Strategy & Commercial

We found the BFY team easy to work both pre-transaction and following completion, highly skilled and experienced and empathetic of what we as a team were going through. For any founders and management teams going through a transaction, I’d highly recommend BFY.

Co-Founder and COO

Strategy & Commercial

Empowering strategic decisions for long-term value

Every board needs to decide what to deliver to which customers, how and when. In retail energy, opportunities are obscured by complexity, competition, and the pace of change.

Our clients turn to BFY to support strategy development because of our in depth knowledge of the energy market. We have the experience, expertise, and processes needed to deliver executable action plans to improve your profit margin.

We can help with:

- Strategic Planning and Analysis

- Pricing

- M&A, Transaction Advisory and Due Diligence

- Target Operating Model Design

- Financial Modelling

- Compliance, Policy and Regulatory Advisory

- Market Scans and Feasibility Assessments

- Go-to-Market Strategies

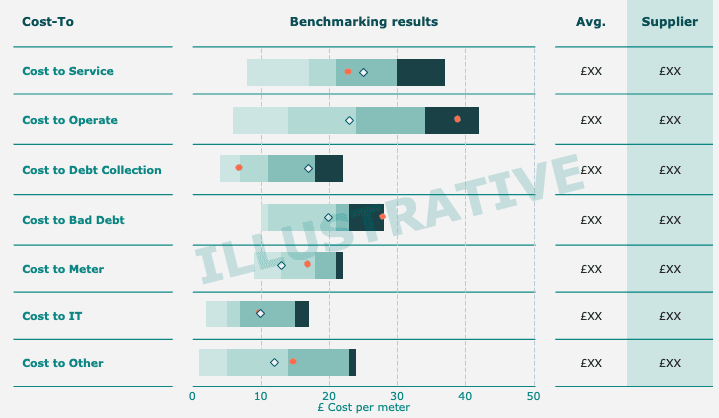

Benchmarking

Know how you're performing, stay ahead of the competition

Our Energy and Water supplier Benchmarking study often confirms a case for change, or starts the conversation about why it's needed.

In the first year, our Benchmarking study typically:

- Kicks off a strategic process – using real market comparisons to demonstrate the need to review current and future cost targets; or

- Confirms directions of travel for existing strategic decision making through clear insights and recommendations

For example, some suppliers have participated in Benchmarking having decided on pursuit of a cost-leadership pathway. Cost Benchmarking then supported the target cost envelope and therefore the scale and ambition of transformation required.

Strategy & Commercial

One of the UK's leading consultancies

Advancing to Silver in this category is a testament to our team’s hard work and dedication over the past year. It’s been an exciting period for Strategy engagements at BFY, supporting energy and utilities clients on regulatory changes, growth opportunities, M&A, and more. Ian Barker Managing Partner

At BFY Group, we’ve been closely involved in transactions in and around the energy market over the past decade. This includes customer book sales and private equity investments, in areas adjacent to the energy market.

Ian Barker

Managing Partner

WHITEPAPER

Post-Deal Value Creation: How to maximise ROI

Investment cycles are coming to an end for many private equity investment funds launched pre-covid, while today’s economy is making exits difficult.

Finding new routes to deliver this value is an urgent need, and proactivity is paying dividends for those with robust value creation roadmaps.

In this whitepaper, you’ll find insight on the most effective planning approach for Post-Deal Value Creation, including:

- A framework for effective Post-Deal Value Creation

- The levers you need to maximise ROI

- Our four-step model for investment success

Click ‘Access Now’ to read this insight in full.

Strategy & Commercial

Meet the Team

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

David Watson

Principal

As Principal at BFY, David leads client engagements on energy strategy, policy and commercial excellence, helping them to navigate a complex policy and regulatory landscape, capitalise on emerging opportunities in the energy transition and optimise their operating models for long-term success.

Julia Hughes

Senior Consultant

Julia helps clients to deliver commercial value and optimise their planning and performance management processes.

Strategy & Commercial

Our Impact

Strategic analysis identifies ~£103m in opportunities for energy retailer

We delivered strategic analysis for a large energy retailer, identifying up to ~£103m in incremental revenue opportunities, through a comprehensive Market Scan Analysis and Sales Channel Maturity Assessment.

Supporting a large supplier's transformation through challenger strategy and scenario analysis

Our client, a large Energy retailer, was looking for quantitative and qualitative analysis on how challenger energy suppliers operate. We delivered our insights and recommendations to the board using our modelling on the energy market, backed by the evidence gained through our benchmarking study.

Economic advisory on Ofgem’s price cap for a large energy retailer

Our client, a large energy retailer, was looking for economic advisory on how it would be impacted by Ofgem’s price cap and how it should respond to its consultation. It needed to pull together a team at short notice to provide the quantitative and qualitative analysis of the published data provided in the Ofgem data room.

Strategy & Commercial

Our Insights

Price Cap to rise by £35 (2%) to £1,755 in October - higher than expected ahead of winter

Ofgem has today confirmed that the Price Cap will increase by £35 (2%) to £1,755 in October - rising slightly more than expected as we head into winter. This small change reflects a more stable wholesale market, with the increase driven by higher balancing costs and the expansion of the Warm Home Discount, which will support up to 2.7m more households.

Britain’s Energy Transition: Strong foundations, shaky confidence

The UK’s energy transition has strong foundations but faces wavering political commitment. We discuss how suppliers can build strategies that perform across policy cycles and seize opportunities without relying on subsidies.

From Power Providers to Tech Partners: How energy companies are evolving

In a market where returns from energy supply are low and technology-enabled solutions are more dynamic, the opportunity for energy suppliers to move from commodity traders to technology partners has never been clearer.

Subscribe today to receive the latest news and updates from BFY

By submitting my personal data, I consent to BFY collecting, processing, and storing my information in accordance with our Privacy Policy.