Energy complaints increased in the latest data, and although volume is normalising at pre-pandemic levels, there’s a concerning trend emerging with third party involvement.

It’s creating further costs for suppliers, at a time when service pressure is already heightened, with domestic debt levels reaching another all-time high.

Our latest analysis digs deeper into industry complaints performance, looking at what’s likely to be driving the prominence of third parties, the impact of smart-related cases, and the actions suppliers can take to reverse this trend.

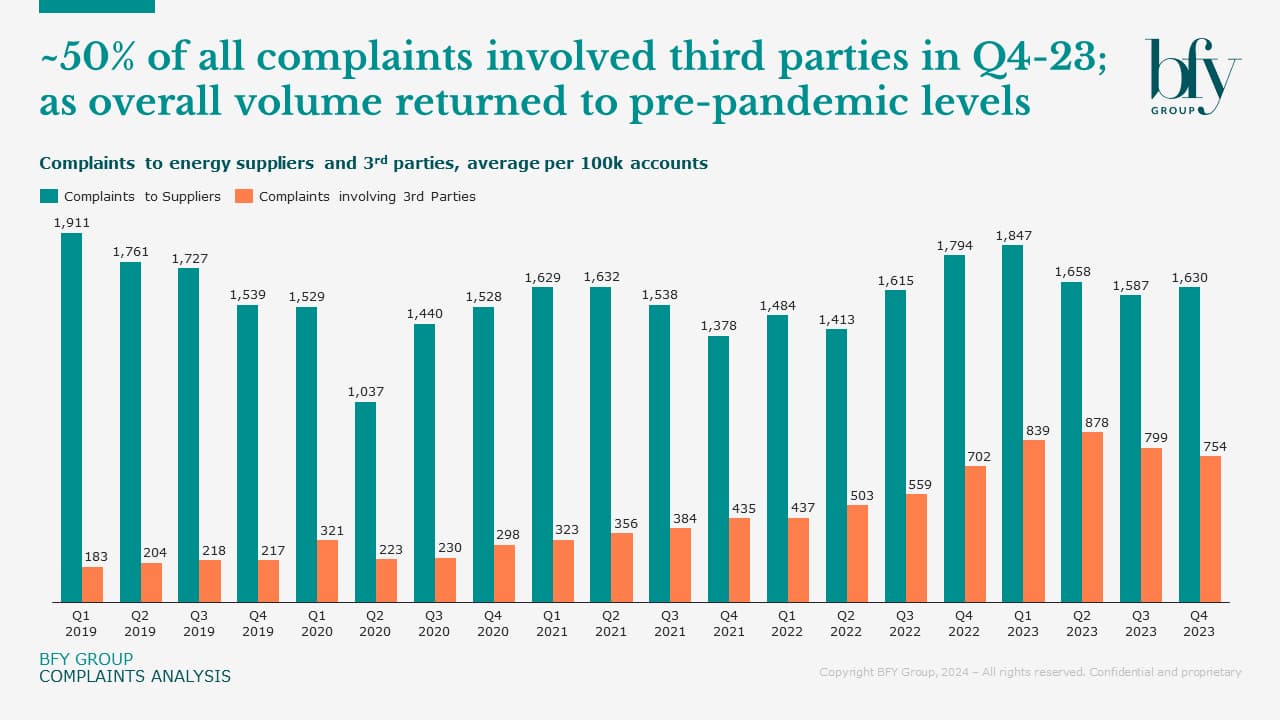

Nearly half of all complaints involved third parties in Q4-23

Like the previous year, energy complaints continued to rise during Q4-23 as the seasonal peak in consumption and bill values took hold, driving up a customer’s overall propensity to complain.

Looking at the overall long-term trend, complaints volumes are starting to return to pre-pandemic levels (Q4-23 was 6% higher than Q4-19), and although this will be welcome news for suppliers, it’s concerning to see a protracted increase in complaints requiring third party support.

The difference is stark when looking at third party volume over the same period (Q4-23 vs Q4-19), showing a ~240% increase, with ~46% of all complaints now being referred to third parties.

More third party cases means more cost, and potential backlog growth

For suppliers, increasing Ombudsman fees will be the most significant material impact of rising third party cases.

Our modelling suggests the overall volume of Ombudsman complaints will have increased by 100% in 2023 vs the prior year. Meaning our forecasted total cost to the industry in 2023 is expected to be in the region of £60m, up from £30m in the previous year.

Although data shared by suppliers doesn’t include the volume of complaints unresolved after day 56, it’s likely the increase in complaints over the past 18 months has contributed to significant backlog growth. This could mean more customers are reaching out to third parties for the support they need, which suppliers can’t provide due to the constraints of servicing high volumes and a large backlog.

Of course, it’s not just the pandemic, or cost-of-living crisis that have driven up complaints and their impact on suppliers. A range of internal factors are also at play, particularly surrounding backlogs and aged complaints, as explored below.

Back office re-deployment – a driver of aged complaints?

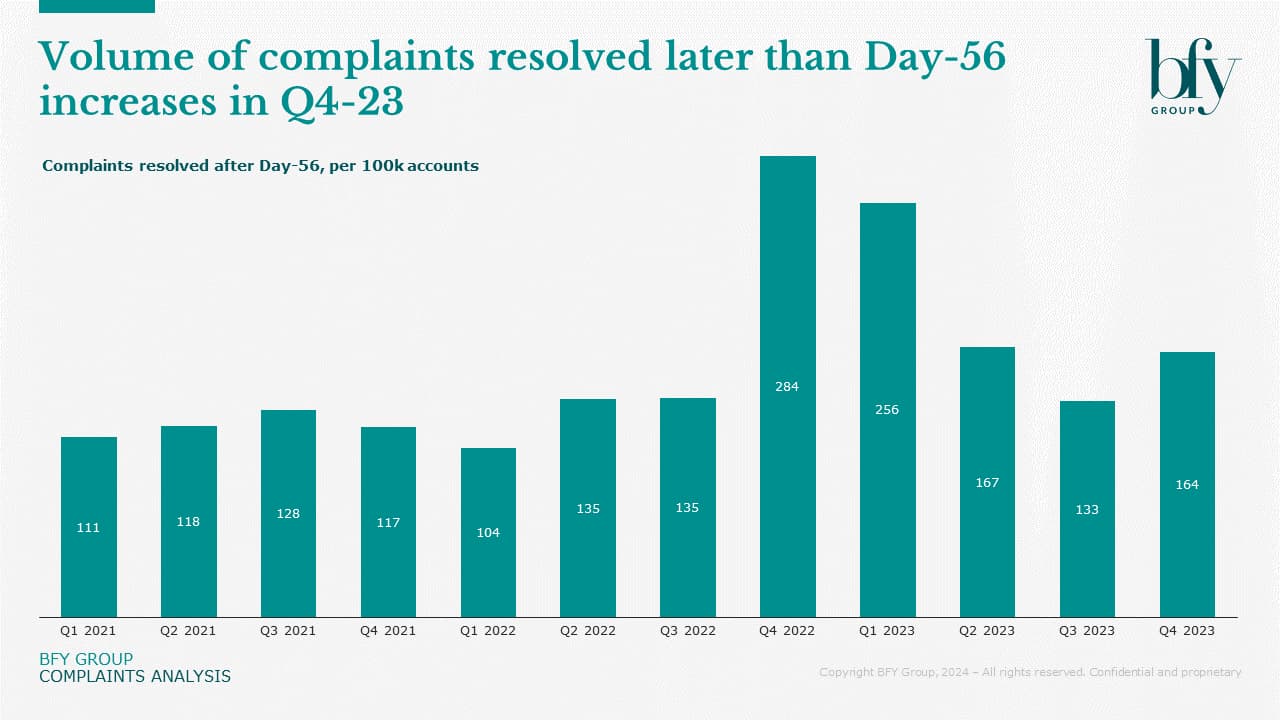

At the end of 2022, we saw a sharp increase in the volume of complaints being resolved after day 56, as suppliers re-deployed back office resource to support unusually high service demand.

While these resolutions did normalise throughout 2023, likely as temporary complaints capacity was moved back into their substantive roles, we did see a ~20% increase between Q3 and Q4-23 – something to keep an eye on in the current year.

Whilst back office re-deployment makes sense to get on top of immediate problems, it’s often counter intuitive, as a lot of complaint drivers can be pre-empted within the back office.

Further compounding the issue; back-office teams often don’t have the same level of service capability, which can mean they aren’t as effective at resolving complex customer queries and complaints. This increases the volume making it past day 1 unresolved, with subsequent customer engagement becoming more challenging, which ultimately increases the likelihood of aged reopens in the future.

Therefore, this approach in the long-term can lead to a reduction in same day closure rates, a growing complaints backlog, and an increase in the FTE effort required to maintain complaints performance.

Two factors may be increasing complexity – leading to more referrals

1) Migrations

Three suppliers were deep into or completing customer migrations through 2023, which can exacerbate billing and service issues.

Customer migration is a highly complex process that can deliver great results if approached with diligence. Migrations aren’t just about moving data; they impact all parts of the customer journey. It’s key to remain focussed on the customer to avoid increased demand and ultimately complaints as issues with complex industry processes, data, and metering inevitably surface.

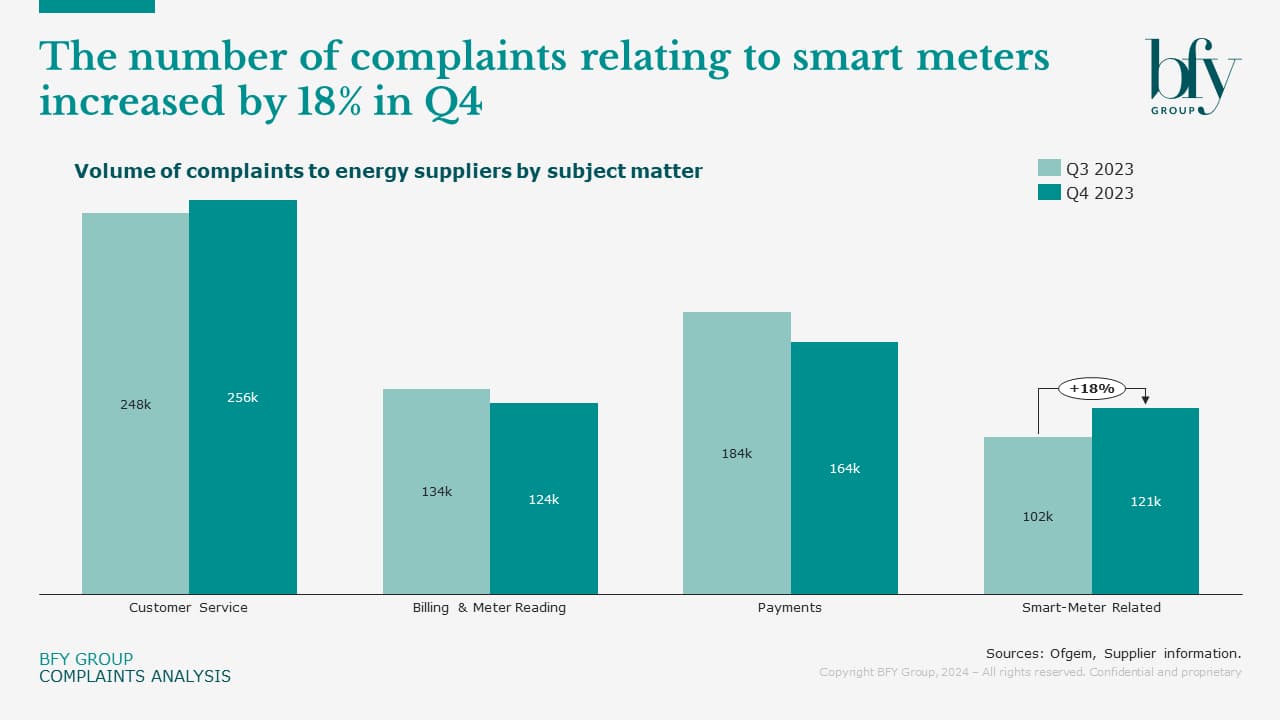

2) Smart

The proportion of complaints relating to smart meters increased during Q4-23, which isn’t surprising given more customers now have smart meters.

However, customer satisfaction with billing has not materially improved during this time and customers are reporting no improvement in the overall accuracy or ease of understanding of their bills which will be at odds with a lot of the initial business cases around the smart programme.

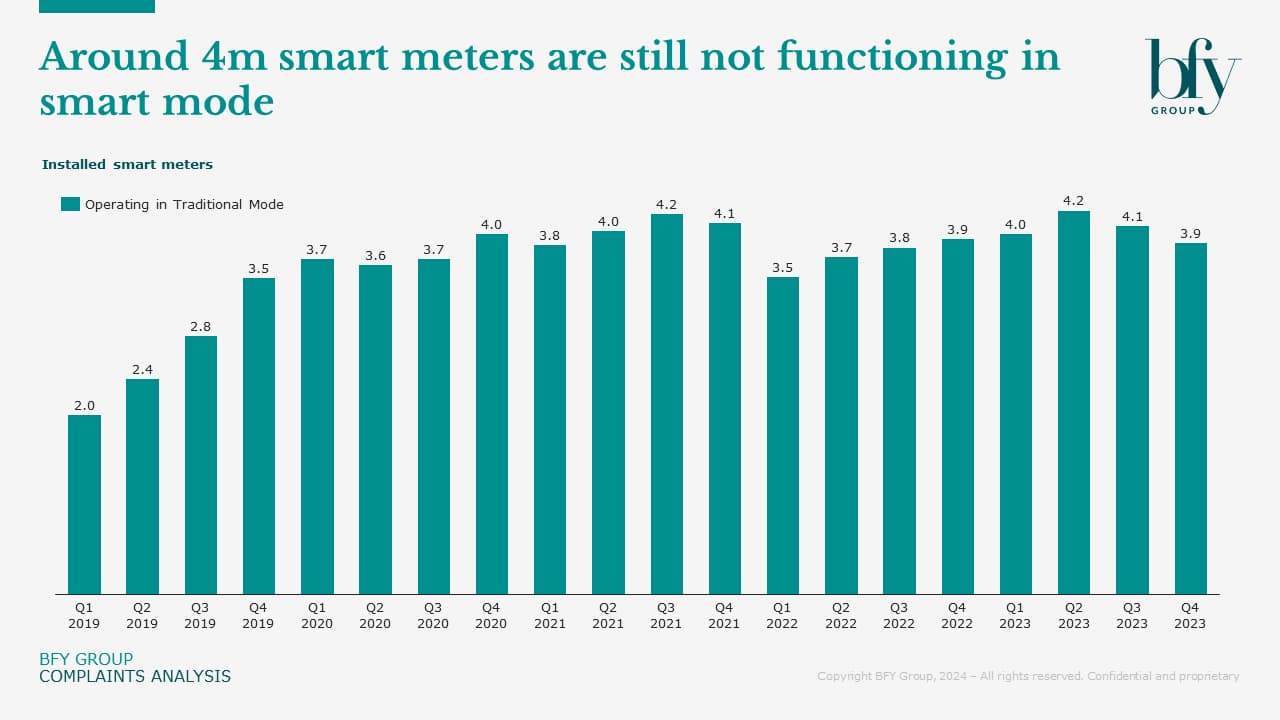

With DESNZ recently reporting around 4m outdated or non-communicating smart meters (12% of smart meters), there’s a real risk of increased customer frustration, if suppliers don’t tackle these issues effectively moving forwards. However, we know metering queries are often the most complex, and can therefore take much longer to resolve, increasing the effort required, and placing further strain on complaint resolution times.

How can suppliers improve complaints performance?

1) Know how your performance is trending

Suppliers must have the right level of reporting in place to accurately track key complaint metrics over time.

These metrics should be known and understood at a senior level to ensure risk can be identified and mitigated in a timely manner.

2) Invest in same day closure

Ensure customer facing teams are equipped with the right levels of skill and access required to resolve a complaint on day one whilst the customer is engaged and on the phone.

Use post-resolution feedback to identify opportunities for faster resolution.

3) Understand complaint drivers

Conduct root cause analysis to better understand the drivers of complaints in your business so improvement initiatives can be deployed.

4) Prioritise complaint customers

Queries from customers with a complaint must be prioritised across front and back-office worklists and backlogs.

Prioritising complaint customers in back office allows you to unlock the complex back-office skill that enables front office to manage complaints to closure.

Overall, complaints continue to be a hot topic for industry, and with the surge in customers seeking ombudsman support, it’s critical that suppliers act to better manage their customer journeys to mitigate the associated cost risk they’re facing into.

When helping a client to tackle complaints challenges on the frontline, we enabled a ~50% reduction in their complaints backlog through initiatives at a tactical and strategic level, helping to reduce Ombudsman complaints and drive a ~65% increase in Same/Next Day closures.

If you'd like to know more about improving complaints performance, contact Joseph Cooper.

Joseph Cooper

Manager

Joseph supports our Retail clients to improve their operational processes and business performance.

View Profile