Summary Overview

- Power and Gas prices have seen sustained falls in recent weeks (~30-40%)

- Shorter hedge tenor from changes to the cap mechanism sees more market-reflective pricing

- Reduced market volatility is giving more price consistency (but Ofgem are calling for input on market liquidity)

- Supplier confidence is improving: we see an increase in tracker tariffs, a return of refer-a-friend offers, and increased customer retention activity – all supported by returned appetite for suppliers to hold a level of open hedge position

- A small but highly engaged cohort of customers are already seeing immediate benefits from agile pricing and demand flexibility

- If prices stay at or around current trajectory for the next few weeks, then it's highly possible we'll see a £1,650 Price Cap

Prices coming down 30%

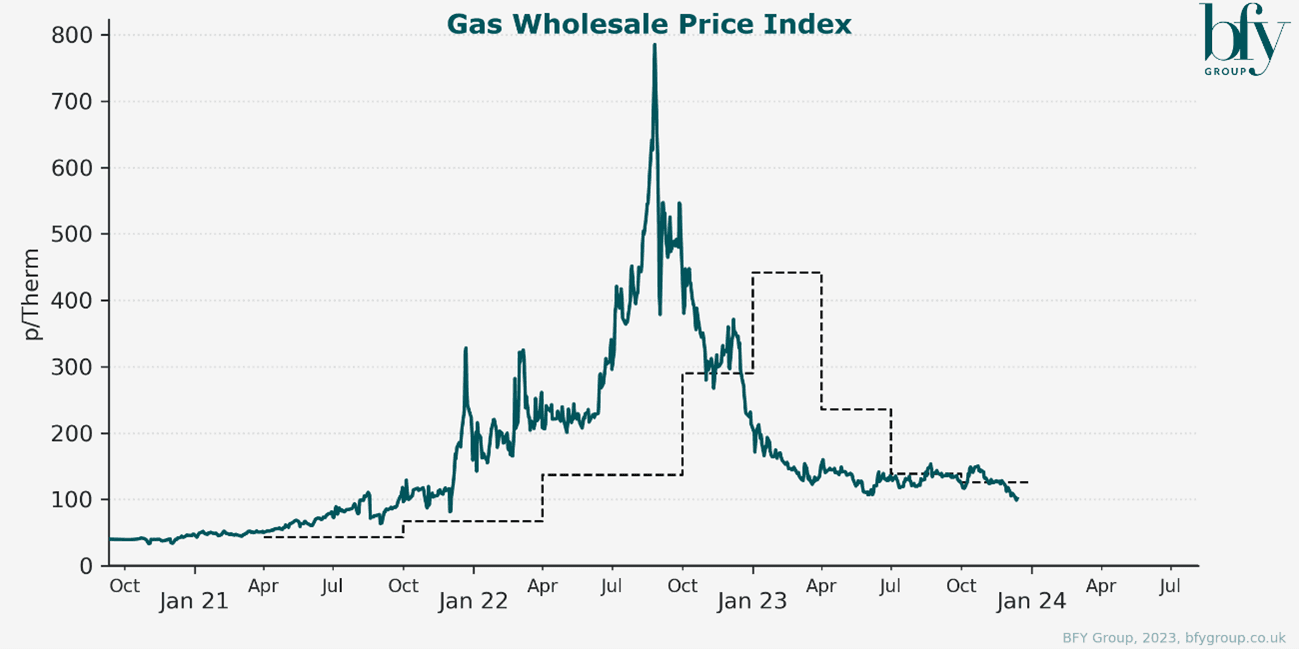

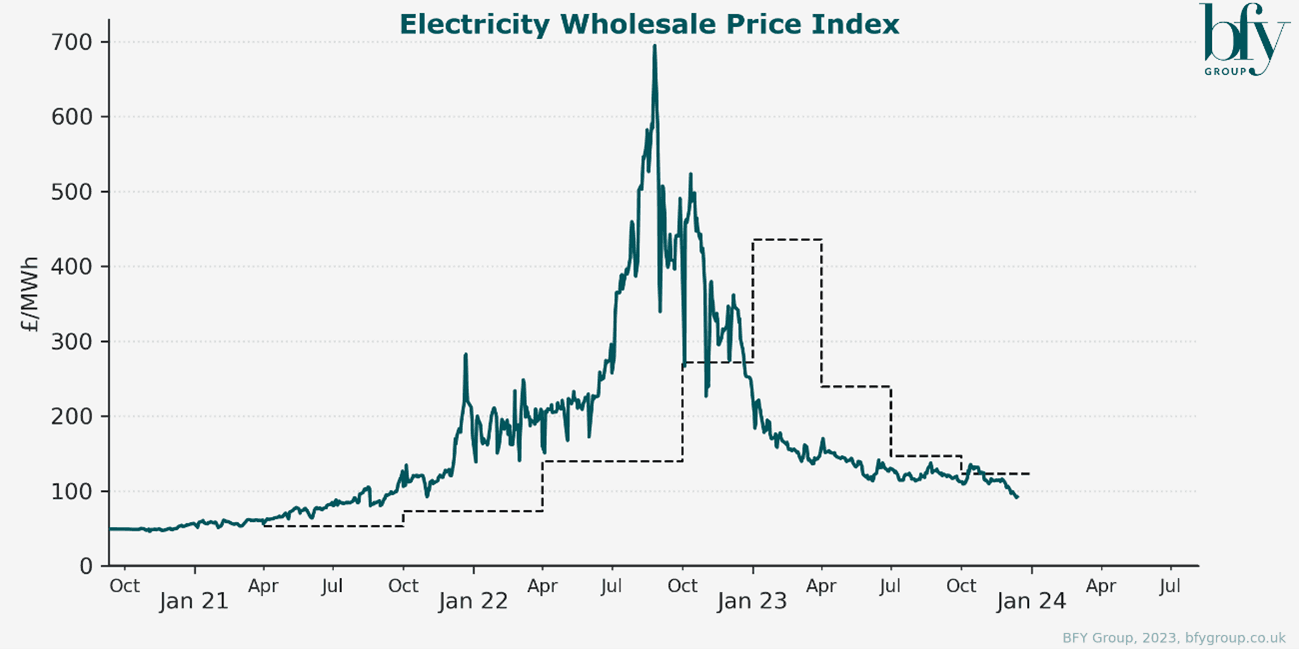

Over the last few weeks, we’ve seen gas and power prices fall c. 30%. This corresponds with the start of the observation window for the Energy Price Cap for April – June 2024 (Q2-24).

