Ofgem today (23 Feb) announced the headline Price Cap is decreasing £238 (12%) to £1,690 for a typical customer paying by Direct Debit.

Key points:

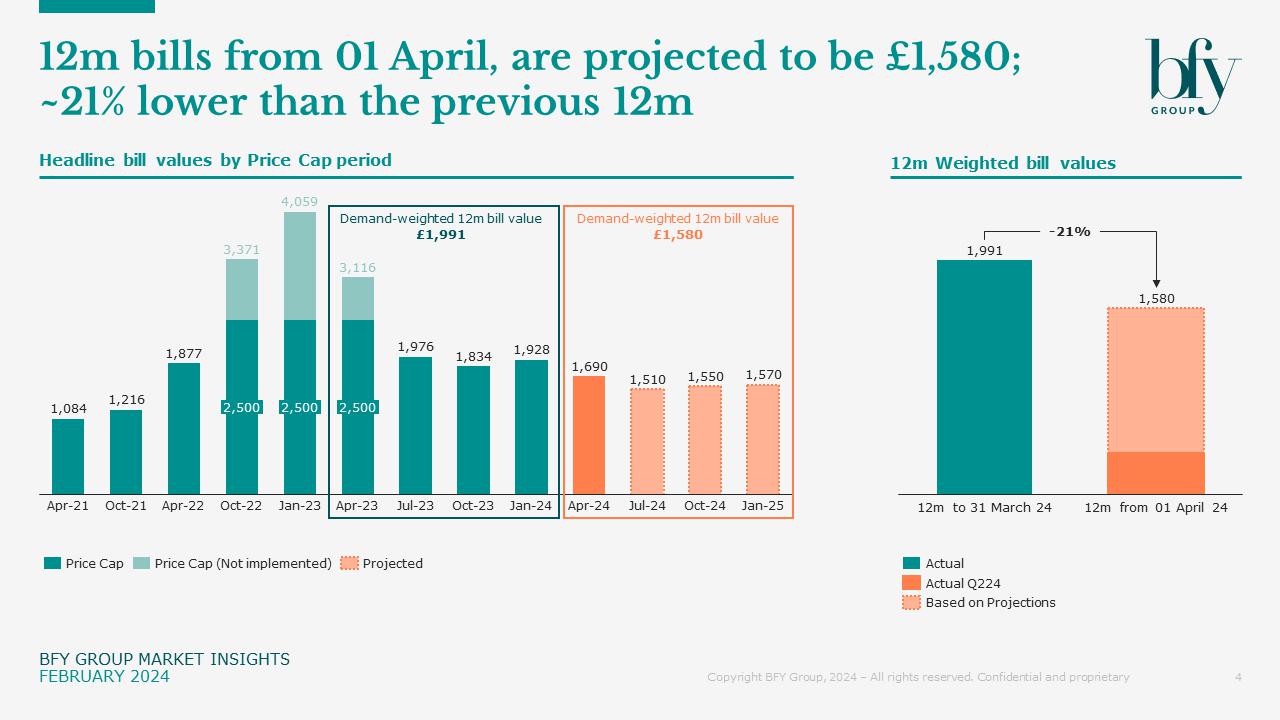

- From 01 April 24, customers could expect to spend £1,580 over 12 months; a £411 (21%) fall compared to 12m to 31 March 24

- Easing prices provide a welcome relief to both consumers and suppliers

- Market conditions allow for more competitive tariffs, but not at the unsustainable levels we saw before the energy crisis

Falling Energy Costs – 12-month bills to drop ~21%

Ofgem have announced that April’s Headline Price Cap will be £1,690 a fall of £238 (12%) compared to Q124, now standing at its lowest level since October 2021.

This settled slightly higher than our £1,650 central case in December.

If wholesale costs remain steady, our analysis suggests that Price Caps will stay at or below their current level for the next 12 months - meaning customers could expect to pay £1,580 in the 12m from 01 April. This is a £411 (21%) fall compared to 12m to 31 March 24.

Wholesale prices have fallen by 30% in the last 3 months, so it’s possible we could see even lower projections over the next few weeks. Although time will tell, as we sit outside of the relevant observation windows for some time yet.

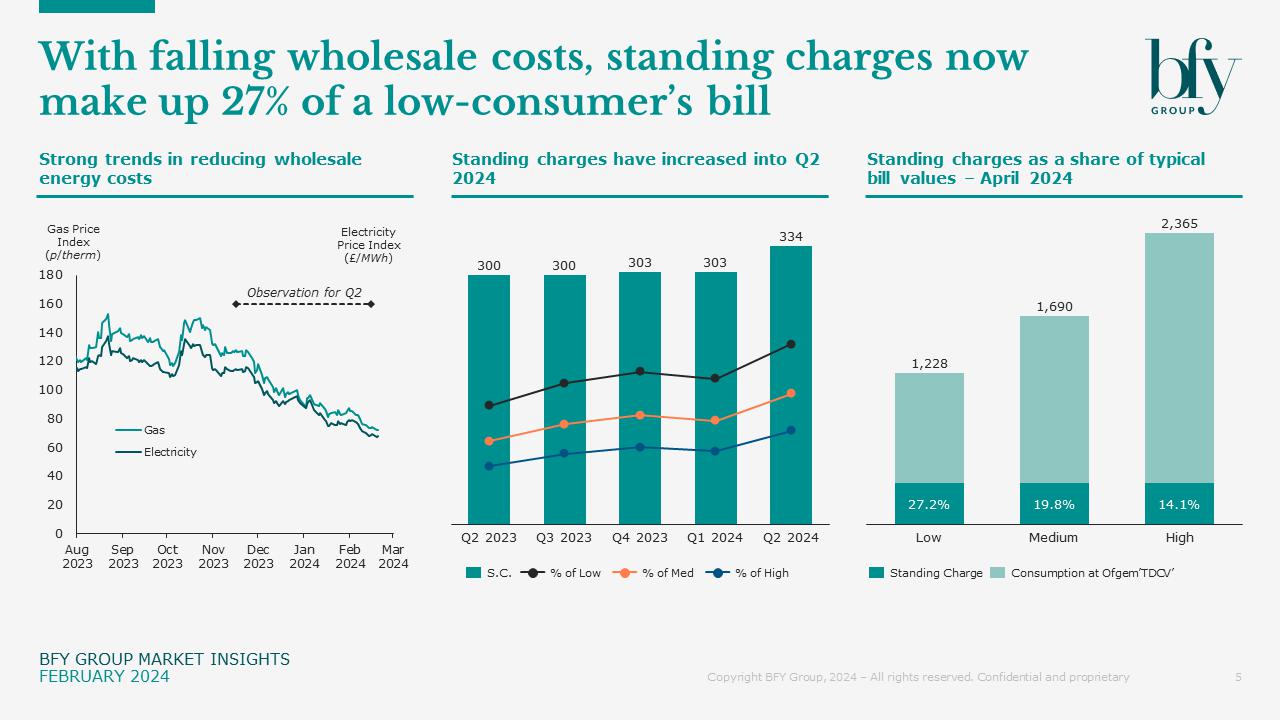

With wholesale prices falling, fuel costs now make up less than half of the typical headline bill. This means standing charges make up a significant proportion of customer bills – especially for lower-consumers at 27%.

What does it mean for customers?

In the last two years, we’ve seen customers reduce their gas consumption at a faster rate in response to record high energy prices. Both 2022 and 2023 recorded significantly lower domestic consumption of both electricity and gas, after accounting for the weather.

The easing of prices could suggest a slight increase in domestic consumption year-on-year, as we look set to face lower bills next winter. While falling energy prices will be a welcome relief to customers struggling with bills, we don’t expect total energy debts to have plateaued yet, and energy bills are still high compared to pre-energy crisis averages.

Alternatives to Standard Variable Tariffs?

Along with the Price Cap announcement, Ofgem also announced that, while the Market Stabilisation Charge (MSC) will come to an end on 01 April, the ban on acquisition-only tariffs (BAT) will extend for another 12 months (although it intends to open a consultation to consider shortening this extension to just six months).

Based on the latest wholesale costs, we see a theoretical range of fixed tariffs currently sitting at £1,450 to £1,600. Prior to the energy crisis (and without a BAT), we’re confident we’d have seen prices at the lower end of that scale. But pricing at that level of GM investment proved to be unsustainable, and we don’t expect to see tariffs on offer in the current market – especially with the BAT remaining in place.

We do expect to see more fixed tariffs on offer to customers that are lower than the April Price Cap and, increasingly, competitive with the projected future levels of the cap over the next 12 months. We’re seeing a steady rise in energy suppliers “defensively”, but proactively offering attractive fixed tariffs to existing customers, in anticipation of competitor offers, and a reintroduction of refer-a-friend and similar promotions.

As we see more tariffs on offer, the question for customers on whether to switch to a fixed tariff or remain on the Price Cap is not straight forward. It’s a confusing landscape for customers, in a falling wholesale market. We’ve previously shown that the Price Cap doesn’t represent the 12 month spend, and we’ve also discussed how the headline Price Cap figures don’t reflect actual regional spend regional energy bills.

The downward trend in recent wholesale prices means near-term products (e.g. week ahead) have continued to trade below forward contracts (the basis of the Price Cap). As the falls in wholesale get shallower, the benefits to consumers opting for agile / tracker type tariffs will tighten back up and potentially move from “anyone wins”, as they practically have been, back to being more dependent on the correct daily consumption shape.

If anything, 2022/23 has shown consumers the value of price certainty. Yet the decision on whether to fix remains synonymous with whether that fix sits below the latest view of the Price Cap, without reflecting the volatility of the energy market.

If you'd like to know more about the Price Cap and its impact on the energy market, contact Matt Turner or John de Bono.

To receive our Market Insights directly to your inbox, join our Mailing List here.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile