Following on from last week’s look at the latest Ofgem debt figures, I wanted to dive deeper into the worrying number of £2.3bn of unsecured debt, up from £1.3bn a year ago.

As I discussed in my last blog, this stark increase is likely driven by the failure of previous debt arrangements, as customers struggle to keep up with previous commitments.

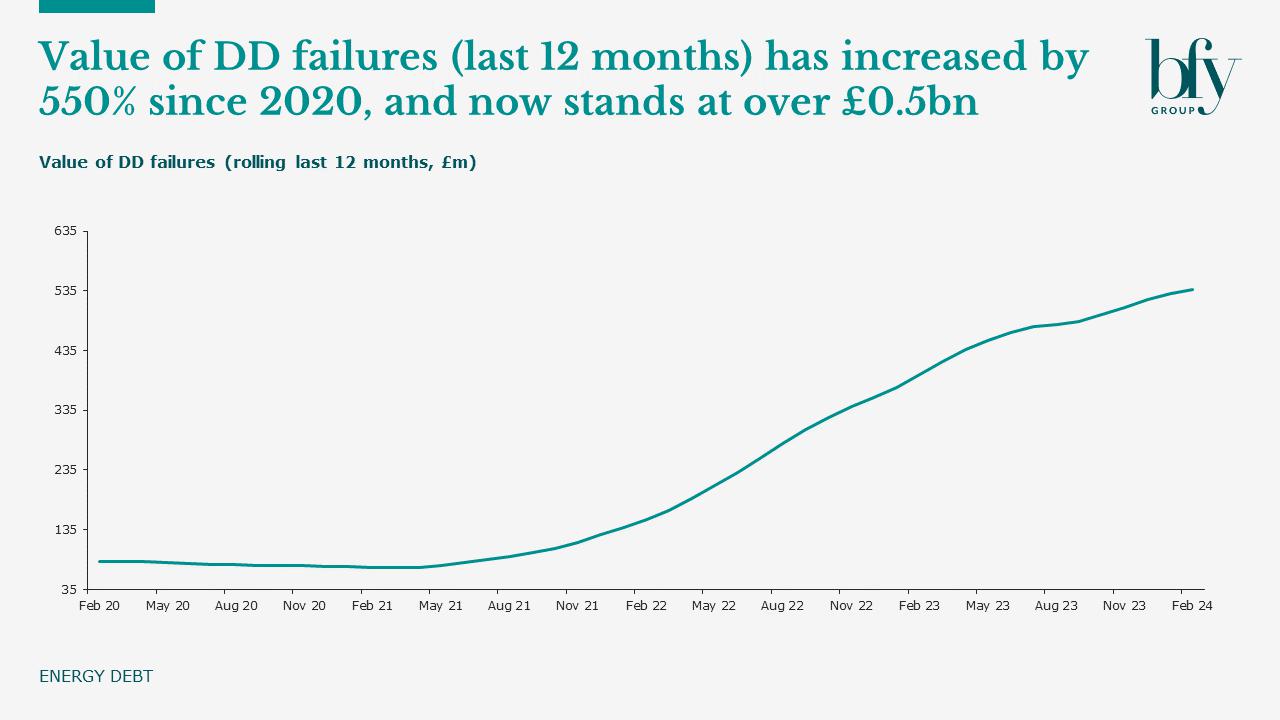

Lending weight to this hypothesis, the latest ONS data shows a material rise in DD failures, with our modelling showing an increase of 440% in volume and a 550% increase in the rolling 12 month value since the 2020, shown by the chart below.

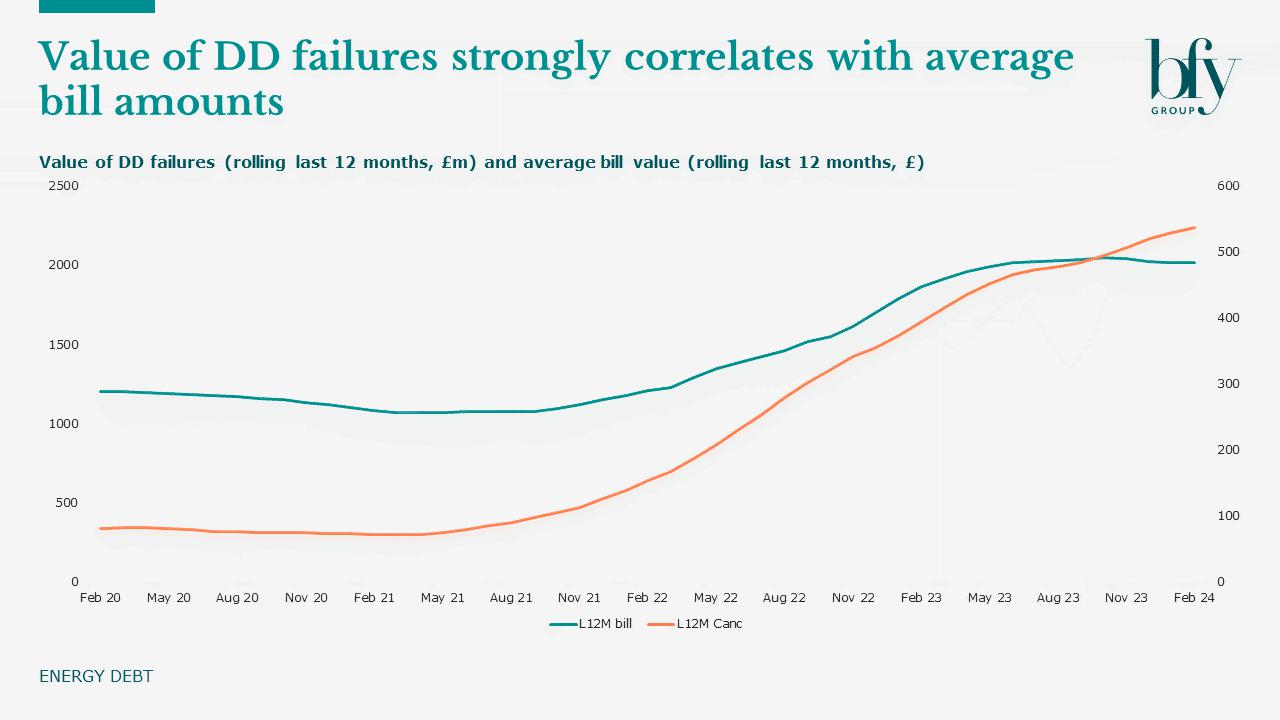

Unsurprisingly, this increase in DD failures correlates strongly with the increasing price level observed during this period although whilst prices have now levelled off, DD failures continue to rise.

Put together, this means that in the last 12 months alone we’ve seen over £0.5bn of energy DD failures, a ~40% increase on the previous 12 month period. 87% of this movement is driven by a 25% increase in failures, and 13% is driven by a 3% increase in average DD value. This will likely be a significant contributor to the ~£1bn increase throughout 2024 of debt owed to suppliers by customers without an arrangement in place to repay their balance.

It also raises real questions about the level of non-procedural debt sat on DD customers’ accounts which is currently not disclosed by Ofgem. Based on the average bill amounts vs. the average DD payments, our modelling shows this could be as high as £4bn.

Shoring up DD adherence should now become the priority to limit further growth in debt values not in an arrangement as this has the potential to start really challenging the cashflow of suppliers. With PPM becoming a diminishing option, maintaining customer engagement is essential, as well as having strong policies in place around supporting customers with affordability challenges, and where necessary, being able to manage payment for arrears and ongoing consumption separately.

For more information on debt in the energy market, contact Rachel Littlewood.

Rachel Littlewood

Director

Rachel leads our operational and financial turnaround engagements, helping to solve complex operational challenges while maximising commercial performance and customer outcomes.

View Profile