Latest Price Cap Projection

The projected decrease in the July Price Cap may provide some short-term relief for households on standard variable tariffs. While energy prices typically dip in summer due to reduced demand, market signals indicate that prices could stay at current levels through the winter as well, challenging expectations of the usual seasonal rebound.

Matt Turner-Tait

Senior Manager

PRICE CAP PROJECTION

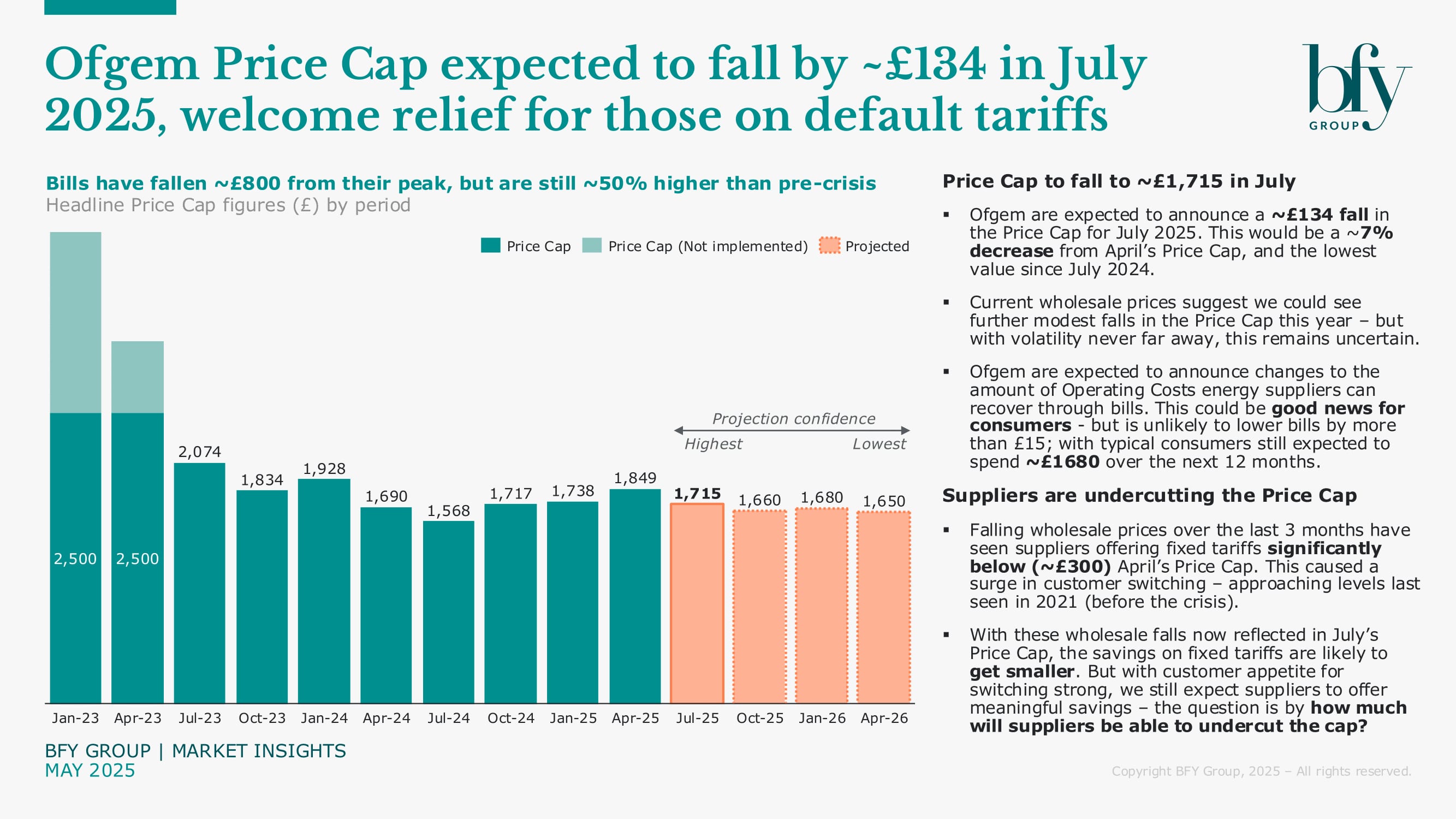

Price Cap set to fall by ~£134 (7%) in July to ~£1,715

Ofgem's Price Cap expected to fall by ~£134 (7%) in July to ~£1,715 - the lowest level in a year, and welcome relief for customers on default tariffs.

We expect typical annual bills to settle around £1,680 over the next 12 months, which is £800 lower than their peak, but still 50% more than pre-crisis.

This reduction reflects recent wholesale price declines. While energy prices typically dip in summer due to reduced demand, the current market suggests prices could stay around existing levels through the winter, challenging typical seasonal patterns.

Ofgem is also expected to announce changes to the allowance for supplier operating costs - potential good news for consumers, but only likely to reduce bills by around £15 per year.

Recently, fixed deals have been undercutting the cap by £250–£300, reigniting customer switching activity to near pre-crisis levels. With July’s lower cap, that gap will reduce – but we still expect suppliers to offer meaningful savings.

The question is: How much headroom will suppliers have to undercut the cap?

Our latest projections for the next four Price Caps:

- 1st Jul to 30th Sep - £1,715

- 1st Oct to 31st Dec - £1,690

- 1st Jan to 31st Mar - £1,700

- 1st Apr to 31st Jun - £1,670

These figures are rounded to the nearest £5 due to wholesale-driven uncertainty, and represent the average bill across Great Britain for a dual fuel customer with medium consumption, paying by direct debit.

(Updated 16 May 2025)

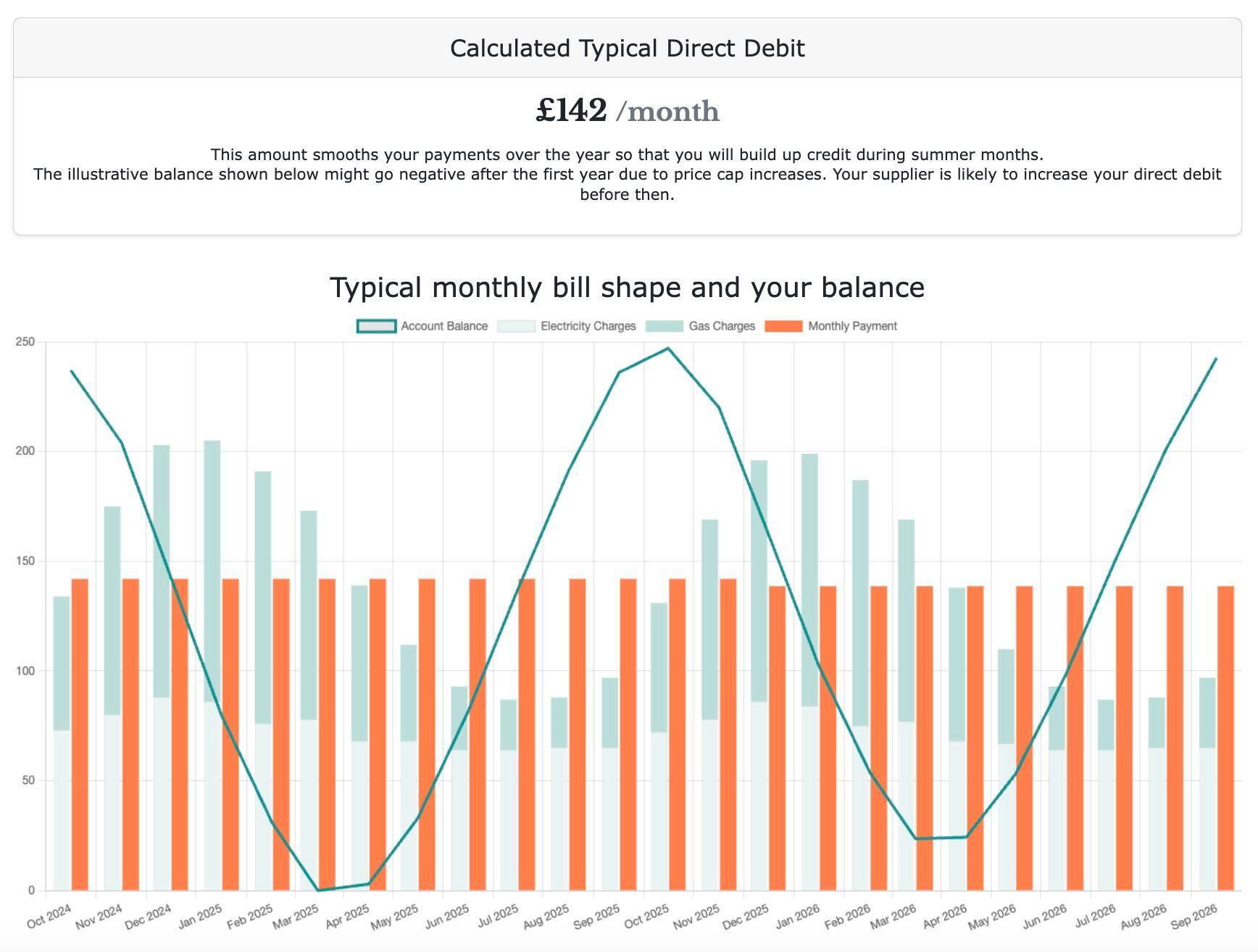

Price Cap Calculator

Estimate the impact on your Direct Debit levels

With our Price Cap Calculator, you can:

- Estimate the impact of the latest Price Cap on your Direct Debit levels

- Visualise your typical monthly bill shape over the next 12 months

- Compare fixed tariffs with the standard variable rate to explore potential savings

How it works:

- Find the average usage for your region and property size, or provide actual consumption (click 'Add a Fixed Price Tariff for Consumption' if desired)

- Enter your current debt or credit levels, and suggested Direct Debit amount

- See a forecast of your account balance over the next 24 months

Our Team

Market-leading energy expertise

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

John de Bono

Consultant

John performs various analyses to provide BFY and their clients with unique insights, which help to inform decision making and inspire exceptional performance.

About Us

About BFY Group

BFY Group is one of the UK’s fastest-growing management consultancies, trusted by clients across the energy, utilities, and private equity sectors to deliver exceptional results.

Since our founding in 2004, we’ve been proud to remain an independent, privately owned firm based in Nottingham, supporting clients throughout the UK.

Working with 75% of the UK energy retail market and an expanding number of water suppliers, we help our clients to overcome their toughest challenges, realise new opportunities, and achieve lasting results.

We’re proud of the recognition we've received for our growth and impact. We’ve been named one of the UK’s Leading Management Consultants by the Financial Times, featured in The Sunday Times Hundred as one of the fastest-growing private companies, and earned multiple Best Workplaces awards. Ian Barker, our Managing Partner, also made The LDC Top 50 Most Ambitious Business Leaders list in 2024.

News

More insight from our team

March saw 320k customer switches, with discounts available before April Price Cap

320k domestic customers switched energy supplier in March, seeking savings ahead of the April 2025 Price Cap. This marks a rebound to 70% of pre-crisis switching levels (which averaged 475k per month), as the Price Cap was set to rise, and customers were able to lock in fixed deals £250 below the upcoming cap.

Bringing Clarity to Dynamic Tariffs: A framework for energy retailers

Dynamic tariffs present new opportunities for the energy market, but they also bring a growing challenge. How can suppliers offer smarter, more flexible products - without overwhelming customers, confusing internal teams, or diluting commercial performance?

Dynamic Tariff Strategy: Five commercial considerations for energy retailers

A new wave of innovation is sweeping the domestic energy market. As we explored in our previous blog, suppliers are introducing a range of new tariffs designed for EVs, heat pumps, time-of-use patterns and more. Whilst this innovation creates exciting opportunities, it also introduces complexity, and with complexity, comes commercial risk.

Subscribe today to receive the latest news and updates from BFY

By submitting my personal data, I consent to BFY collecting, processing, and storing my information in accordance with our Privacy Policy.