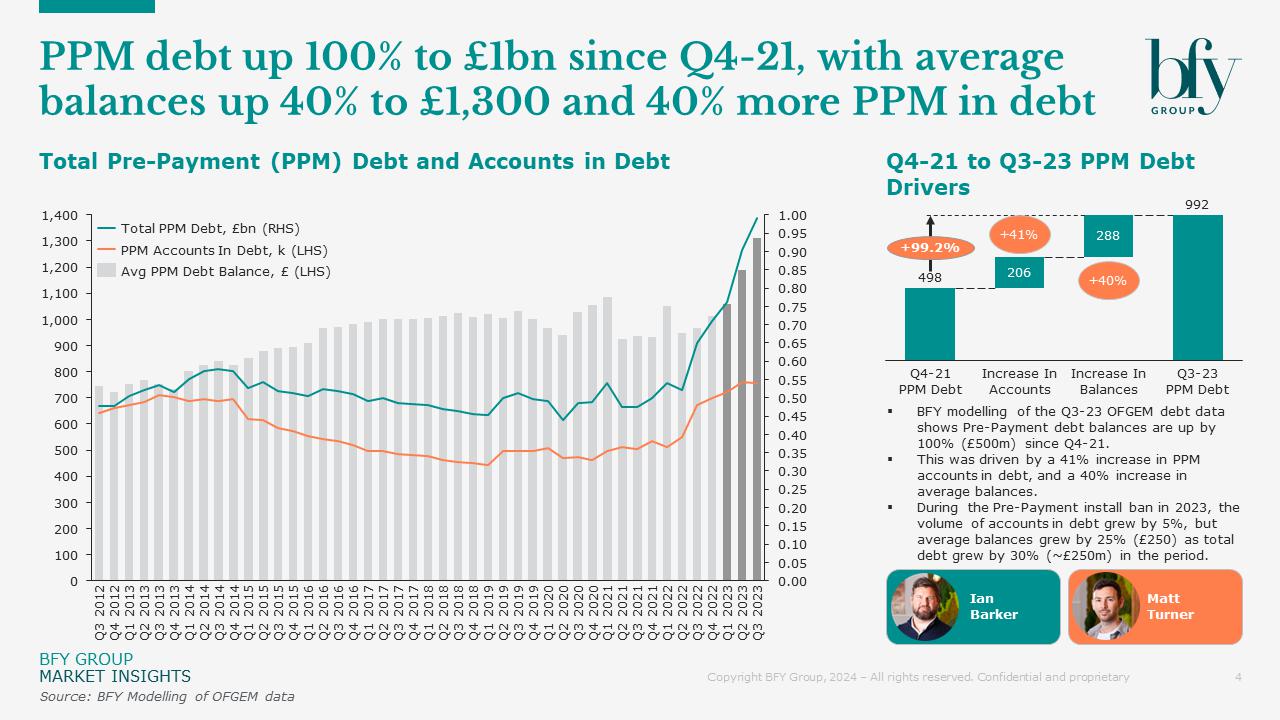

Over the past two years we’ve seen pre-payment meter (PPM) debts continuing to rise, and as of Q3-2023 they now stand at £1bn.

The amount of customers using their PPM to repay a debt has risen by 40% (up 220k to 750k), and the average debt balances have also risen by 40% (up £400 to £1,300) - resulting in a 100% (up £500m to £1bn) increase in total pre-payment meter debt.

Total PPM debt grew by 30% during 2023’s install ban

In early 2023, energy companies were forced to halt the installation of pre-payment meters under warrant (typically referred to as a ‘forced installation’), due to concerns with the approaches taken during installation.

While the 2023 install ban was in place, the volume of accounts in debt grew by 5%, but average balances grew by 25% (£250) as total debt grew by 30% (~£250m) in the period. Some of the debt growth will have been driven by customers seeking Additional Support Credits, as they struggled to pay for their energy and relied on support from suppliers.

Average balances are ~£1,300 – What can suppliers do?

Pre-payment meters are only installed as a last resort – the debt at point of PPM install is typically ~15-18 months of consumption, as of Q3-2023 this is ~£1,300.

Without a pre-payment meter installed, customers are able to continue consuming without paying – which increases their debt balance, and ultimately puts them in a worse position overall.

This is the quandary faced within the energy industry today:

- How do we help those who need energy, but are unable to pay?

For example, if rather than a pre-payment meter being installed on the 220k accounts above, we allowed customers to consume and not pay, the following would happen:

- Customers would be on-track to have a £7,500 to £10,000 household energy debt balance within ~5 years

- Suppliers would face increased bad debts of £1.7bn to £2.2bn over the period

- This would raise bills by all customers by £25 per household per year

- And would be a failure of customer duty – which was recognised by Ofgem who said “we … know that allowing households to build up unsustainable amounts of debt isn’t the right thing to do”

Rising PPM debts highlight a critical challenge in the energy sector: balancing the provision of essential services with financial sustainability.

The installation of pre-payment meters is going to be under increased scrutiny from Ofgem, and suppliers will be expected to drive customer engagement earlier in the arrears process.

For more information on debt in the energy industry, contact Ian Barker.

You can also sign up to our mailing list here, to receive updates like these directly to your inbox.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile