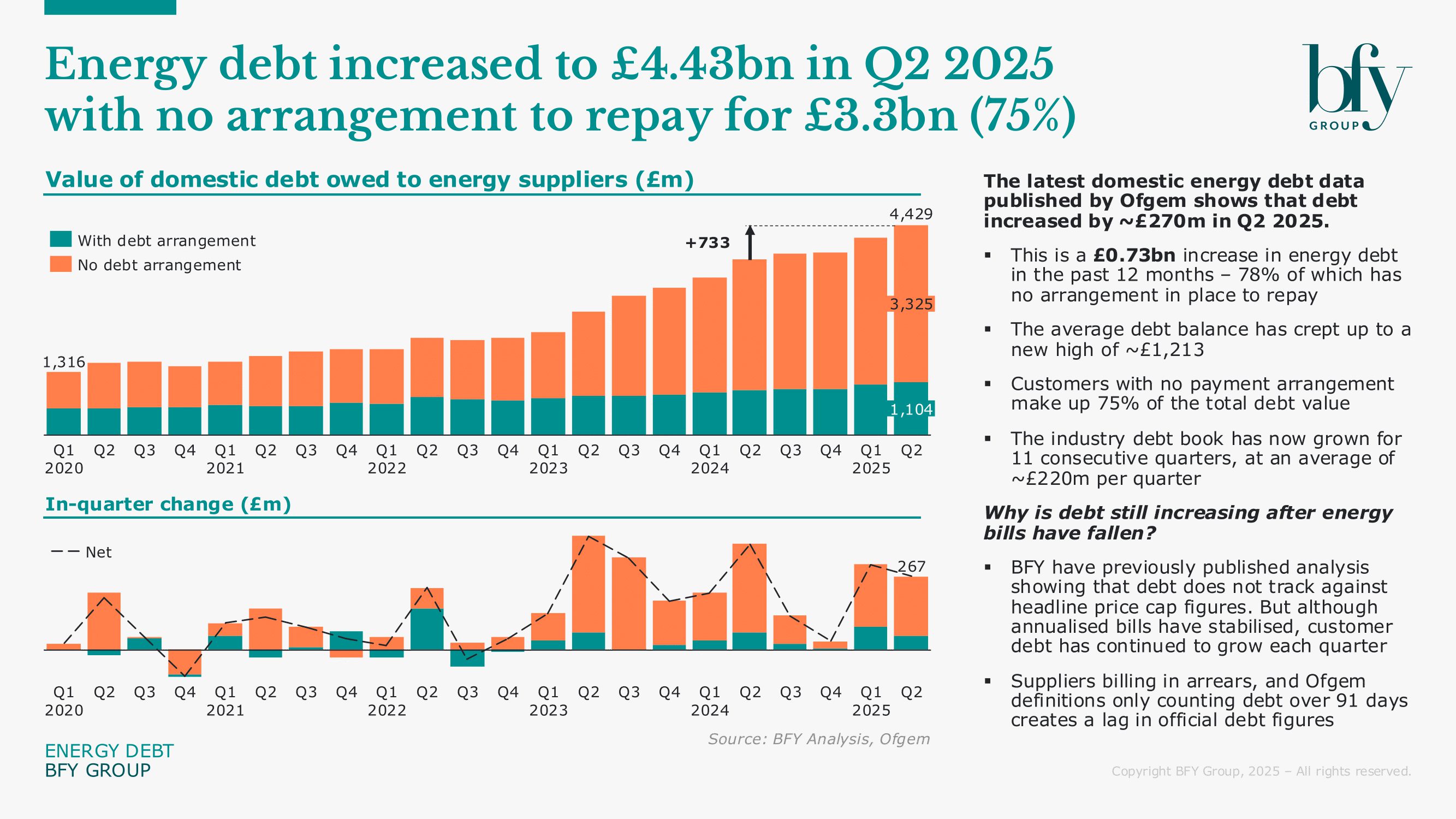

Domestic energy debt has climbed to a record £4.43bn in Q2 2025, an increase of £0.73bn compared to Q2 last year.

This marks the 11th consecutive quarter of growth, with debt rising by ~£270m in the last quarter alone. Over this period, the average quarterly increase now stands at ~£220m.

The need for stronger, coordinated action remains urgent. Although recent government and regulatory measures are a step forward, their overall impact remains unclear.

Key insights from Ofgem’s latest data:

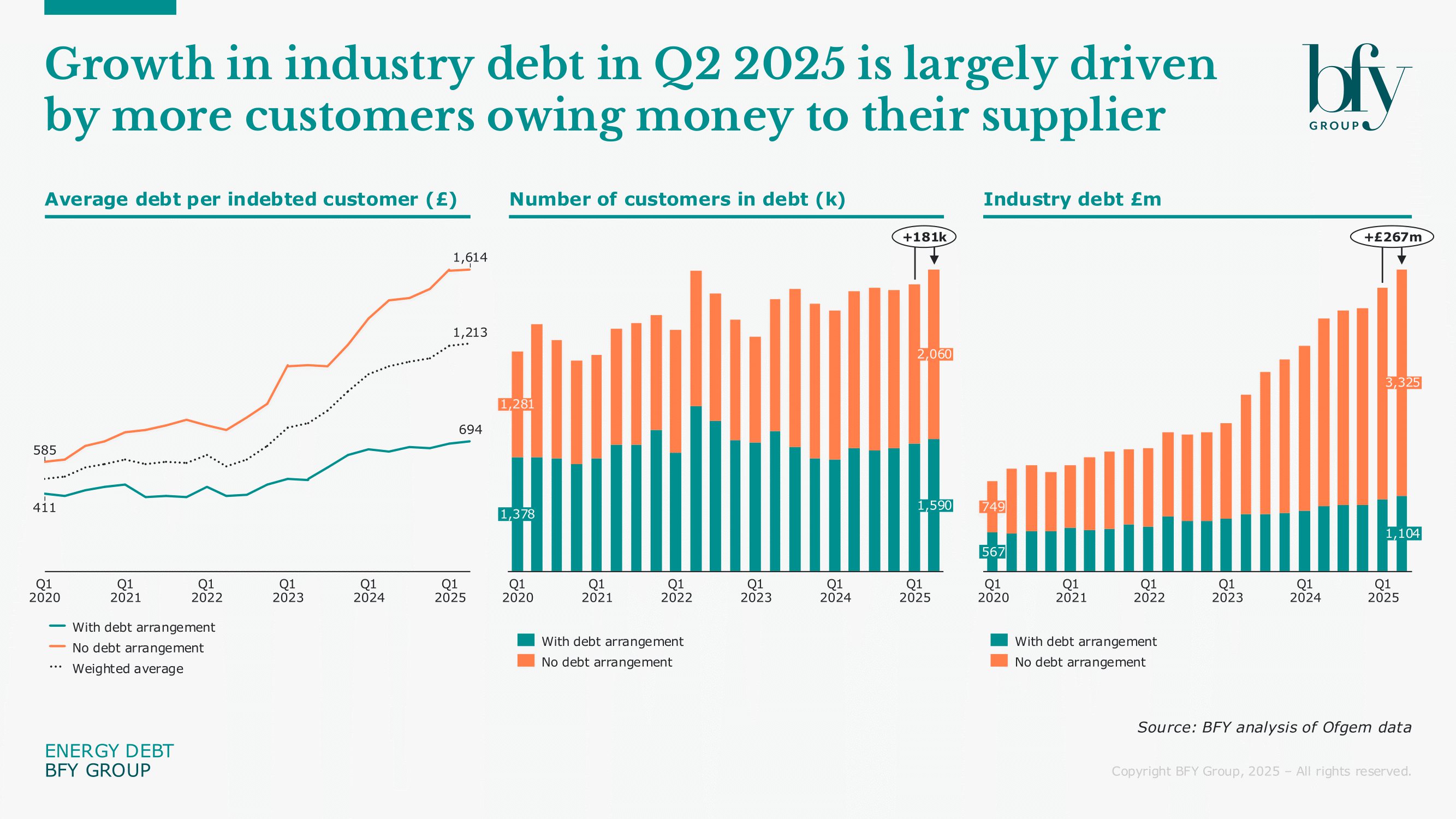

- The latest increase has been driven largely by a rise in the number of customers in debt, which grew by 181k to reach 2.06m

- Average debt per household increased slightly to a new high of £1,213, up from £1,202 last quarter

- A concerning 75% of total debt (£3.33bn) remains without any repayment arrangement in place

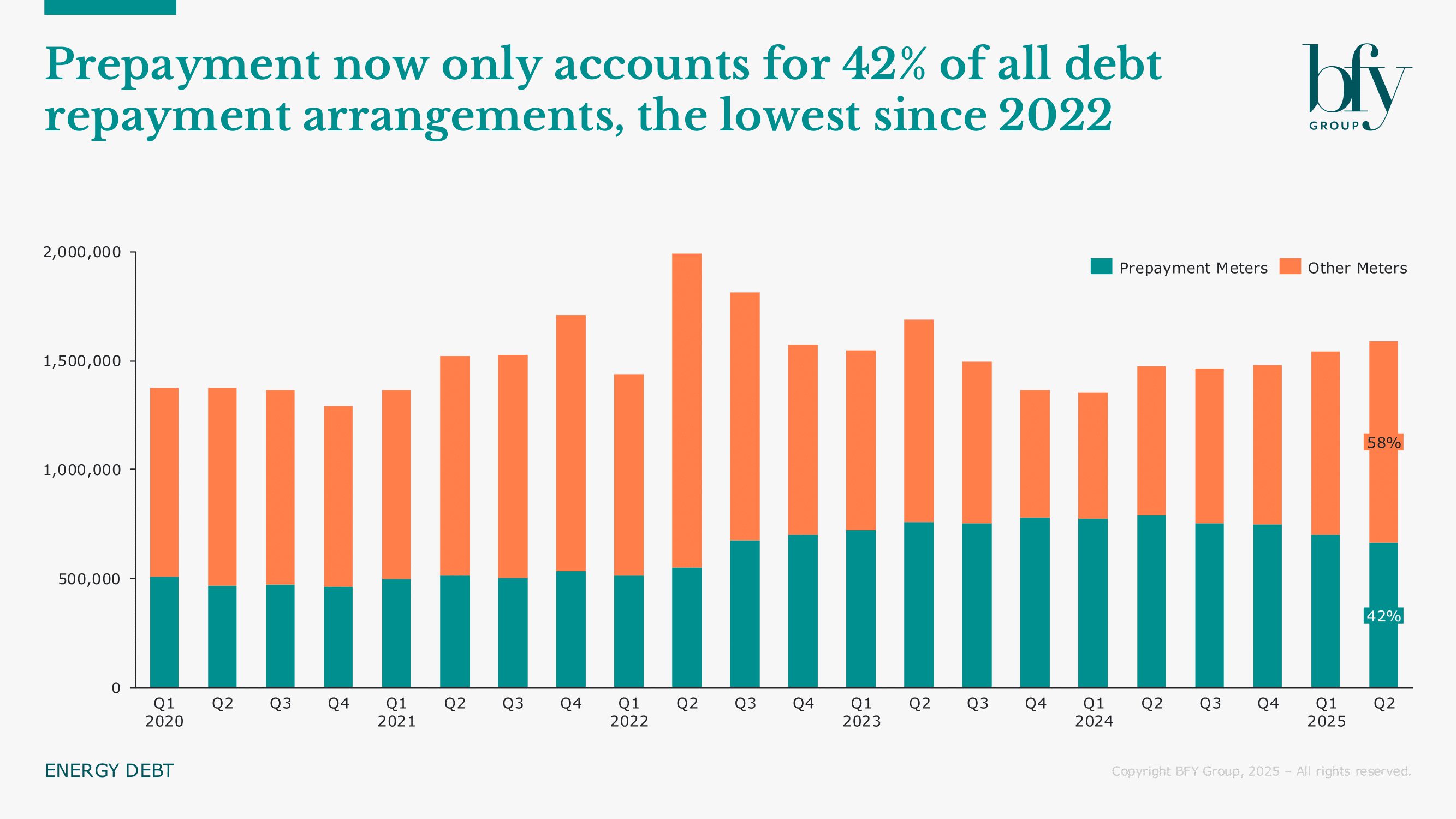

- Prepayment meters now account for just 42% of repayment arrangements, the lowest proportion since 2022

Limited impact of interventions leaves debt challenges largely unaddressed

Ofgem’s Debt Relief Scheme is projected to write off £300m of customer debt. However, this covers only the increase in debt from the latest quarter alone, leaving the wider £4.43bn challenge largely unaddressed.

There are also concerns about how quickly the scheme can be rolled out, with debt likely to continue climbing in the meantime.

Despite these challenges, there are opportunities for suppliers to take action now, by investing in key areas to improve collection rates and better support customers, as outlined later in this article.

Debt growth in Q2 driven by 181k more households falling into arrears

The latest quarterly increase in domestic energy debt has been driven primarily by more households falling into debt, rather than sharp rises in individual balances.

In Q2 2025, the number of customers in debt grew by 181k, reaching a total of 2.06m. This has pushed industry debt to £4.43bn, despite only a small increase in the average debt per household, which rose slightly to £1,213.

Because of this, suppliers should assess their collections strategies, identifying the opportunities to maximise engagement and provide tailored solutions where possible. This increase will likely see many customers experiencing financial difficulty for the first time. Ensuring the right treatments and support are in place now will be key to preventing these balances from escalating further.

Prepayment arrangements fall to lowest level since 2022

Prepayment meters now account for just 42% of all repayment arrangements, the lowest proportion since 2022. This reflects a shift in how debt is being managed, with more customers now on alternative repayment methods that may offer greater flexibility but also carry higher risks of arrears escalating if plans fail.

This once sought after route to managing customer debt has become ever increasingly difficult for suppliers to instigate. Now to be considered as the “last resort”, customers are opting for more informal agreements through repayment plans, making the ability to install prepayment meters even harder for suppliers. Yet, with 75% of debt without a repayment arrangement in place, it begs the question, are customers engaged enough with their energy bills?

Now the ability to have informal agreements does provide customers with options and flexibility for managing their debts. However, for suppliers, without the correct controls and processes in place, they could see themselves taking large financial hits but also allow customers to create a worsening situation for themselves.

Where suppliers should focus now

Although debt remains a wider societal challenge, there are still opportunities for suppliers to act, by investing in the right areas to improve collection rates and strengthen customer support.

Smarter technology like AI and machine learning is opening up new ways to predict customer behaviour, flag early warning signs, and guide next-best actions for collections teams. Automation is also playing a bigger role, helping to deliver personalised, flexible messages and set up repayment plans at scale.

Alongside this, many organisations are rethinking how they work day-to-day. Data-driven models are helping teams step in earlier when customers begin to struggle, while digital tools and joined-up processes are breaking down silos between departments so customers get a more seamless experience.

Frontline teams also remain central to tackling debt, and suppliers have an opportunity to invest in the skills, data, and tools that help agents hold sensitive conversations with empathy, while still focusing on performance. Finally, partnerships with external agencies and charities can bring extra capacity and specialist expertise, particularly for late-stage collections and supporting vulnerable customers.

Reflection questions for suppliers

Are you making full use of AI, machine learning, and automation to predict customer needs, personalise communication, and improve repayment journeys?

How well are your teams using data-driven insights to step in early and prevent debt from escalating?

Are your frontline teams equipped with the tools, insight, and training needed to manage difficult conversations effectively and empathetically?

Are you effectively utilising external partnerships, including with agencies and charities, to strengthen collections and better support vulnerable customers?

Looking ahead to winter

Although interventions like the Debt Relief Scheme are a step forward, our current understanding suggests they’ll be too slow and too limited to address the full scale of the problem. More targeted support will be needed to halt the continued growth in domestic debt.

In the meantime, suppliers should focus on strengthening their own support mechanisms ahead of winter, doubling down on capabilities for early intervention and frontline support to help those most at risk.

For more on the implications of rising debt, or opportunities to strengthen customer support, contact Rachel Littlewood.