Ofgem will soon publish their latest view of domestic energy debt, and whilst concerning trends are expected to continue, suppliers should act now in preparation for the challenges ahead – capitalising on lower contact levels during summer months.

External collections activity is set to remain vital. Customers are grappling with unprecedented levels of debt, ~£2.3bn of which was unsecured in Ofgem’s previous data. This is likely translating into high volumes of customers being sat in external collections processes, as suppliers look for solutions to help gain control.

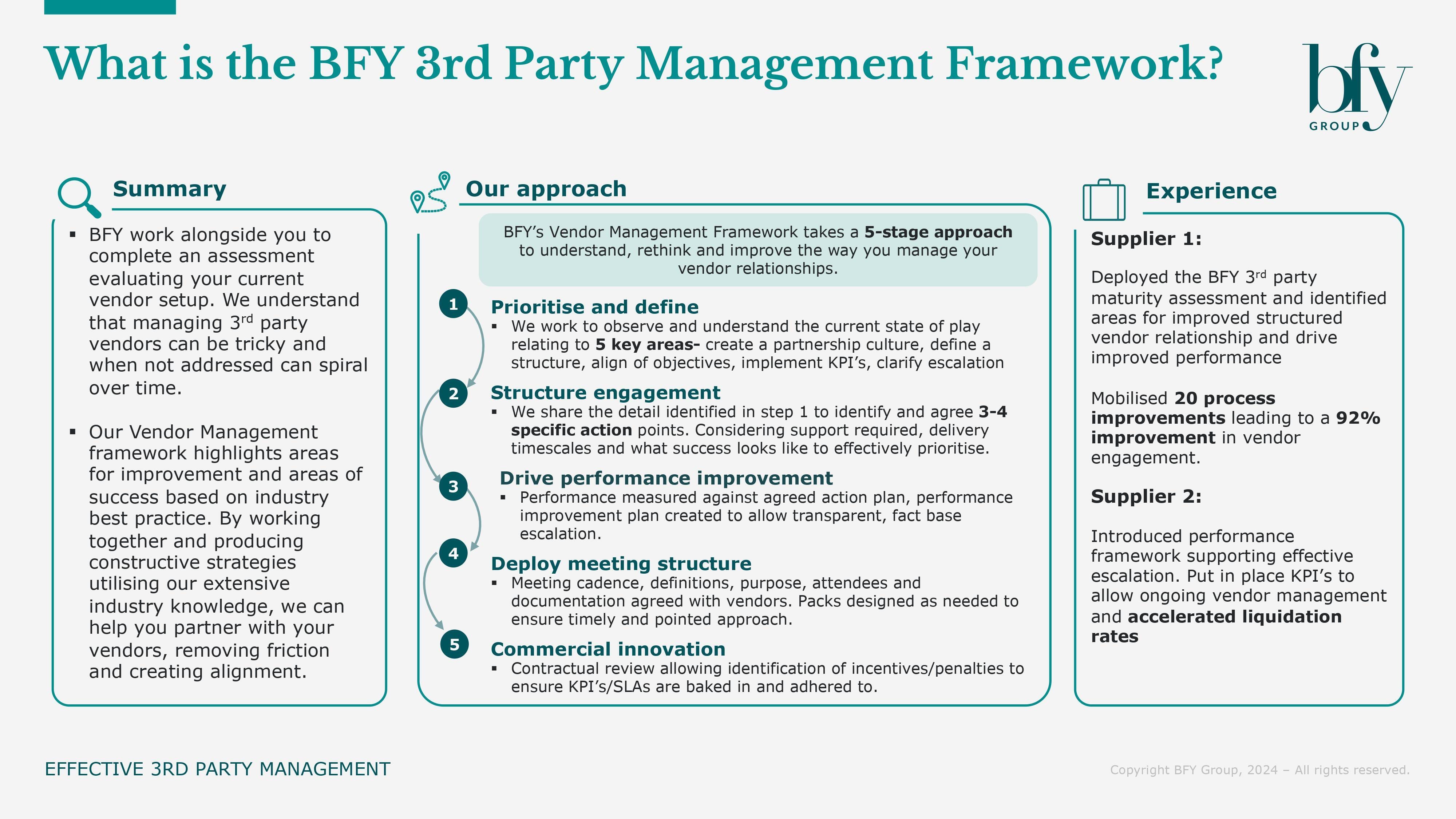

It means third party relationships, like those with Debt Collection Agencies (DCAs), should be optimised to drive positive customer engagement over the coming months. Reviewing your approach to managing third parties can be just impactful as your internal maturity, deploying a clear strategy to connect internal and external teams within ways of working.

Below, we ask critical questions from our Third Party Management Framework to help you navigate the challenges ahead, and enable fair customer outcomes, protection of your reputation, and the delivery of KPIs, such as cash collection and bad debt impact.

Could your third party relationships be more effective?

Managing third party relationships is complex – suppliers have many variables to juggle – but the positive benefit of relationship management shouldn’t be overlooked. Granted, it requires a different type of skill and competency, but the effort invested in building a strong relationship can translate into more opportunities to leverage third party expertise, and drive tangible solutions for customers – such as optimum collection strategies.

Positive relationship management should be underpinned by proactive performance focus, and the effective use of industry insight, to drive these tangible benefits. For example, insights into the debt collection approaches working elsewhere in the industry, can help to identify areas for improved third party performance and enhance the collections strategy, based on external expertise.

Applying limited principles without strong a hypothesis will drive little impact. A one-sided relationship, with limited opportunity to mutually agree actions and gain insight, will invariably lead to poorer outcomes such as limited collection rates.

Are your external processes mature enough?

It’s important that suppliers review third party performance regularly, to maintain an awareness of delivery, and expend or reduce panels of third parties in line with performance. Utilising segmentation and customer insight can also be crucial, to potentially regroup customers into cohorts with new opportunities.

Suppliers should also ask whether additional opportunities exist to expand insight and performance-based knowledge. An example of this could be champion versus challenger, in which a supplier will apply balance and consistency to similar relationships, and review performance against an agreed framework of metrics to understand which third parties work better for them. This could lead to additional insight, such as whether one third party is likely to operate better in a specific industry.

It’s fundamentally important to be transparent, and communicate openly with third parties, exploring any additional services, data, and tech options they have available. In terms of performance management, suppliers should review whether robust mechanisms are in place, how frequent and effective the interactions are, and the maturity of the support levels received.

Our framework below is an example of an effective solution, which we’ve previously deployed to ensure that active performance management is driving industry leading results for our clients.

This framework is proven to be highly effective in identifying root causes of third party performance issues, helping suppliers to articulate and address the challenges.

When supporting a large energy retailer, we found our client was engaging with third parties and reviewing performance as part of regular business reviews, but not seeing any step change in performance. Applying our framework, we quickly identified the third parties were unclear on their performance targets and objectives.

Our team supported on both sides of the relationship, helping to incorporate effective KPIs and cascade key objectives, ensuring a robust framework was in place to measure performance and improve crucial outputs. This included an increase in collection opportunities, contributing to an ~£8.5m cash uplift, alongside ~£4.5m in bad debt benefit.

Can you adapt your approach to third party management?

Building a strong third party management framework is critical over the coming months, as suppliers prepare for more concerning debt headlines from Ofgem, and the likely prospect of another challenging winter.

Our framework below offers guidance to ensure critical relationships are driving value end-to-end, focussing on five key aspects to deliver positive outcomes:

- Creating a partnership culture

- Defining a structure

- Aligning objectives

- Implementing KPIs

- Clarifying escalation

Each aspect can help to set up third party relationships for success, ensuring engagement plays a fundamental role in overcoming debt challenges.

Our framework also offers a third party maturity assessment process, which utilises external benchmarking to allow a full review of third party capabilities against ‘best-in-class’.

Key points to consider:

- How are your third parties performing in comparison to industry best practice, and could you be overlooking opportunities for improvement?

- Is your third party management framework focused on collaborative goal achievement, and driving end-to-end value? What results have you seen to back this up?

- Do your third party objectives support the targeted outcomes in your collections strategy, and are these objectives cascaded frequently enough to relevant teams?

For more on the impact of rising customer debt, and how third party relationships can be strengthened to deliver tangible results, contact Rachel Littlewood.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile