Sales performance is becoming a growing concern for B2B energy suppliers.

More leaders are coming to us with challenges around hitting targets and maintaining momentum, especially as customer buying cycles evolve and competitors shift the landscape with tactics like offering 10-year terms. These changes are putting pressure on commercial models that previously worked well.

At the same time, years of strong performance have, in some cases, led to less attention on the basics - like consistent performance management, channel effectiveness, and aligning targets with outcomes. Now that market conditions have changed, the cracks are beginning to show.

Many suppliers are looking for in-year improvements, but don't have time to wait for large-scale digital programmes or long-term strategy shifts. What they need is a practical way to lift performance now, within the control of their sales leaders.

From our experience working closely with B2B energy teams, we've identified four challenge areas that consistently hold back margin, and where targeted action can deliver measurable impact. In one case, this approach helped uncover an additional ~£16m in potential gross margin in just one year.

The four challenge areas are:

- Misaligned targets or metrics

- Individual and team performance variability

- Underperforming sales channels

- Ineffective sales processes

Four sales challenges holding back B2B performance

1) Misaligned targets and metrics

Sales teams work best when goals are clear, consistent, and aligned to the overall strategy. However, we often see KPIs that create conflict between teams, targets that drive behaviour in the wrong direction, or individual targets being changed to help them stay on-track.

Whilst often well intentioned, misaligned goals can lead to uncertainty which prevents sales teams performing at their best.

2) Performance variability

It’s natural that there are high-performers who regularly exceed their targets However, high performers can often give an illusion of high-performance for the team.

Without a focus on performance management and a consistent approach to skill development and coaching for all sales agents, teams risk over-reliance on star performers.

3) Underperforming channels

Sales channels can drift into underperformance if they’re not continuously nurtured or adapted for changing market dynamics.

For example, a new customer acquisition channel may work well for a certain sector or for a specific geography, but must be continuously improved to ensure the product or service offer stays relevant to the target customer base.

4) Ineffective sales processes

Many teams operate with processes that may have initially worked well, but have been poorly maintained. This is often seen through blurred roles and responsibilities, and teams finding workarounds that ‘work better’ in silo, but may create issues or missed opportunities for other teams.

It’s important to spot these opportunities as often clarification of responsibility, or slight process adjustment, can lead to compounding results.

How we help suppliers get it right

When sales performance has been slightly overlooked, we’ve stepped in to help companies ensure it receives the attention it deserves.

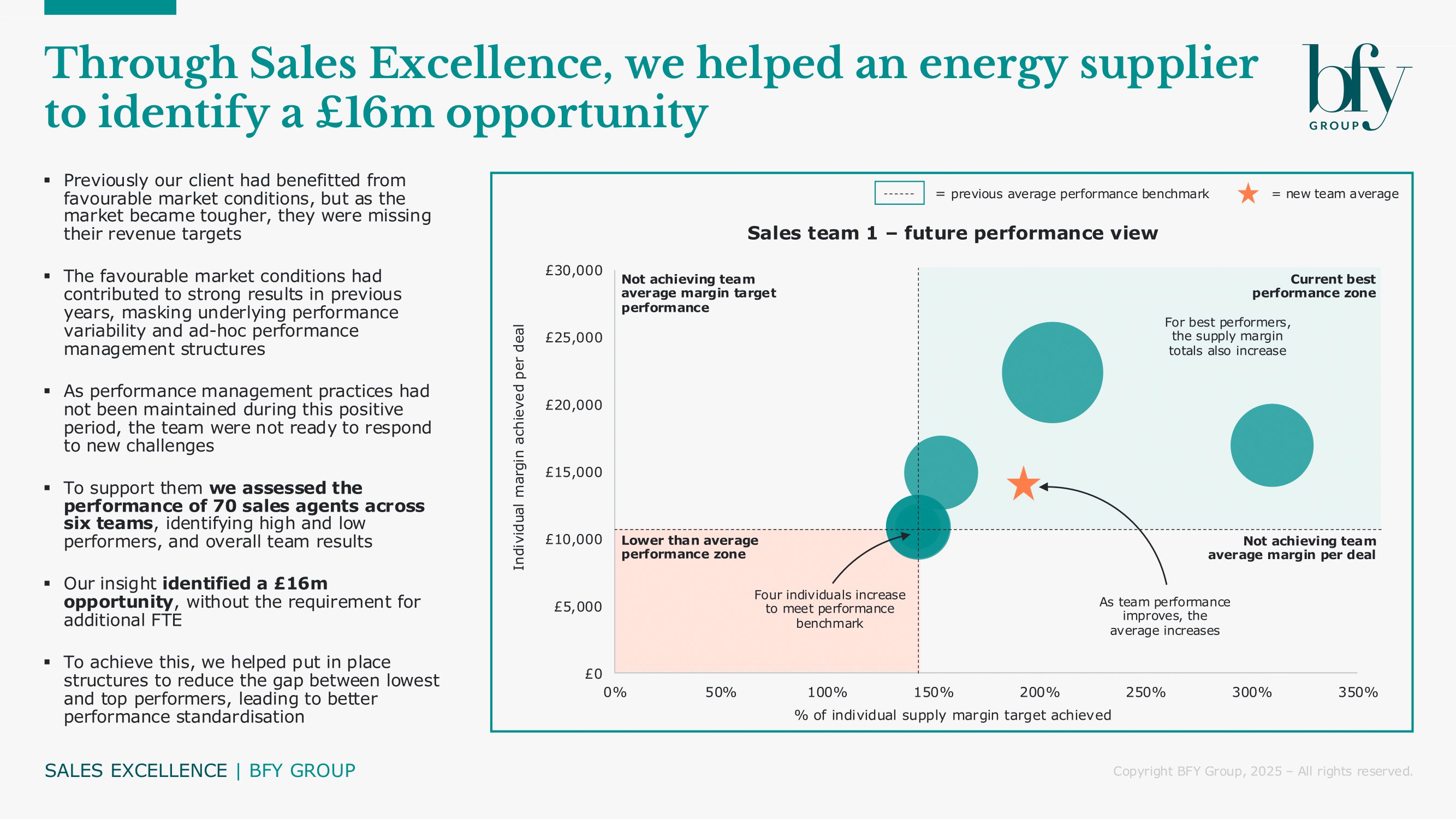

In one example, following our approach of assessing the challenge areas, we noticed a significant performance variance between teams and individuals. High-performers were inadvertently masking underperformance in other parts of the sales team.

Based on our analysis, both data-led and qualitative, we found that gross-margin sales performance could have been 12% higher in the previous year, equating to ~£16m.

We worked together with the client to build the right practices, and upskill leaders and agents to improve their sales performance. We’ll share more on these practices in our next article.

Where to start if you’re facing the same challenges

To begin understanding where you are, here are some typical questions that we like to explore with our clients to build a clear picture and identify where the greatest opportunities lie.

Misaligned targets or metrics

- Are the targets of individuals clearly connected to overall business objectives, and do individuals understand this connection?

- How are the targets created? Are they based on reliable data, or something else

Performance variability

- What performance management structures are in place, and how well are they followed?

- Are there clear performance expectations, and do we hold our team to account?

Underperforming channels

- Are teams the right size to address the known or potential opportunity in the market?

- Is there a feedback cycle or continuous improvement culture in place to adapt to observed market changes?

Ineffective sales processes

- How well is data used to visualise the flow of customers or sales opportunities through each stage?

- Is there any friction or tension between different teams in a process, and what is the root-cause of these tensions?

How can we help?

At BFY, we support utility companies in building Sales Excellence, combining deep industry expertise with our transformational practices and a collaborative partnership approach.

Specifically, our team has extensive experience leading SME and B2B sales functions at major UK energy retailers.

Our capabilities include:

- Shaping strategies to unlock commercial value

- Developing products to increase sales performance

- Driving performance through structured performance management

- Optimising operations and back-office processes to increase efficiency and enable scale

If you’d like to explore how Sales Excellence can drive better performance in your organisation, contact Hannah Sword or Lauren McCullough.

Hannah Sword

Director

Hannah leads client engagements, striving to ensure clients gain significant value and benefits and from the work we deliver.

View Profile