ESG due diligence has become integral to investment decisions for private equity and debt lenders, driven by tighter regulations, and growing demand amongst stakeholders for responsible investing.

As we see increasing evidence of the correlation between ESG practices and future business performance, firms should be on the front foot with ESG, looking to maximise opportunities for value creation. The obvious question is how?

We’ve explored this below, outlining the reasons for the shift in ESG focus within today’s market, and showing how a proactive approach can deliver significant strategic and financial benefits.

ESG is a driver for sustainable value creation

Unlike Environmental Due Diligence that focuses on a business’ physical real estate; ESG Due Diligence provides a holistic view of an organisation’s entire value chain. It considers how each aspect of ESG impacts the world, and is strongly aligned to the United Nations Sustainable Development Goals (SDGs).

Historically, ESG has been viewed as an annual cost to address regulatory compliance, rather than a source of sustainable value creation. Today, lenders and investors are increasingly tightening their monitoring processes, requiring validation of ESG claims.

Therefore, for ESG to be commercially viable and respond to the growing urgency to address climate, biodiversity and energy demand challenges, businesses must start to think like an investor, demonstrating measurable strategic and financial outcomes.

There’s growing evidence of a direct correlation between ESG practices and future business performance. ESG considerations are shaping business strategies, with investors looking to capitalise on synergies and new market opportunities. This is leading to higher valuations and premiums of up to 5-10% for those that can evidence best practice, and a strong track record of delivering financial and social benefits.

Embedding ESG into the investor-readiness process

ESG due diligence is not a “one-size fits all” model. Each industry presents its own array of material risks and value levers, that will drive improvement in revenue and EBITDA, while delivering a positive environmental and social impact. Those companies who want to get ahead of the curve are embedding ESG into their investor-readiness process.

An independently validated strategy and transformation roadmap is essential in today’s market. This document should be presented to potential investors and acquirers, linking sustainability targets and performance indicators. It should also address the material ESG factors that will inhibit future growth, or enable the transition to new business models and market opportunities.

Typically, the importance of ESG due diligence is well understood by firms with large estate footprints or carbon emissions, who require significant capital and human investment to reposition portfolios or transition to new business models. Think legacy energy, utility, and infrastructure businesses.

However, with a greater focus on Scope 3, business services (especially those who play a role in energy transition and decarbonisation) need to better understand their risk exposure and regulatory requirements. This applies in areas such as consumer protection, employment practices, off-shoring, data management, and cyber security.

Insight to inform investment decisions

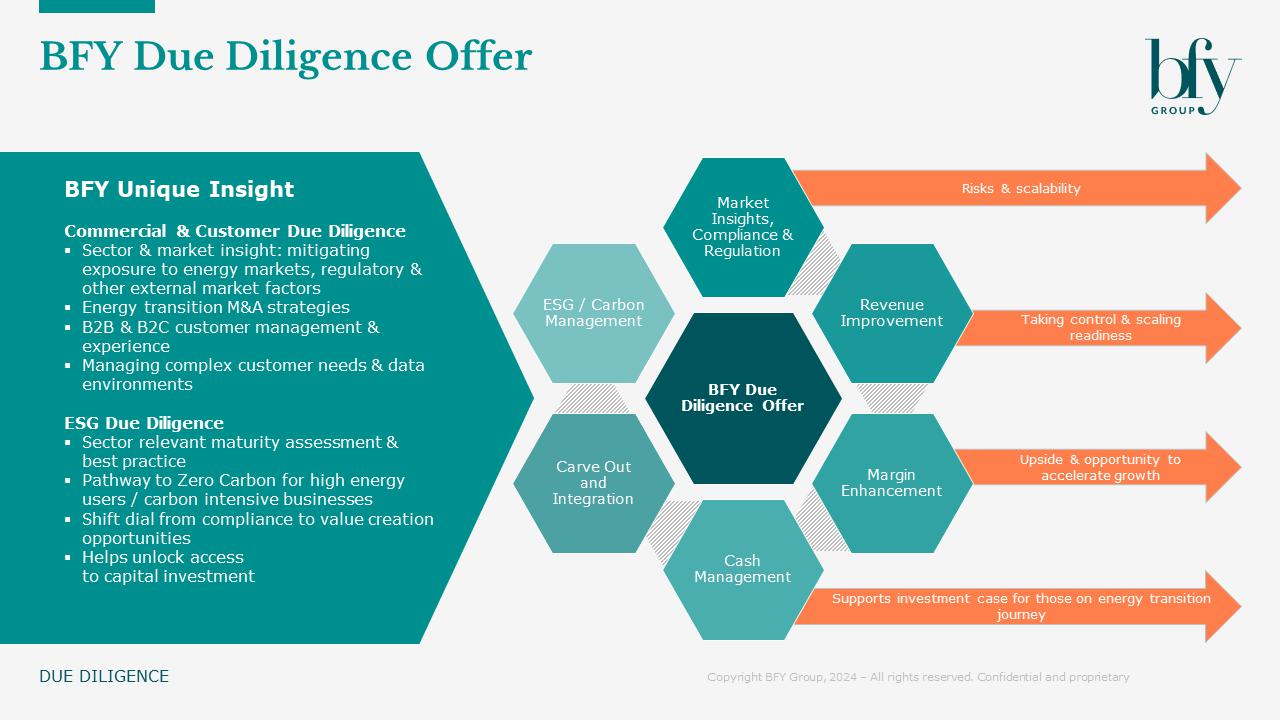

Our ESG Due Diligence offering provides a comprehensive audit and ranking of ESG related practices, programmes, and metrics, together with a maturity assessment of the business’ net zero carbon journey.

We provide tailored benchmarks and peer comparisons, to support the development of roadmaps and actions plans, while mitigating material investment factors that affect risk and return.

Our Due Diligence also provides a view of alignment between the ESG commitments of targets and buyers, enabling recommendations on material factors where upside could be realised post deal.

ESG Due Diligence forms part of BFY’s Due Diligence, Value Creation and Carbon Strategies offering, helping Private Equity, Asset Managers and Corporate Lenders to make more informed investment decisions, structure investment cases, and drive value from their portfolios.

If you’re looking to take on investment, then our ESG services can support your sale readiness planning, by ensuring that your ESG and decarbonisation plans achieve the minimum requirements of investment firms. We can also help you identify where opportunities exist to undertake value-increasing activity.

For more information on our ESG Due Diligence offering, and how it could benefit you, contact Angela Tooley.

Ian Barker

Managing Partner

Ian shapes the BFY vision and inspires our team to bring it to life, while remaining central to complex client engagements in Strategy, Commercial, and Operations.

View Profile