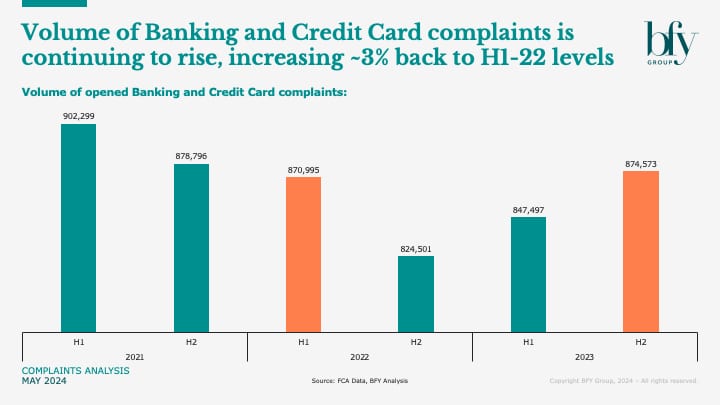

For banking and credit card organisations, rising complaint volumes are a warning on the cost of firefighting instead of addressing root causes, which is particularly risky in the context of Consumer Duty.

Banks and credit card issuers have seen complaints increase by 50k (6%) in the past year, and a closer look at the H2-23 data shows a 15k (8%) uplift in credit card complaints from H1, with overdraft complaints also rising by 6k (62%).

Firms continue to spend £m’s per year on handling complaints, not just because of redress costs (up 10% across the sector in H2-23), but also the vast range of operational costs attached to each case.

We’ve previously highlighted handling costs per complaint are likely as high as £300, which when applied to the half-year increase in credit card complaints alone, means there’s up to ~£4.5m in extra complaints costs being shared across issuers. And that’s before the potential impact of losing customers is factored in.

As customers continue to face cost-of-living challenges, organisations should focus on controlling what’s ‘controllable’, leveraging root cause analysis (RCA) in a wider pursuit of Operational Excellence. It could save up to £20m per year on complaints costs for a medium-large sized operation.

Firefighting is increasingly risky in the context of Consumer Duty

FCA’s latest complaints data suggests banking and credit card organisations are continuing to firefight, rather than address the root causes of complaints.

This is a risky approach in the context of Consumer Duty, which sets out a very clear focus on good customer outcomes and the expectation that organisations identify the source of the problem, and take preventative action.

Complaints data is often an earlier indicator of future trends, highlighting the products and services causing issues for customers who’ve taken the time to raise concerns.

Better use of root cause analysis can highlight and stamp out recurring problems, which brings a clear, competitive edge to customer experience, and is likely to prove critical in meeting the obligations of Consumer Duty.

Data is your best friend – if you’re set up to maximise it

Organisations need to know what’s driving complaints, whether it’s poor processes, inefficient systems, business strategies, external factors, products, or pricing. The more data points you have for every area of your business, the easier it is to identify the root cause of a problem – providing you can analyse the data effectively and tell the story.

A common issue we see is data from different systems, residing in different tables, in different locations. This creates complexity in stitching the data together and makes analysis more difficult.

Using this analysis to spot trends in the data will be the foundations of any complaints hypotheses, requiring validation.

But don’t blindly trust the data

With a variety of complaints hypotheses, based on solid trend analysis, validation is key to ensuring you don’t blindly trust the data, no matter how simple the hypothesis might be.

Sometimes there may be other attributing factors to various trends, and so validation based on sampling will either prove or deny your hypotheses.

Whether it’s call listening, side-by-sides, market research, or focus groups, hypotheses must be validated before recommendations are generated. It’s easy to jump straight to solutions, but this stage can be critical.

Now where to start

Following validation, the focus shifts towards determining which root cause needs addressing first. A simple act of prioritising the most impactful changes is sufficient - effort score or benefit/value analysis - with quick wins identified to help gather momentum.

Whilst not part of RCA, it’s important to ensure your Change Management process is efficient and effective. Significant effort will have been spent identifying the root cause of complaints, with an associated plan of how to address them. Therefore, making sure the changes can be implemented correctly, to genuinely reduce the flow of complaints, is vital.

It’s not once and done

When you’ve identified and addressed the priority complaints drivers through RCA, do it again and re-prioritise.

Adopting this culture of continuous improvement means your teams handling complaints are more likely to be proactive in reducing complaint volumes, and ultimately improving the customer experience.

RCA in a wider pursuit of Operational Excellence

To bring cost-to-serve savings to life, organisations should focus on achieving Operational Excellence across the end-to-end customer journey, where RCA can help to identify opportunities for significant volume reduction.

This focus could involve:

- Reviewing your end-to-end customer journey, identifying potential complaint drivers across the value stream

- Conducting root cause analysis to fully understand the true drivers of complaints

- Translating these data points into actionable insights – utilise machine learning and predictive analytics to drive the correct behaviours and manage risk

- Empowering your team to increase first contact resolution

- Optimising the operating model to remove bottlenecks and reduce touchpoints

- Enhancing agent skillset to get to the heart of each complaint and reduce the likelihood of repeat contacts – empathetic listening is vital!

- Making people accountable – reducing complaints is a business target, not just a target of the teams handling complaints

At BFY, we have extensive experience in supporting complaint reduction and process optimisation across industries. This includes rapid mobilisation of support to deal with urgent interventions, as well as the delivery of long-term, sustainable improvements.

If you’d like to know more about how we can help, contact Jonathan Paton.

Jonathan Paton

Senior Manager

Jon specialises in Customer Operations leadership, customer contact, and operational service delivery transformation/improvement.

View Profile