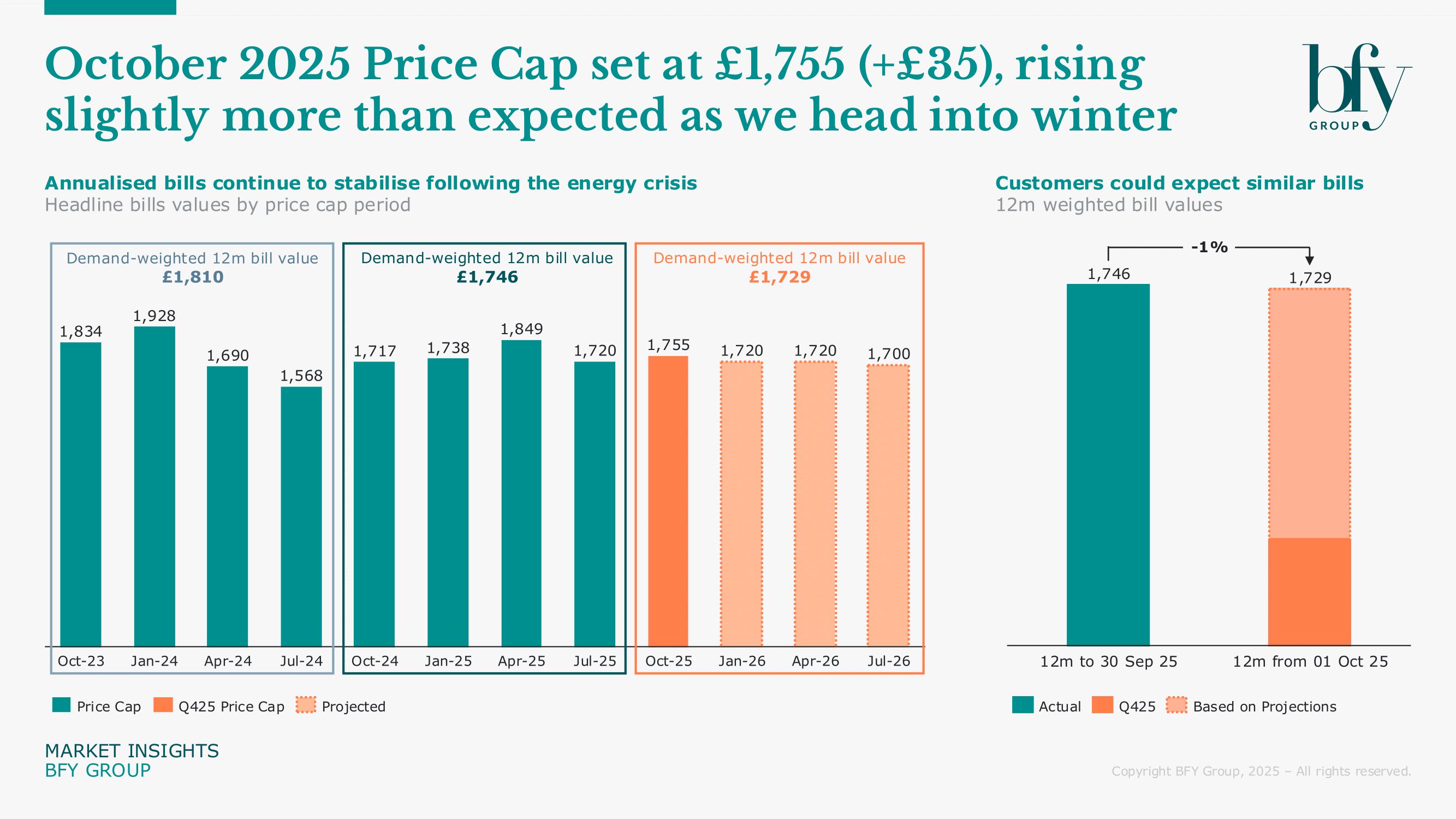

Ofgem has confirmed that the energy Price Cap will rise by around 2% (£35) to £1,755 in October 2025. It’s slightly higher than expected as we head into winter.

Key points from Ofgem’s announcement:

- October’s increase of £35 is a rise of 2% from July’s level of £1,720

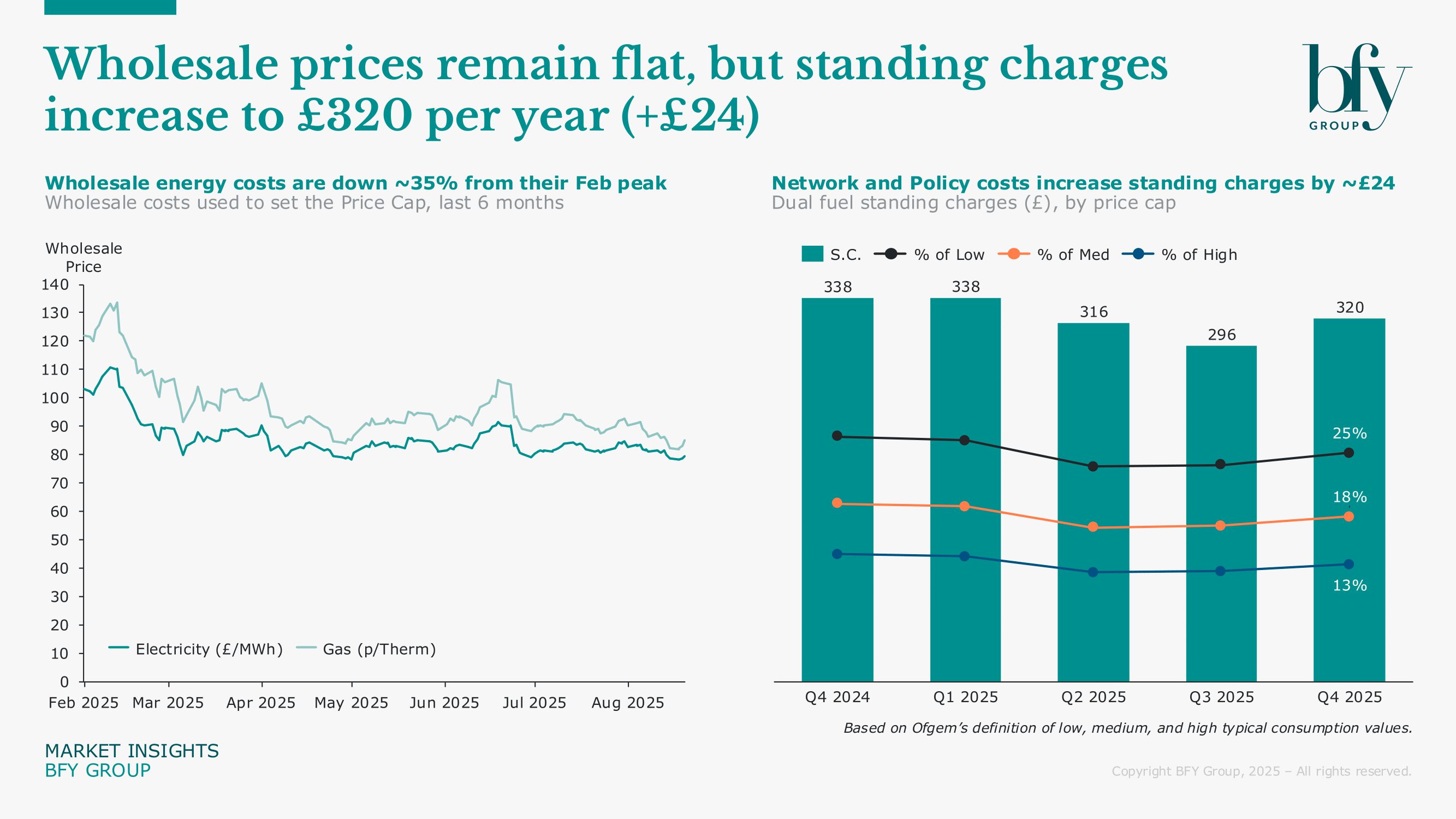

- Wholesale prices have remained relatively stable over the past three months, with today’s increase in the cap being driven by higher balancing costs, and the expansion of the Warm Home Discount scheme

- While any rise in unwelcome, this modest change is far smaller than the sharp winter increases seen in three of the last four years

- Looking ahead, modest falls are projected in 2026, with the Price Cap potentially edging down to ~£1,700, factoring in higher network costs to fund essential grid upgrades

Current projections suggest typical customers could spend around £1,729 over the 12 months from October 2025. Accounting for seasonal consumption, this is a 1% (£16) decrease from the prior 12 months. These projections reflect the reduced market volatility we’ve seen in 2025, with calls to return to a six-monthly price cap growing.

These projections also include further anticipated increases to network costs in 2026, to fund necessary long-term investments in the UK’s energy infrastructure. This includes expanding the grid with new power lines, substations, and technology to accommodate more renewable energy.

Wholesale energy prices continue to stabilise, but standing charges increase

Wholesale prices have remained stable throughout the period used to calculate October’s Price Cap, with today’s increase being driven by wider factors. In particular, higher balancing costs, and the expansion of the Warm Homes Discount, which will support up to 2.7 million more households this winter.

These factors will see standing charges increase to £320 per year (+£24) in October 2025, making up ~18% of a typical customers bill, after falling for the last two quarters.

Although prices this winter will be lower than what we’ve seen in some recent years (e.g. 2023/24), they remain ~50% higher than they were pre-crisis, with affordability still a major challenge for those on lower incomes.

With global tensions ongoing, and the risk of volatility never far away, how wholesale prices trend over the next few months will be critical ahead of January, when gas consumption is at its highest.

Switching activity continues to rebound, reaching ~50% of pre-crisis levels

Customer switching activity has grown this year to an average of 235k per month, with an estimated 11m households now avoiding the Price Cap on non-default tariffs. This has mainly been driven by suppliers offering meaningful discounts against the cap of £250-£300.

At the same time, we've seen rapid growth in the number of customers on smart time-of-use tariffs, with as many as 700-800k currently using them. The continuing rollout of low-carbon technology, such as EVs and Heat Pumps, and the growing need for a flexible energy system, means we expect to see further growth in this area.

Smart tariffs have the potential to reduce emissions, lower bills, and deepen customer engagement, but they also bring strategic and commercial challenges for suppliers - particularly around managing tariff complexity as innovation accelerates.

Our recent article explored five commercial considerations to help suppliers turn tariff innovation into a strategic advantage, rather than a risk.

For more on October’s Price Cap and what it means for the market, contact Matt Turner-Tait.

Matt Turner-Tait

Senior Manager

Matt lead clients through key strategic projects exploring growth opportunities, business models, competitive advantage, and mergers & acquisitions.

View Profile