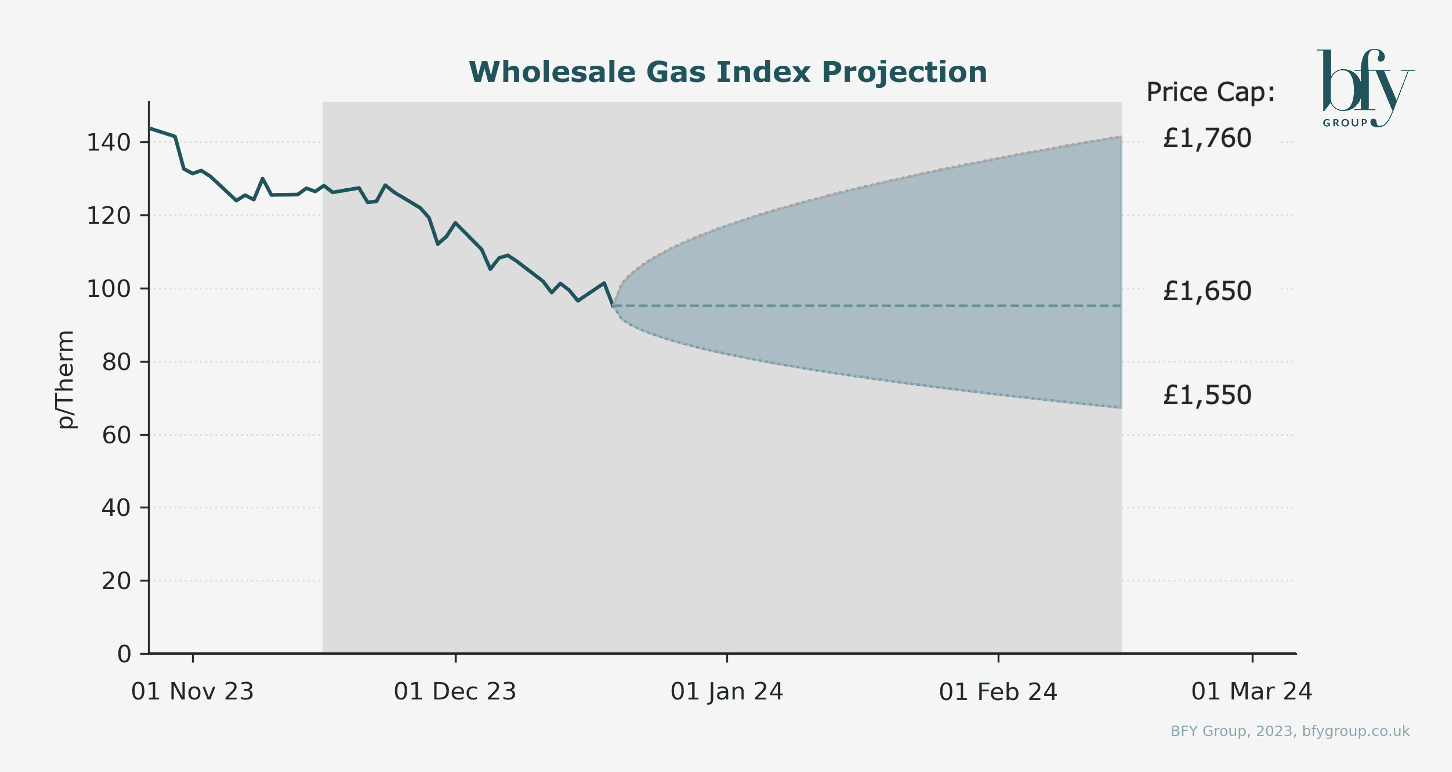

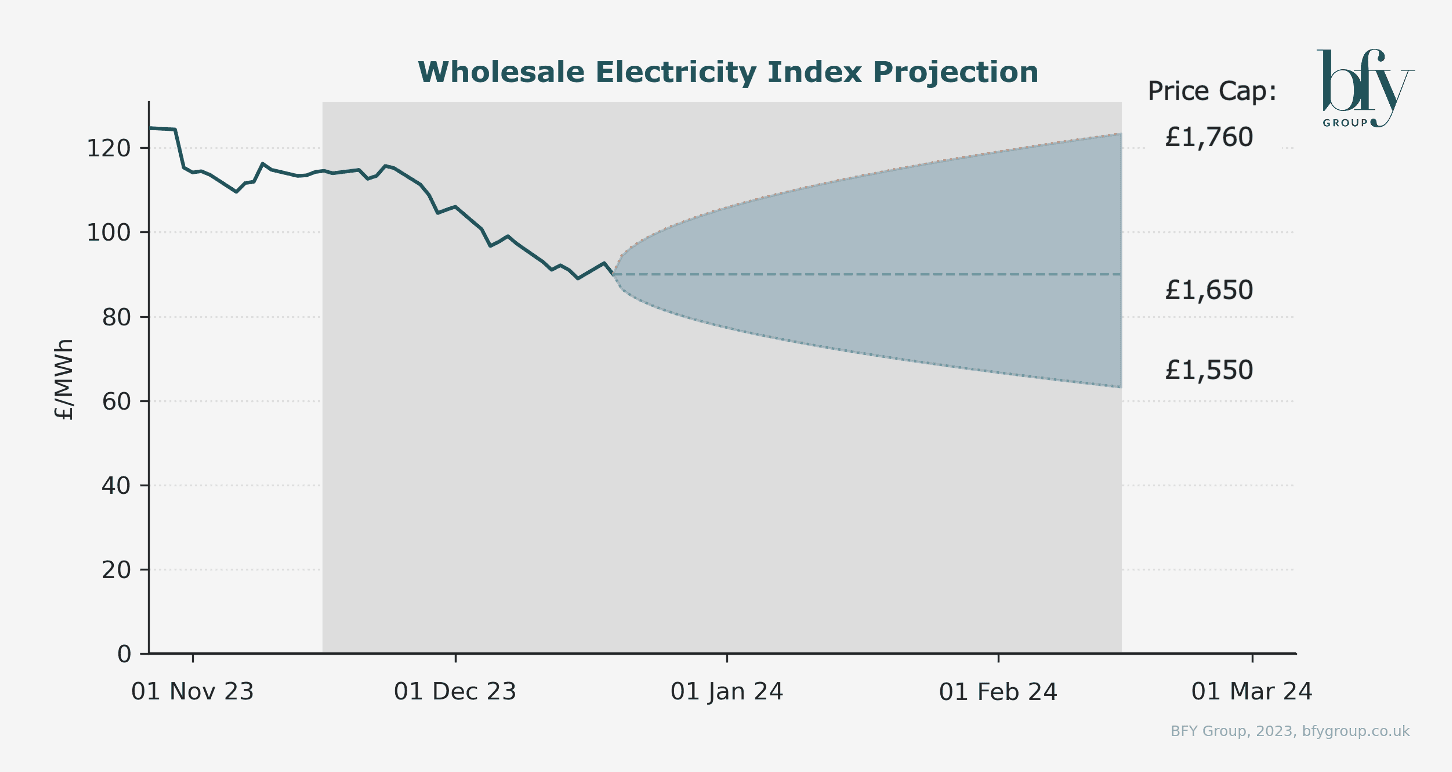

Based on the observation window so far, and a modelled view of the remaining window, we could see a Q2-24 Price Cap of ~£1,650 but a +/- £100 uncertainty. This gives a latest range of £1,550 - £1,760. By mid-January, we expect price uncertainty to be +/- £30 as the window closes out.

This would be a significant fall of £170 - £380 for customers at typical consumption.

These findings are demonstrated below in analysis from John de Bono and Matt Turner.

Shorter hedge tenor from changes to the cap mechanism sees more market-reflective pricing

