This is the first in a four-part series exploring how to improve customer service agent performance in energy and utilities.

Today, we’re focusing on a critical area under pressure - debt collection.

Understandably, this topic has been top of the agenda since the cost-of-living crisis. Its prime position remains with domestic energy debt reaching a record-breaking £4.15bn. With 75% of customer debt having no payment arrangement in place, the challenges are steep.

To successfully manage this level of debt, agents need to be highly skilled, resilient, and empathetic. Collections processes will be pushed to their limits as we head into winter. Then add into the mix the Market-wide Half-Hourly Settlement (MHHS) migration from October. Contact centre agents will need sufficient expertise to navigate the intricacies of debt collection and MHHS, while maintaining high levels of customer service. (Here’s some of our advice on preparing for MHHS migration.)

Turning agents into experts

As we see customer indebtedness continue to rise, you may feel your contact teams aren’t delivering the outcomes you want, or lack the expertise required to weather the storm. Although it’s natural to have these concerns within the extreme debt landscape, it’s important that you avoid knee-jerk reactions. Focus your efforts on building confidence and expertise within your teams.

Developing this expertise will come as a function of natural talent and skill, agent experience, and crucially – the broader changes to customer interactions needed to resolve customer issues effectively, and compliantly.

Take it from the top

Over the years working with over 75% of the UK’s energy suppliers, we’ve found that driving fundamental change in frontline team performance is best achieved from a top-down perspective.

If you really want to build a high performing culture and a high-performing team, you have to invest in leadership.

COO

Energy Retailer

Adopting this approach will help you make a wider impact at a faster rate, getting ‘scores on the doors’. One client achieved an £8.5m increase in cash collection, and £4.5m BDC reduction within six months. Example below:

Following poor ‘on-call’ collection rates, with 13% of agents responsible for over half of payments, performance was hampered by skill gaps, disengaged staff, and lack of visibility. A significant portion of agents couldn’t handle difficult conversations, and leadership struggled to manage outcomes remotely.

As part of a 6-month debt transformation, we introduced 15 new collections campaigns and an enhanced comms suite. We also deployed initiatives from our people transformation offering to upskill the collections team, drive customer engagement, and improve debt resolution. This helped to unlock £8.5m in cash and a £4.5m reduction in BDC.

Starting with team leaders and managers helps set the direction and drive change. They can share their vision, immediate focus and encourage best practice in weekly coaching sessions with agents. Following this up with a dedicated improvement programme (focusing on items covered later in this article) across all agents will be a significant investment, but the pay-off will be equally substantial.

Where should investment be focused?

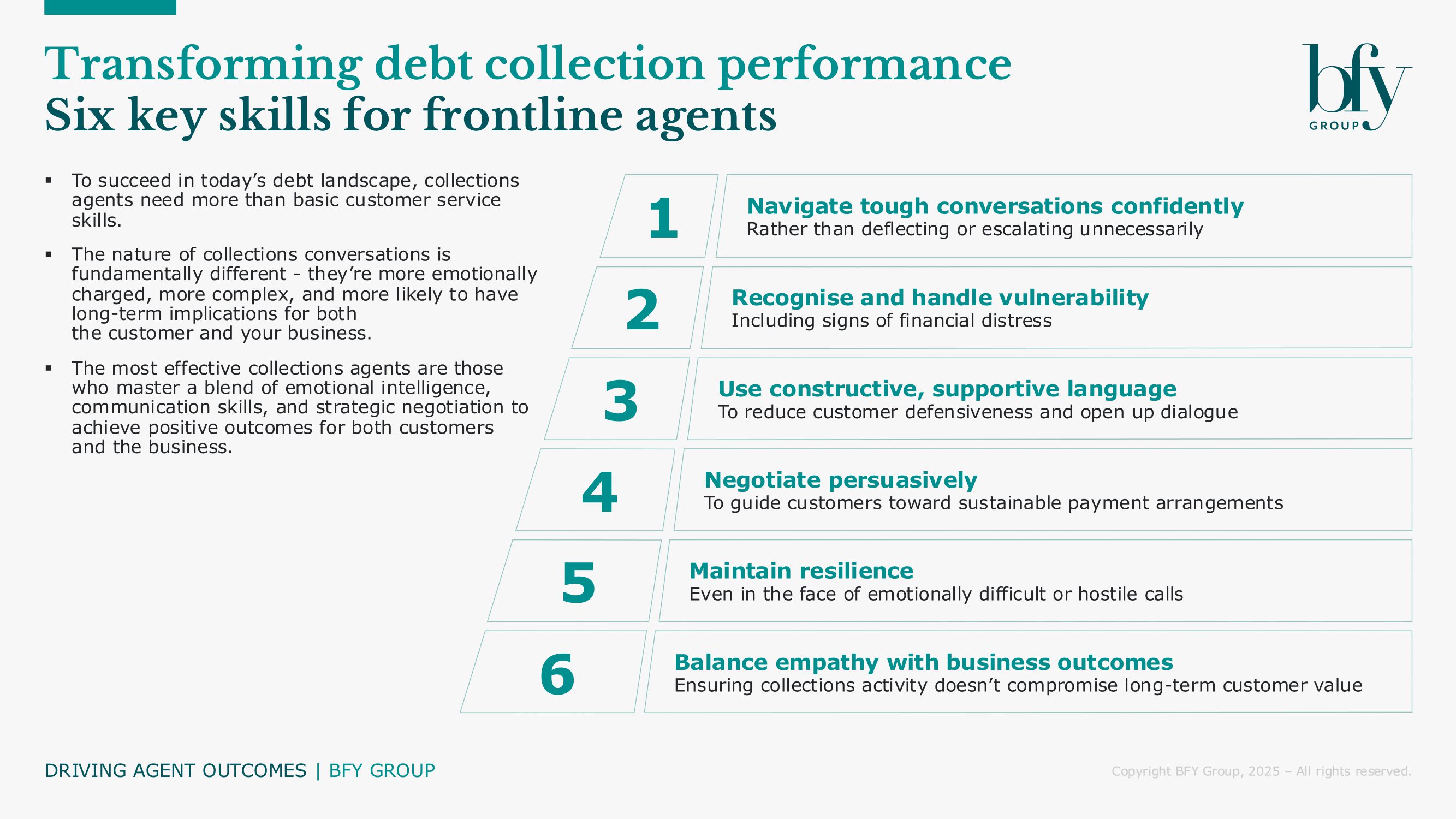

To succeed in today’s debt landscape, collections agents need more than basic customer service skills. The nature of collections conversations is fundamentally different - they’re more emotionally charged, more complex, and more likely to have long-term implications for both the customer and your business.

The most effective agents are those who can:

- Navigate tough conversations confidently, rather than deflecting or escalating unnecessarily

- Recognise and handle vulnerability, including signs of financial distress

- Use constructive, supportive language that reduces customer defensiveness and opens up dialogue

- Negotiate persuasively to guide customers toward sustainable payment arrangements - not just one-off payments

- Maintain resilience, even in the face of emotionally difficult or hostile calls

- Balance empathy with business outcomes, ensuring that collections activity doesn’t compromise long-term customer value

Often, simple collections training courses or online learning videos focus too much on systems and process - how to log a note, how to follow a script, how to refer to external support. While those things matter, they don’t equip agents to truly lead the conversation.

When agents feel underprepared, it’s not uncommon for them to default to handing customers off to third-party charities. While support organisations play a vital role, they should be the exception - not the norm. With the right skills, many customers can be helped earlier, more effectively, and without leaving your ecosystem.

By embedding these behaviours - and supporting them with regular coaching and structured feedback - you can transform collections calls from reactive firefighting into proactive financial support.

How can we help?

At BFY, we’ve developed a tailored Agent Conversations Programme that builds exactly the skills needed for today’s collections environment.

This is not a training course, but a people transformation that supports frontline advisers, team leaders, and subject matter experts across all your contact channels. We focus on coaching people to confidently engage in difficult conversations, spot signs of vulnerability, and build sustainable repayment arrangements that genuinely help customers.

For more on how our Agent Conversations Programme can help you, contact Kevin Scott.

Kevin Scott

Director

Kevin leads client engagements with a laser focus on empowering clients to navigate large-scale events and market challenges.

View Profile