The Energy Price Cap was introduced by Ofgem back in 2019, to ensure “that prices for people on default energy tariffs are fair and that they reflect the cost of energy”.

If the goal was to prevent loyalty premiums (which was the original stated intention), then we’d argue that a relative price cap would have been better. For example, this might have restricted suppliers from offering an SVT at 15% more than their cheapest fixed tariff.

The CMA only ever recommended the implementation of a price cap for pre-payment customers – and recognised the aim of such a cap was to create wider choice, but allowing efficient suppliers to compete effectively below the cap. They also flagged the risks of introducing a price cap that wasn’t designed correctly or set at the right level, arguing that suppliers would end up leaving the market, reducing competition and consumer choice.

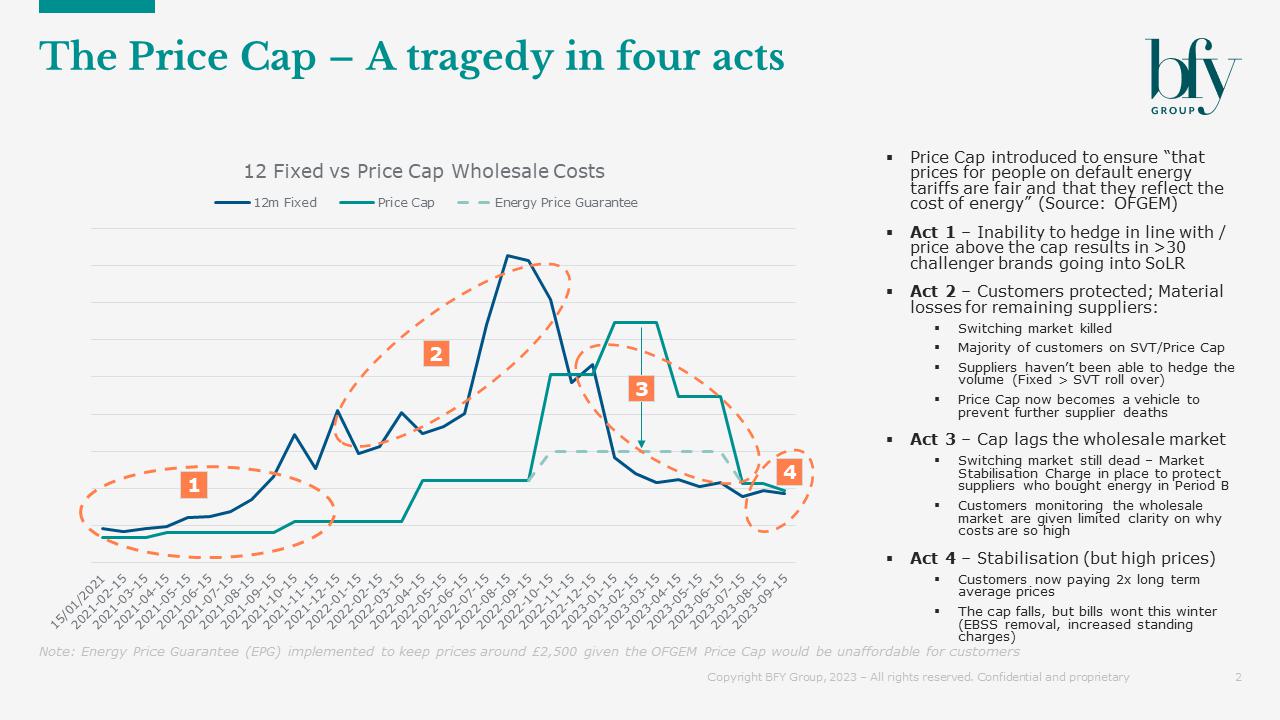

Reflecting on this, we’ve considered the E2E movement of the price cap from 2019 to the present day, looking at how this has impacted the market across four notable acts.

In Act 1 we saw ~30 suppliers going bust. The cap wasn’t easy to hedge – many suppliers simply didn’t have the balance sheet strength to support the credit limits needed.

The inefficient design of the price cap also meant we didn’t have a price floor, and so we saw two things happen:

- The forward curve – i.e. the wholesale market - exceeded the limit set within the cap. Simply put, there were extended periods where you couldn’t buy energy for a customer for less than you were allowed to sell it.

- Many suppliers were selling acquisition tariffs at negative gross margin (i.e. less than costs), on short term hedges in order to generate cash flows based on the future value of customers moving to SVT.

Suppliers couldn’t hedge their intrinsic risk, so they just carried it to delivery. And that was a time bomb for the market.

Over time we saw many of the under capitalised suppliers – who were mostly offering excellent service to customers – go bust due to an inability to raise prices in response to market costs.

Act 2 – Bulb were placed into Special Administration in late November 2021. All of their customers were on a Vari-Fair tracked product, where prices moved in relation to the market.

The challenge here was this type of product was covered by the Price Cap, but used a shorter methodology. This variance created risk which eventually went against Bulb.

With 12 month fixed prices being so high, the vast majority of customers rolled off their 12m fixed tariffs, and into the arms of the price cap – which was saving them a fortune, and costing suppliers > £1,000 per customer in gross margin losses.

The surviving suppliers are now the vehicle by which to stabilise the market, and the price cap is the chauffeur. The first stop on the journey is to create a shorter observation window for setting the level of the price cap to be more reflective of the market.

Prices start to come down from their peak – which creates a further problem for the remaining suppliers. Margin calls. The energy they have bought at peak is now worth less than they paid for it. This is the point at which, in a functioning rational market, we would see further supplier deaths. In this scenario, some suppliers would be able to sell at lower prices, which reflects the reduction in the wholesale market. Then if customers started switching, the previous suppliers would be left on the hook for energy purchased at higher prices.

Act 3 – The first thing we see here is the lag between the market and the cap. With the wholesale market dropping, we see the underlying price cap rising and then falling. Those of us who have been in the market for some time will remember the rocket and feather accusations laid against the energy suppliers – this chart shows what happens when you need to try and set prices many months in the future by buying today.

We also see the level of protection that was given to customers through government intervention, via the Energy Price Guarantee.

As wholesale prices for a 12m fixed deal drop, we start to see two things:

- The necessary evil that is the Market Stability Charge means suppliers can’t price in line with the market. This acts as a protection against stranded energy costs, as a result of suppliers having to procure energy at high prices in Act 2.

- A massive lack of clarity for customers – wholesale prices have dropped, but it’s not clear to the end customer on why these prices are not being passed on.

The price cap now starts to serve as a mechanism by which to repay suppliers for the losses they were forced to endure.

But this lack of clarity creates a dangerous negative sentiment against suppliers. These are suppliers who’ve previously weathered the storm and suffered hundreds of millions of pounds of losses, and having been able to recover some or part of those losses, are now being accused of profiteering. One MP even decided it was a clever idea in the Commons Select to ask energy company CEO’s how they slept at night.

Act 4 – I’m a price cap, get me out of here.

Prices while high, have started to stabilise. We’re seeing some suppliers now starting to offer fixed prices at a discount to the cap.

What now needs to happen is a return to a functioning market. If a price cap is to be in existence, then it should serve a specific purpose.

For more information on the price cap and how it’s impacting you, contact Ian Barker.

You can also sign up to our mailing list here, to receive updates like these directly to your inbox.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile