

Green Shoots of Change

The news has been flooded with reports that energy prices are falling, leading many to assume that their bills will also start to reduce. In reality, and as we’ve previously reported, consumers are unlikely to see an immediate impact on their bills, due to the removal of government support that was previously in place over the 2022/23 winter season – see our post here for more detail.

What this reducing wholesale market does create though is the potential for market reopening. Costs are at a level where fixed price tariffs are starting to become potentially viable. And, indeed, over the past few weeks / months, a few suppliers have started to test the waters by offering fixed prices.

However, what we could see is the emergence of a ‘prisoner’s dilemma’. For large suppliers, holding onto existing customers is likely to be a preferred option, avoiding increased customer churn and the payment of switching fees to price comparison websites. Alternatively, if they are not prepared and competitors make a move on fixed tariffs, they may be left behind and their market share could begin to erode.

The Old World – Pre-Energy Crisis

How rapidly the market will reopen remains to be seen, however, the approach suppliers will take towards customer service and new sales promises to be an interesting watch.

Historically, it could be argued that many suppliers had a tendency to prioritise the experience of potential new customers, rather than the retention support for existing customers. A series of studies were completed by various market research agencies (before COVID-19 and the energy crisis), that sought to rank suppliers on customer service attributes, including telephone response times.

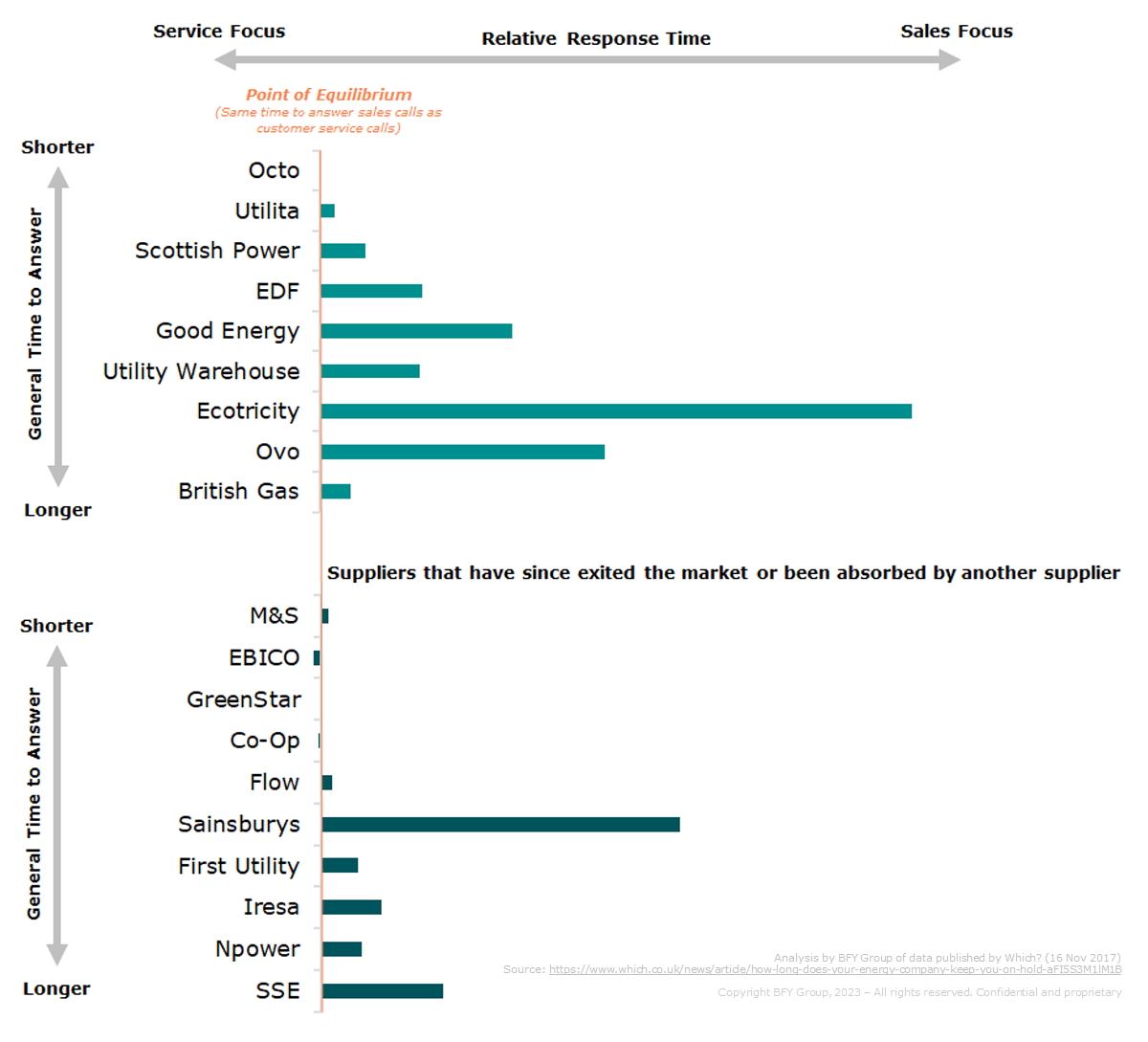

In the chart below, we’ve compared the call response times between the customer service and sales channels for each supplier (where possible), to create a view of how the existing suppliers used to prioritise new customer calls.

Bars that extend far to the right highlight a very short time to answer sales calls but a long time to answer customer service calls.

The chart shows that almost all suppliers included in the studies had a significant preference towards answering new sales calls over existing customer calls. At the time of the research, only a few were leaning the other way, and have since been absorbed into other suppliers, or have exited the market.

Octopus historically were coming out on top with a rapid general answering time, and no clear prioritisation of service or sales.

The New World – Market Reopening

To be clear, this chart provides a historical view, and does not necessarily reflect how suppliers will approach the new era as the market reopens. It will be interesting to see how actual activity unfolds, and whether this trend becomes even more exaggerated.

Many suppliers have stripped back their ‘sales’ departments since the market all but shut down, so the question remains as to whether they will be able to mobilise quickly, or if they will have lost much of their capability to chase acquisitions.

As with most industries, the cost of acquisitions is higher than retention, so we may see a state of retrenching as suppliers seek to protect their position, while they rebuild their sales capability. It is difficult to comment on precisely what suppliers may need to have in place to meet the demands of an open switching market in this new-era, but those suppliers that have removed, not repurposed, their ‘sales’ teams will almost certainly be on the back-foot.

For more information on market reopening, contact Zander Cleves. To receive Market Insights directly to your inbox, sign up to our mailing list here.

You may also be interested in our previous blog - Retaining and attracting customers in a changing Energy Market.