A familiar pattern is emerging in the Energy market.

Analysis of switching behaviour and market share shows a concentrated landscape, dominated by six large suppliers. This leads us to ask – have we returned to the market structure of the 2010s? And where does this go next?

A lack of price-driven switching, but why?

Last March, we published a blog on attracting and retaining customers in a changing energy market. We concluded that retaining existing customers, while driving direct sales via innovative product offerings, would be key for suppliers as the market returned to a new normal following the energy crisis.

This has largely played out. We are seeing very little activity in the price driven switching market, with most activity focused on driving direct sales, and retaining customers with EV and Time of Use Tariffs. Examples include British Gas’ Half Price Weekends, Ovo’s EV ‘Charge Anytime’, and Octopus’ Go Tariff.

Forward commodity prices have fallen significantly, and we expect a £300 reduction in the Price Cap from April. We estimate a 12-month fixed product, with gross margin equivalent to the Price Cap, should be priced at ~£1700, thereby offering average customers a £200 saving. However, we aren’t seeing pricing at this level. The obvious question is why?

The Market Stabilisation Charge (currently ~£92), and Ban on Acquisition-only Tariffs, are obvious contributing factors. Both of these regulatory instruments fall away from the 1st April, so should we expect the market to return to price driven switching then? The short answer is no – if the market acts rationally.

Fundamentally we have seen a significant switch in the market structure, which means the driver of discounted prices, the challenger players, have largely disappeared.

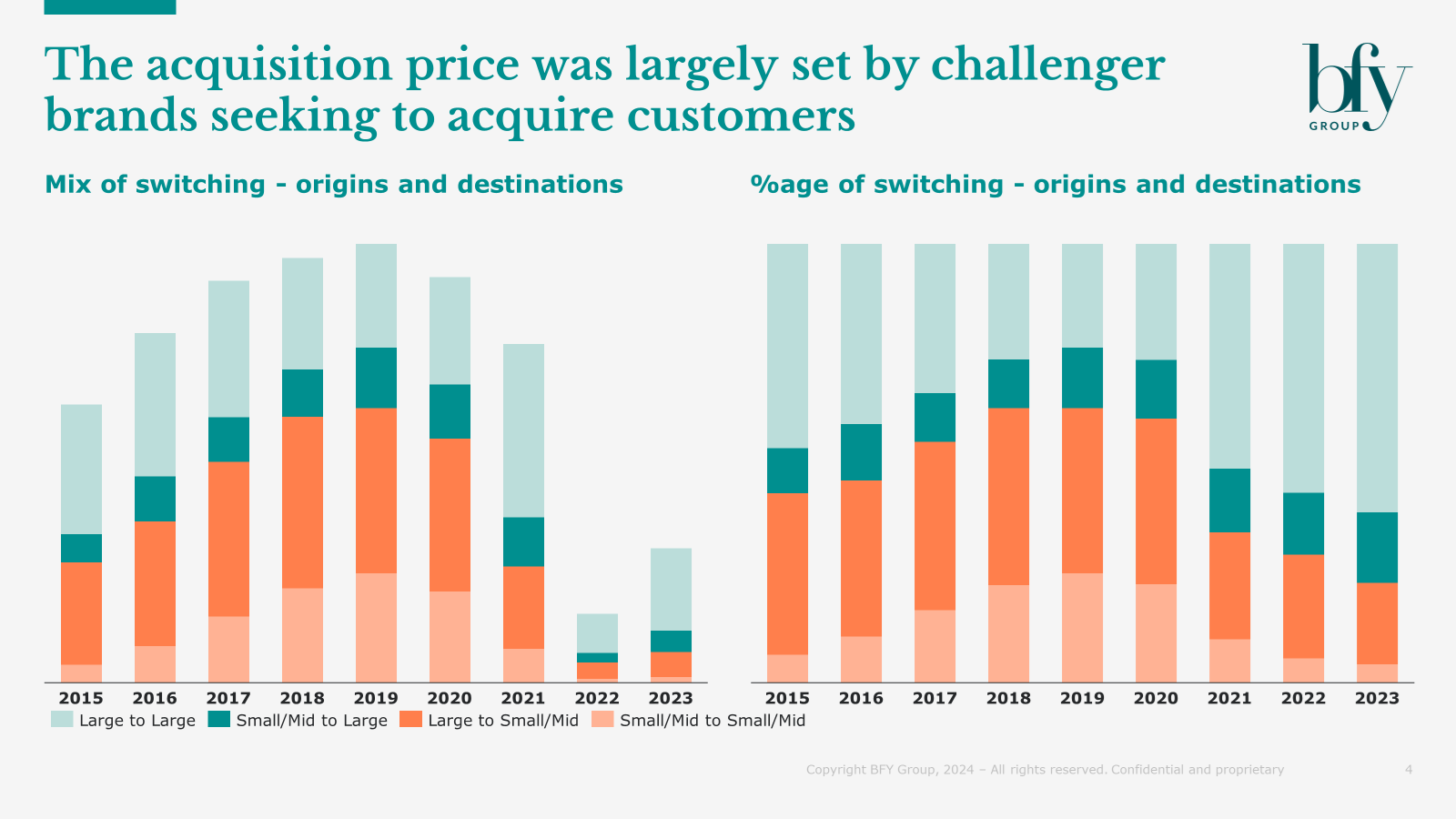

Switching was previously driven by Small/Medium suppliers

The chart below shows the origin and destination of switchers over time. It largely shows movement from large suppliers to small and medium suppliers, and amongst the small and medium suppliers. This is a result of those small and medium suppliers competing heavily on price to grow market share.

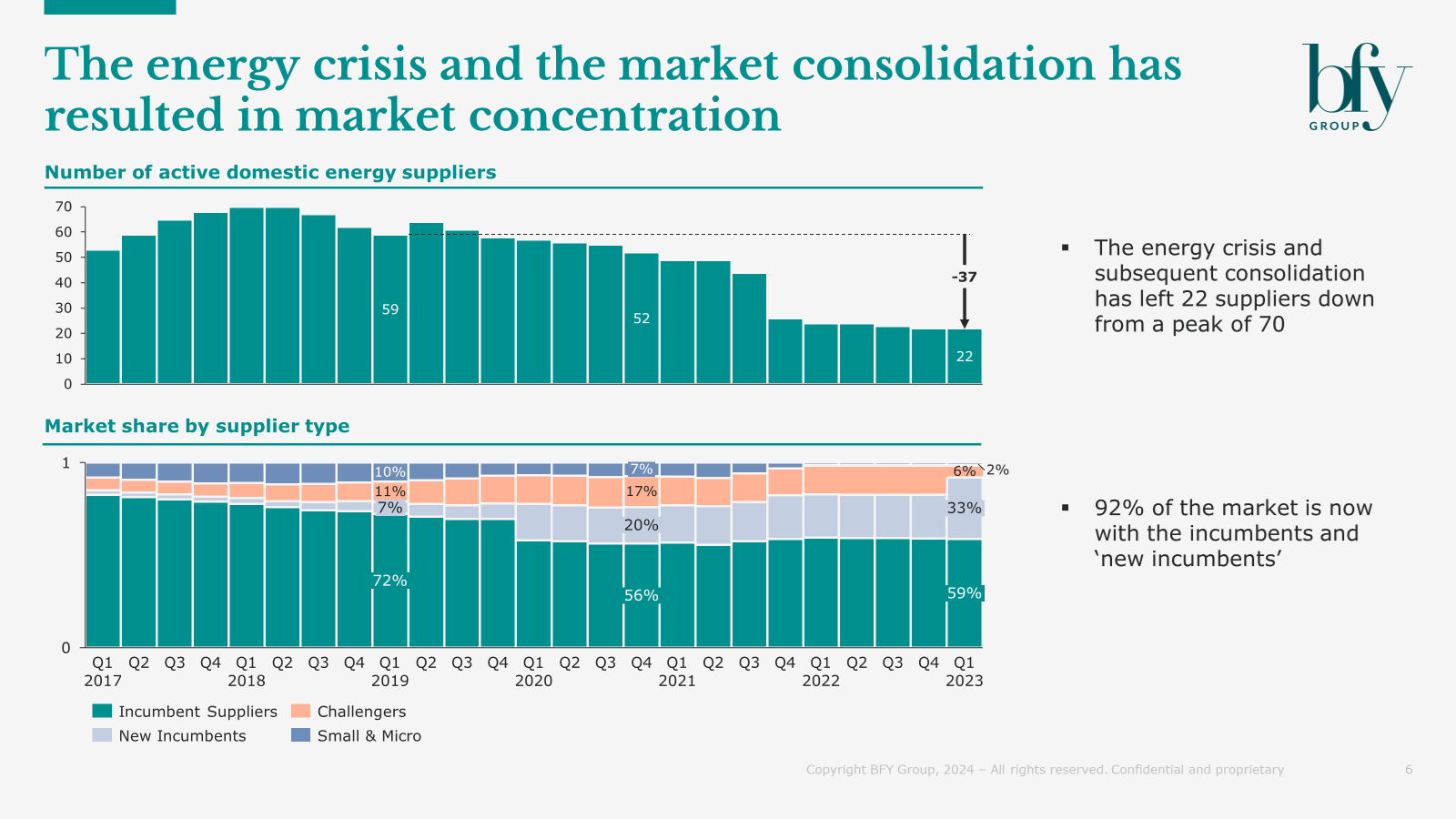

Today’s market is concentrated – Are we seeing a Big Six?

The chart below shows the market shares of various market segments. The incumbent suppliers are what remains of the historic Big Six.

Categorising OVO and Octopus as ‘New Incumbents’ shows that 92% of the market now sits with the six largest suppliers. Sound familiar?

Interestingly, of the next group – the remaining challengers – Utility Warehouse, Utilita and So Energy, two of these suppliers run differentiated business models that are focused on a specific market segment (Prepayment in Utilita’s case) or specific channels (bundles and network selling in UW’s case). Therefore, this group is not likely to drive significant price competition in the market.

When reviewing available tariffs through a major switching site, So Energy was the only offer available with a £106 saving at average consumption.

Deep discounting isn’t viable – What’s next?

The economics of deep discounting mean it’s only attractive if suppliers can ensure that customers, who otherwise would have remained on higher margin tariffs, don’t move in sufficient numbers - otherwise value is cannibalised.

With such high levels of market concentration, no one is incentivised to offer deep discounts. If they do, then others need to respond and the profit pool in the market falls. With EBIT allowances of 1.9% under the price cap, there’s nowhere to go.

Fundamentally we are back to a market structure comparable to the early 2010s. Back then, new suppliers and challenger brands entered the market, and drove up competition.

A similar market disruption is the only way we’ll see a certain return to high levels of acquisition price discounts. This will require a well-funded new challenger to invest in driving rapid growth. The quandary for the market is clear - how do we avoid a repeat of the last decade’s boom and bust?

For more insight on the Energy market and potential switching trends, contact Tom Bromwich.

If you’d like to receive analysis like this directly to your inbox, sign up to our Market Insights mailing list here.