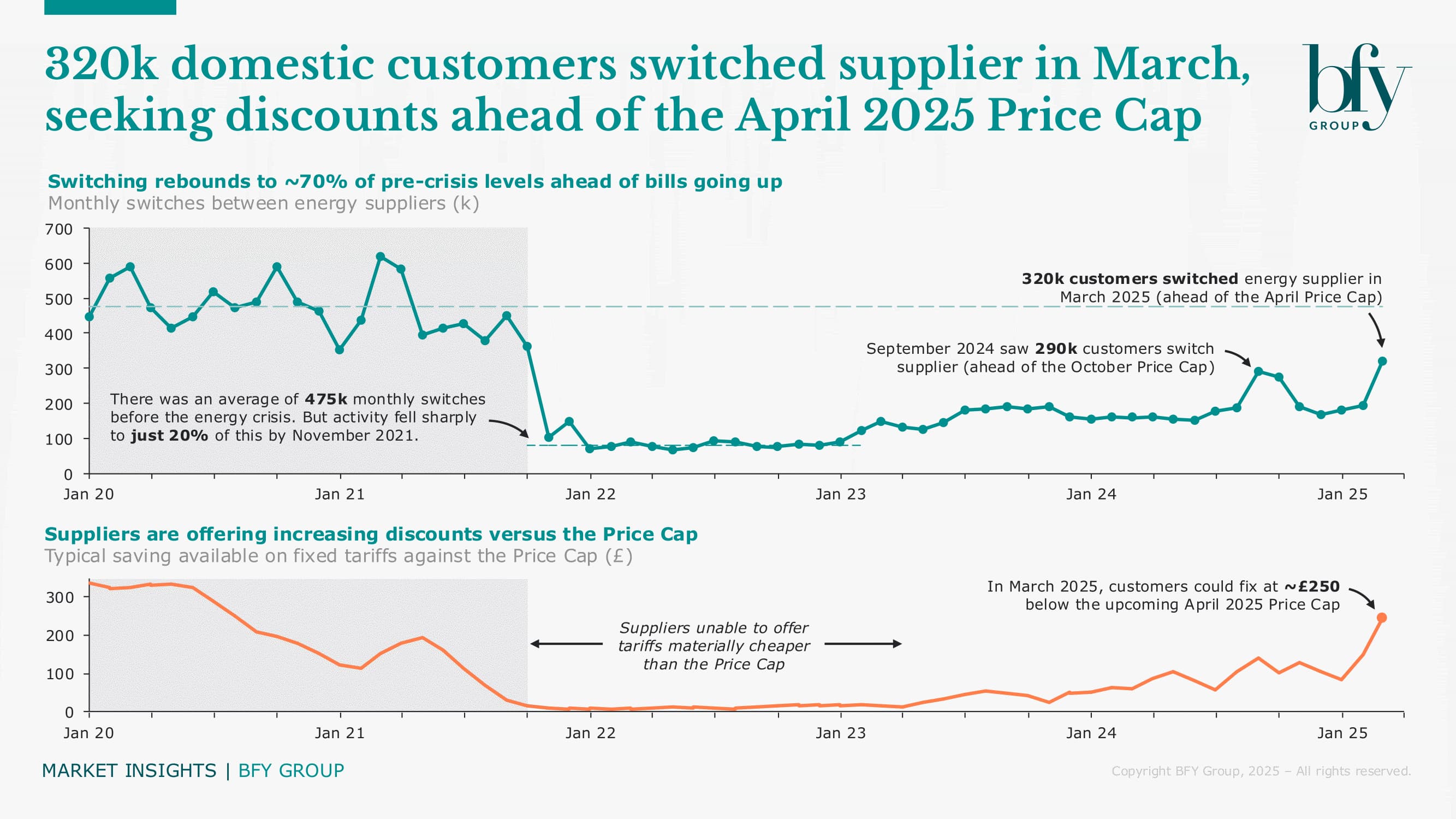

320k domestic customers switched energy supplier in March, seeking savings ahead of the April 2025 Price Cap.

This marks a rebound to 70% of pre-crisis switching levels (which averaged 475k per month), as the Price Cap was set to rise, and customers were able to lock in fixed deals £250 below the upcoming cap.

It represents a sharp contrast to the period from 2022 to early 2024, when meaningful savings were hard to find.

It's the highest number of switches post-crisis, more than the 290k we saw in September 2024, when the price was also set to rise by 10%.

With July's Price Cap set to come down - should we expect switching to fall back, or will customers continue to seek out cheaper tariffs?

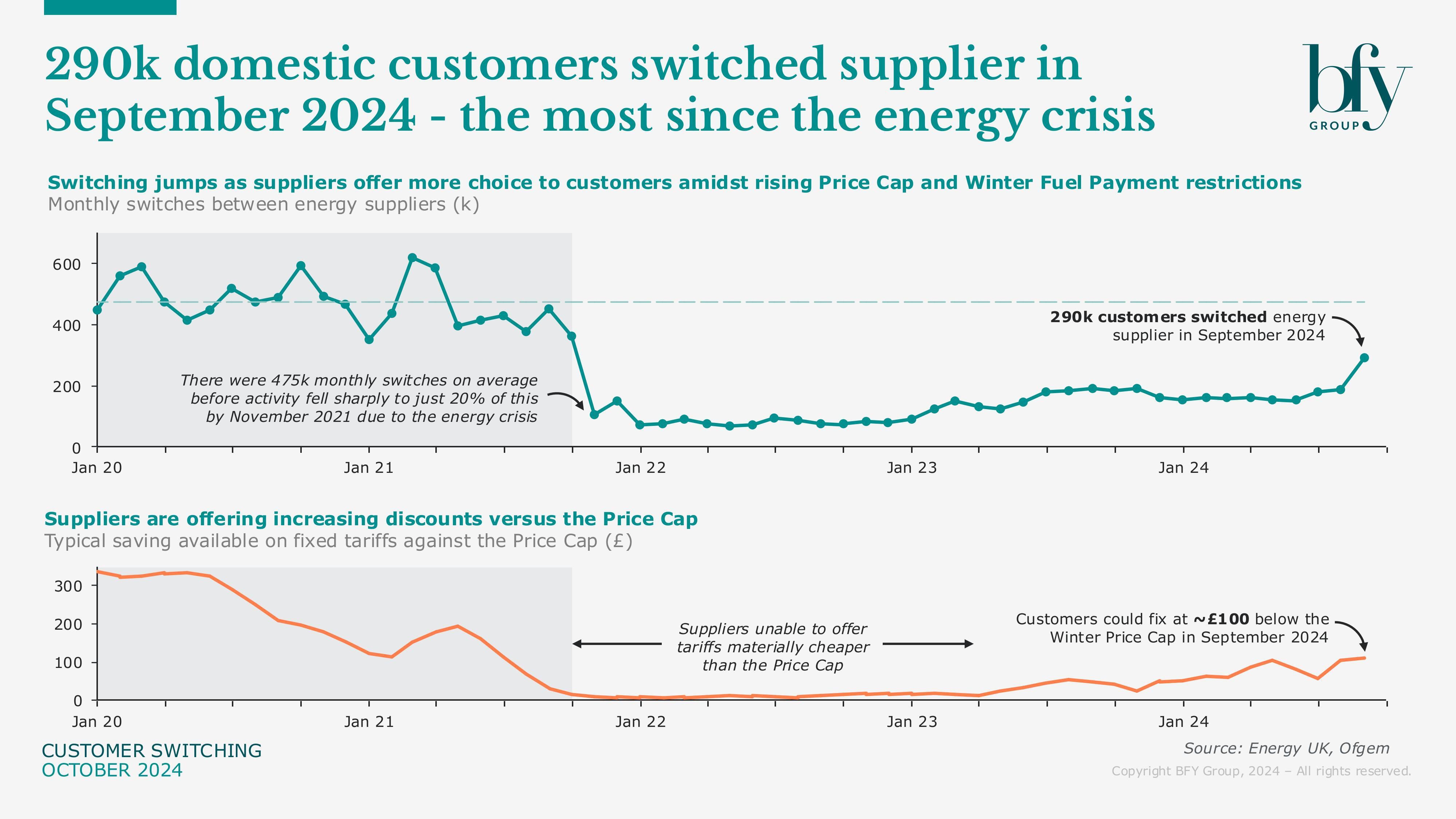

Highest post-crisis switches since September 2024

Our previous analysis showed more than 290k customers switched supplier in September 2024 - a 55% jump from August.

The uptick in switching coincided with the rise in the winter Price Cap, millions of households missing out on the Winter Fuel Payment, and suppliers offering increasing savings against the Price Cap through fixed tariffs.

Some customers saved around ~£100 on their energy bill by seeking out fixed tariffs in September.

Bringing Clarity to Dynamic Tariffs: A framework for energy retailers

Dynamic tariffs present new opportunities for the energy market, but they also bring a growing challenge. How can suppliers offer smarter, more flexible products - without overwhelming customers, confusing internal teams, or diluting commercial performance?

In our latest article, we share a framework to help suppliers cut through the noise - empowering teams and aligning products to real customer needs.

For more information on switching, and how to support customers in maximising the benefits of their tariff, contact Matt Turner-Tait.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile