You may feel you can't see the wood for the trees on agent performance and customer outcomes. You may not understand who’s performing well, and who isn’t – and crucially, why.

Without the right data, you won't be able to create actionable insights. You will then miss out on making meaningful comparisons across agents and managers. To truly understand who your high performing agents, managers, and teams are, you need the right data, as well as the leadership capability to translate insights into great outcomes.

Back to basics

We regularly see clients wrestling with complex data processes. Instead of having simple and hygiene-based data analytics, they manually link data from multiple systems. (Billing and CRM, telephony, and customer engagement platforms).

Too often, clients rush to implement AI or complex analytics before laying a strong foundation. But in most cases, focusing on the basics has a far greater impact on debt collections than niche AI deployments.

If you’re wondering what ‘getting the basics right’ should involve, it typically means:

- Getting to a clear reporting baseline to understand current performance

- Building operational processes to continually improve through feedback loops

- Deploying analytics to understand the outcomes of your actions

- Layering on predictive analytics using an agile approach

Embracing data from emerging tech and hybrid working

That’s not to say AI and automation don’t offer substantial benefits. When deployed sensitively and well, AI and automation technologies can be incredibly effective. The key is using data to understand the need and impact of emerging technologies.

The move to hybrid working, and the rise of technology to facilitate it, means we have access to even more data. We can observe customer interactions live, monitor agent performance and watch recordings - making spotting potential improvements and sharing best practice easier.

Another benefit is our ability to analyse batches of recordings with large language models to identify common themes, hurdles and trends to focus our attention on. Using this approach with clients, we’ve been able to address billing confusion, root cause complaint drivers, and leadership inconsistencies that all directly impacted customer experience.

For many, we’re also shedding light on which customer segments are more comfortable and prefer using AI and automation.

Uncovering insights from customer interactions

There will, of course, be times when it’s crucial to have a real conversation, particularly to support vulnerable customers, manage debt or handle complaints. In these situations, data is vital to inform process improvements to route customers to the right teams with the most appropriate skills.

On a previous client engagement, we were rolling out an agile transformation and needed to put in place light touch reporting very quickly. We developed a report which analysed the correlation curves between customer engagement and debt resolution, then supported in building the leadership capability to action and deliver upon the insight.

Key insights included:

- Customers will need multiple nudges in order to move your bill to the top of the payment ladder.

- Leaving voicemails on a dialler isn’t pointless or ineffective (but doing it manually is costly and inefficient).

- Customers will typically always engage through the channel of least friction, and they’ll tend to pay how they’ve always paid.

- Performance is about resolution over the course of an engagement campaign. Agents collecting the least cash on the day should not be considered as low-performing.

- Customer engagement comes in many forms – speaking on the telephone, opening an email, making a full or part payment, logging on to the CRM to check their bills and balance. Where you have customers engaging, build on that engagement.

This example alone demonstrates the material impact that data can have on agent performance and customer outcomes, without investing significant time and money into overly complex analytics.

But surfacing insight is only half the challenge - what matters next is how leaders use it.

Turning insight into action

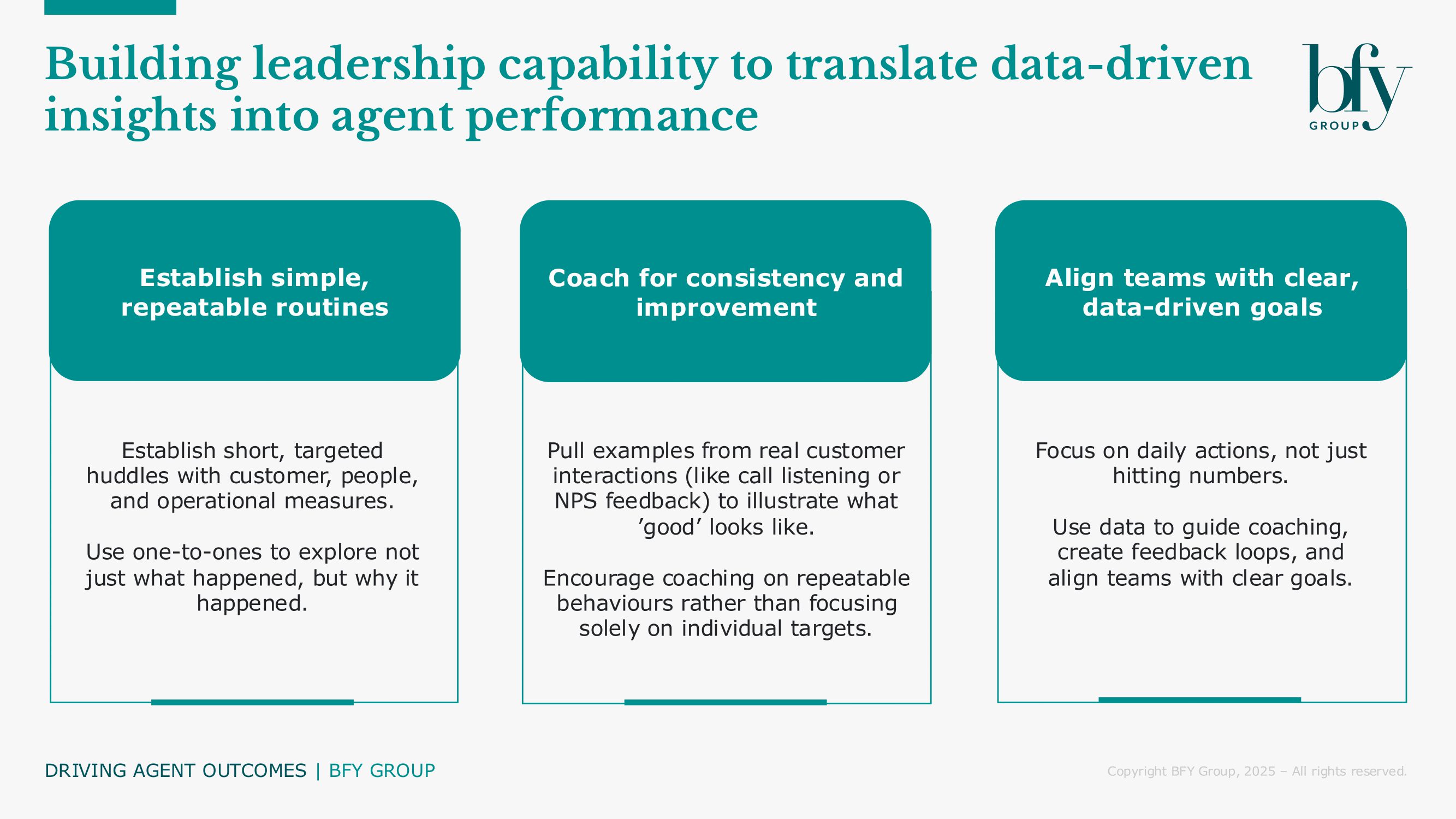

Dashboards and reports are important, but they’re only valuable if leaders can turn what they see into focused action. At one energy supplier, we helped team leaders create a set of simple, repeatable routines to make better use of the insight they had:

- Running short huddles using a small set of customer, people and operational measures to guide team focus

- Using one-to-ones to explore what’s behind the numbers, not only what happened, but what influenced the result

- Pulling examples from call listening or NPS verbatims to coach around what good looks like

Rather than chasing individual targets, teams started to focus on repeatable behaviours. Leaders coached more regularly, conversations were clearer, and performance improved.

In the organisations where this works well, we tend to see a few common things:

- Leaders focus on what people are doing each day, not just whether they’ve hit a number

- They use data to guide coaching, rather than to simply manage performance

- There’s a rhythm to team meetings and one-to-ones that creates space for feedback and course correction

- Everyone’s clear on what they’re working towards, and how they’re tracking against it

These are the kinds of habits we build through our Leadership Excellence programme, helping contact centre leaders translate data-driven insights into targeted actions and outcomes. Our clients typically see a 30-60% uplift in leadership capability, driving stronger performance, better customer experience, and more engaged teams.

For more on how leaders can better use insight to drive performance, and where Leadership Excellence can help, contact Kevin Scott or Kev Brown.

Read the next article in this series: Using accountability and incentives to manage agents effectively

Kevin Scott

Director

Kevin leads client engagements with a laser focus on empowering clients to navigate large-scale events and market challenges.

View Profile