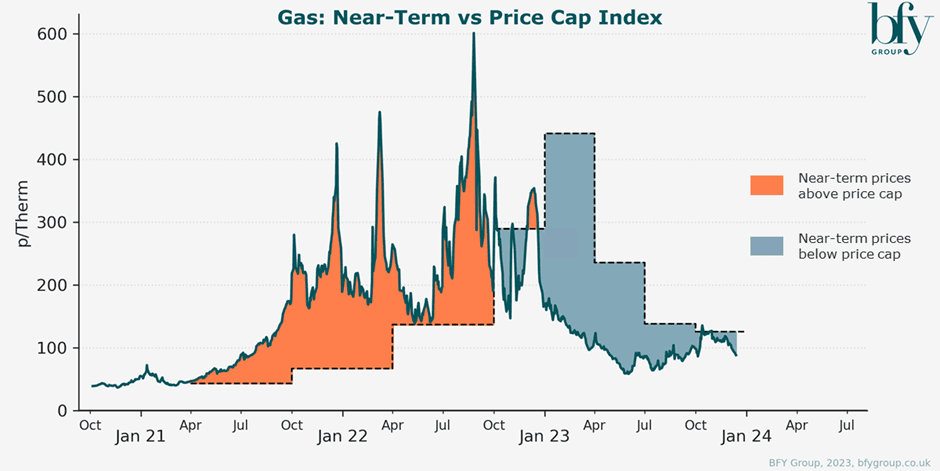

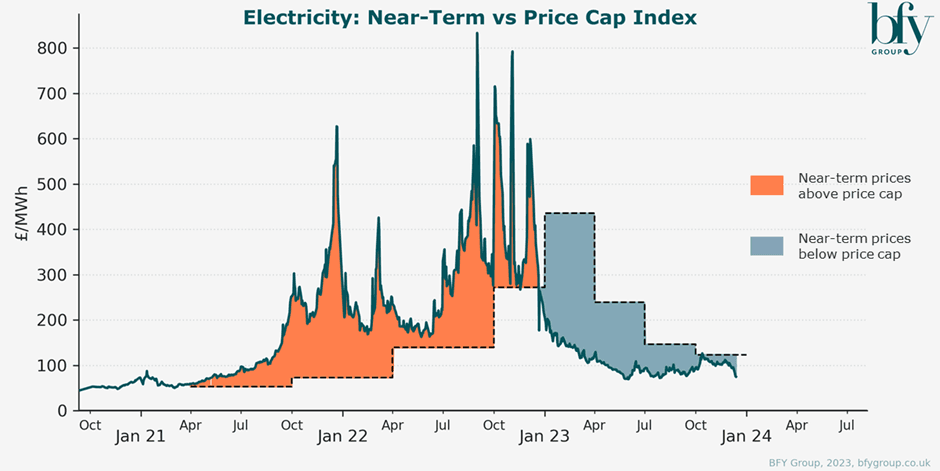

The move to a quarterly Price Cap results in the cap being more reflective of near-term prices. But because wholesale energy is hedged in advance, purchasing in advance during periods of high prices extends the impact for customers.

We saw this last winter, with September’s 2022’s high wholesale prices being reflected in the Q1-23 Price Cap, even though near-term prices had collapsed. It’s a complex and nuanced message to land with customers as suppliers communicate price increases. To a far lesser extent, we’re potentially seeing this again in Q1-24.

Could we see the market opening in ̶[̶Q̶1̶2̶3̶,̶ ̶Q̶2̶2̶3̶,̶ ̶Q̶3̶2̶3̶]̶ 2024?

Prices falling below the Price Cap means suppliers can price 12-month fix products below the level of the cap, for acquisition and retention.

Last year, however, the combination of a ban on Acquisition-only tariffs and extremely expensive hedge books from historical market prices complicated this. Suppliers couldn’t price and offer competitive tariffs without material value-destruction of their existing hedged standard variable base, and gaining suppliers had to pay a Market Stabilisation Charge to mitigate the risk of further supplier failure.

Currently, we forecast that 12-month fixed tariffs will be on offer in Q1-24 at levels comfortably between the £1,928 Q1 Price Cap and our central projection of £1,650 for Q2. These could range materially on two key factors: (A) a suppliers’ willingness to leave some open position on their standard variable hedge book to enable them to offer competitive fixed price tariffs; and (B) the return of gross margin investment into year one acquisition tariffs.

Both of these approaches were highly prevalent before the energy crisis, and both were critical factors in the demise of many suppliers through 2021. Despite this, we believe market conditions has been guiding an increasing number of suppliers, whether because of credit requirements, weather risk management or other commercial reasons, to not hedge all of their volume in line with the cap observation window as noted by Ofgem (Call for input: power market liquidity - Dec 2023).

Should we continue to see week ahead prices trading below prices paid for forward contracts, then we may see profit increases through Q1-24. This would further support the case for significant increases in retention activity and the acquisition market reopening, as this upside could be invested in discounting. We’ve already seen increase in tracker tariffs, a return of refer-a-friend offers, and increased levels of proactive customer retention activity.

Agile products are showing a 30% saving against the Price Cap

Another interesting feature of this falling market is that when comparing week ahead vs the Price Cap (see below) in the last 6 months, we see a 30% discount which means customers on agile type tariffs could have saved themselves up to £500, compared to remaining on standard variable tariffs. Some customers with the ability to store and export energy have reported to have earned up to £80 in a single Demand Flexibility Session.

If you'd like to know more about the Price Cap and its impact on the energy market, contact Matt Turner.

To receive our Market Insights directly to your inbox, join our Mailing List here.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile